What Are Stock Quotes?

A stock quote is a representation of the current price and other relevant information of a particular stock. It provides investors with essential data to make informed decisions about buying or selling stocks.

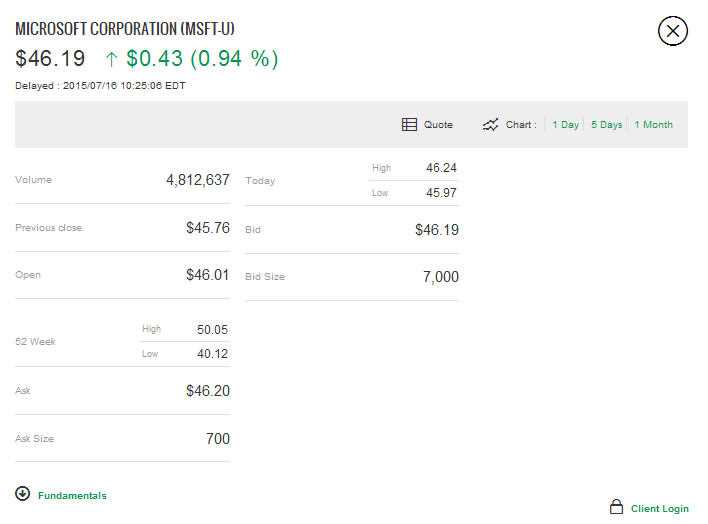

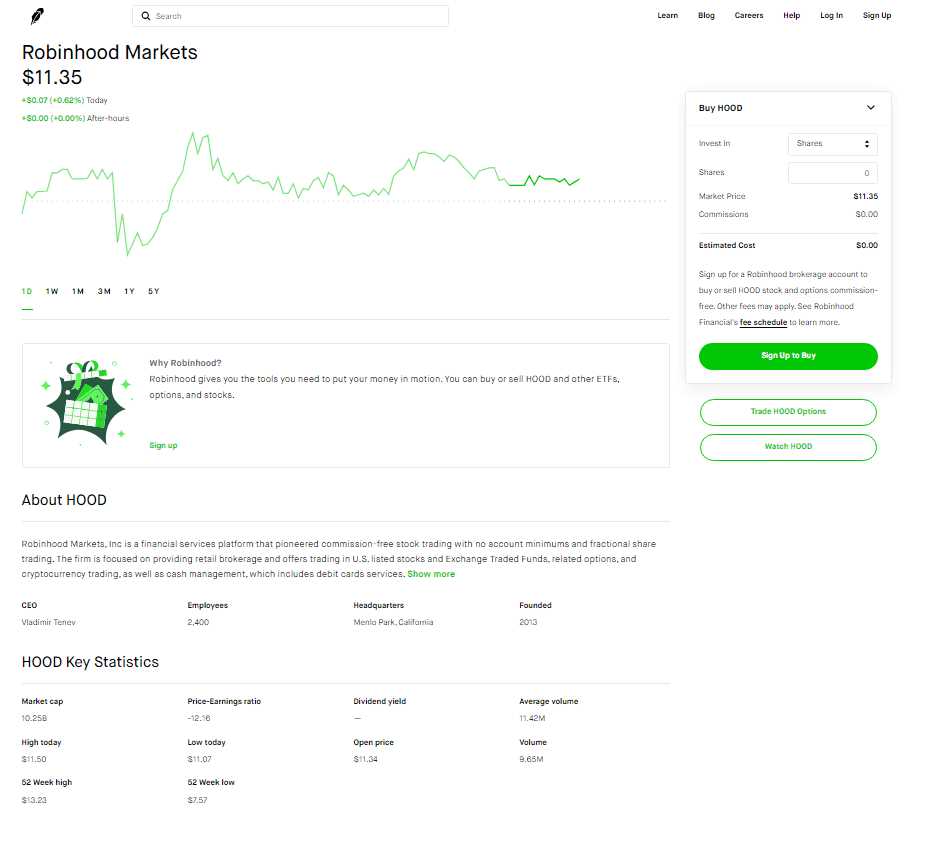

A stock quote typically includes the following information:

- Ticker Symbol: The unique alphabetic identifier for a particular stock.

- Last Price: The most recent price at which the stock was traded.

- Change: The difference between the current price and the previous day’s closing price.

- Percentage Change: The percentage change in the stock price from the previous day’s closing price.

- Volume: The number of shares traded in a particular period.

- Open: The price at which the stock started trading for the day.

- High: The highest price at which the stock traded during the day.

- Low: The lowest price at which the stock traded during the day.

- 52-Week High: The highest price at which the stock traded in the past 52 weeks.

- 52-Week Low: The lowest price at which the stock traded in the past 52 weeks.

Stock quotes are available in real-time or delayed, depending on the source. Real-time quotes provide up-to-the-minute information, while delayed quotes have a slight delay of a few minutes.

Importance of Stock Quotes

Stock quotes play a crucial role in the world of stock trading and investing. They provide valuable information about the current market prices of stocks, helping investors make informed decisions about buying or selling shares.

Here are some reasons why stock quotes are important:

1. Real-time Market Information

Stock quotes provide real-time information about the current market prices of stocks. This allows investors to stay updated with the latest market trends and make timely decisions based on the changing prices.

2. Price Discovery

Stock quotes help in price discovery, which is the process of determining the fair market value of a stock. By analyzing stock quotes, investors can assess the supply and demand dynamics of a particular stock, helping them determine its true value.

3. Investment Analysis

Stock quotes provide essential data for investment analysis. Investors can analyze historical stock prices, volume, and other relevant information to identify trends, patterns, and potential investment opportunities.

4. Portfolio Management

Stock quotes are crucial for managing investment portfolios. By monitoring the prices of stocks in their portfolio, investors can assess the performance of their investments and make necessary adjustments to optimize their portfolio’s returns.

5. Risk Management

Stock quotes help investors manage risk by providing information about the volatility and price fluctuations of stocks. By analyzing stock quotes, investors can assess the risk associated with a particular stock and make informed decisions to mitigate potential losses.

How to Read Stock Quotes

1. Ticker Symbol

The ticker symbol is a unique combination of letters that represents a specific stock on an exchange. It is usually a few characters long and helps identify the company or security. For example, AAPL represents Apple Inc.

2. Stock Price

The stock price is the current trading price of a stock. It is usually displayed as a decimal or a fraction. For example, if the stock price is $100, it may be displayed as 100.00 or 100 1/8.

3. Volume

The volume refers to the number of shares traded during a specific period, usually a day. It indicates the level of interest and activity in a particular stock. Higher volume usually indicates more liquidity and market participation.

4. Bid and Ask Prices

5. High and Low Prices

The high price represents the highest trading price of a stock during a specific period, while the low price represents the lowest trading price. These prices provide insights into the stock’s volatility and trading range.

6. Previous Close

The previous close is the stock’s price at the end of the previous trading session. It helps investors and traders compare the stock’s current performance with its previous performance.

7. Market Cap

The market capitalization (market cap) is the total value of a company’s outstanding shares of stock. It is calculated by multiplying the stock price by the number of outstanding shares. Market cap provides an indication of the company’s size and overall worth.

Examples of Stock Quotes

Stock quotes provide valuable information for investors and traders to make informed decisions about buying or selling stocks. Here are some examples of how stock quotes are presented:

- Company Name: XYZ Corporation

- Stock Symbol: XYZ

- Exchange: NYSE

- Last Price: $50.00

- Change: +1.50

- Percent Change: +3.00%

- Volume: 1,000,000

- Open: $48.50

- High: $51.00

- Low: $48.00

- 52-Week High: $55.00

- 52-Week Low: $40.00

These are just a few examples of the information that can be found in a stock quote. Each piece of information provides insight into the performance and value of a particular stock.

The last price reflects the most recent price at which the stock was traded. The change and percent change show the difference in price from the previous trading day. A positive change indicates an increase in price, while a negative change indicates a decrease.

The volume represents the number of shares that have been traded during a given period. It is an indicator of the level of interest and activity in the stock.

The open, high, and low prices show the range of prices at which the stock has traded during the current trading day. The 52-week high and low represent the highest and lowest prices the stock has reached over the past year.

By analyzing these stock quotes, investors and traders can assess the current performance and trends of a stock. This information can help them make informed decisions about buying or selling stocks to maximize their investment returns.

Stock Trading Strategies & Education

Importance of Stock Trading Strategies

Stock trading strategies are essential for traders to make informed decisions and maximize their profits. A well-defined strategy helps traders identify potential entry and exit points, manage risks, and optimize their trading performance. Without a strategy, traders may fall victim to emotional decision-making, which can lead to poor investment choices and financial losses.

There are various stock trading strategies that traders can employ, depending on their risk tolerance, investment goals, and market conditions. Some common strategies include:

- Day Trading: This strategy involves buying and selling stocks within the same trading day to take advantage of short-term price fluctuations.

- Swing Trading: Swing traders aim to capture short-term price movements over a period of days or weeks. They often use technical analysis to identify trends and make trading decisions.

- Value Investing: Value investors look for undervalued stocks with strong fundamentals. They believe that the market will eventually recognize the true value of these stocks, leading to price appreciation.

- Momentum Trading: Momentum traders focus on stocks that are showing strong upward or downward trends. They aim to ride the momentum and profit from the continuation of the trend.

Continuing Education

In the ever-changing world of stock trading, it is essential for traders to continue their education. Markets evolve, new trading strategies emerge, and staying up to date with the latest trends and developments is crucial for success.

Traders can enhance their knowledge and skills through various educational resources, such as:

- Books: There are numerous books written by experienced traders and market experts that provide valuable insights and strategies.

- Online Courses: Many online platforms offer courses and tutorials on stock trading, technical analysis, and other related topics.

- Webinars and Seminars: Attending webinars and seminars conducted by industry professionals can provide valuable insights and networking opportunities.

- Trading Simulators: Using trading simulators allows traders to practice their strategies in a risk-free environment before implementing them in real markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.