What is Return on Invested Capital?

Return on Invested Capital (ROIC) is a financial ratio that measures the profitability of a company’s investments. It is a key metric used by investors, analysts, and management to assess the efficiency and effectiveness of a company’s capital allocation.

ROIC is calculated by dividing a company’s net operating profit after taxes (NOPAT) by its invested capital. NOPAT is the company’s operating income adjusted for taxes, and invested capital includes both debt and equity.

ROIC provides insight into how well a company generates returns from the capital invested in its operations. A higher ROIC indicates that the company is generating more profits from its investments, while a lower ROIC suggests that the company is not efficiently utilizing its capital.

ROIC is a useful metric for comparing the performance of different companies within the same industry or sector. It helps investors and analysts identify companies that are generating higher returns on their investments and may be better positioned for long-term growth.

Furthermore, ROIC can also be used to evaluate the effectiveness of management’s capital allocation decisions. If a company consistently achieves a high ROIC, it suggests that management is making wise investment choices and effectively utilizing the company’s resources.

In summary, Return on Invested Capital is a crucial financial ratio that measures a company’s profitability and efficiency in generating returns from its investments. It provides valuable insights for investors, analysts, and management in assessing the performance and potential of a company.

How to Calculate Return on Invested Capital?

Return on Invested Capital (ROIC) is a financial metric that measures the profitability of a company’s investments. It provides insight into how effectively a company is utilizing its capital to generate returns for its investors.

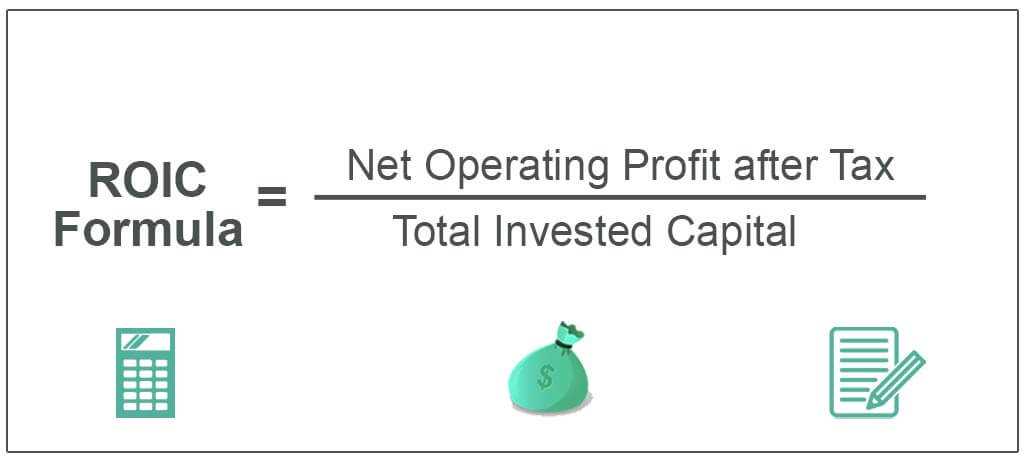

The formula to calculate ROIC is:

ROIC = Net Operating Profit After Tax (NOPAT) / Invested Capital

To calculate ROIC, you need to determine the NOPAT and the invested capital.

NOPAT:

NOPAT is the net operating profit after tax, which represents the profit generated by a company’s core operations after accounting for taxes. It is calculated by subtracting the tax expense from the operating profit.

Invested Capital:

Invested capital is the total amount of capital invested in a company, including both debt and equity. It represents the funds that have been used to acquire assets and finance operations. Invested capital can be calculated by adding the total debt and equity of a company.

Once you have determined the NOPAT and invested capital, you can use the formula to calculate ROIC. The resulting value will be a percentage, which indicates the return generated by each dollar of invested capital.

For example, let’s say a company has a NOPAT of $1 million and an invested capital of $10 million. Using the formula, the ROIC would be:

ROIC = $1,000,000 / $10,000,000 = 0.1 or 10%

This means that for every dollar of invested capital, the company generates a return of 10 cents.

ROIC is a valuable metric for investors and analysts as it provides a measure of a company’s profitability and efficiency in utilizing its capital. A higher ROIC indicates that a company is generating higher returns on its investments, which is generally seen as a positive sign.

It is important to note that ROIC should be compared to the company’s cost of capital to determine if it is creating value for its investors. If the ROIC is lower than the cost of capital, it suggests that the company is not generating sufficient returns to cover its capital costs.

Example of Return on Invested Capital Calculation

Return on Invested Capital (ROIC) is a financial metric that measures the profitability of a company’s investments. It provides insight into how effectively a company is utilizing its capital to generate returns for its investors.

Let’s take a hypothetical example to understand how to calculate ROIC. Suppose Company XYZ has a net operating profit after taxes (NOPAT) of $1,000,000 and invested capital of $5,000,000.

ROIC = (NOPAT / Invested Capital) * 100

ROIC = ($1,000,000 / $5,000,000) * 100

ROIC = 20%

ROIC is a useful metric for investors and analysts to evaluate the efficiency and profitability of a company’s investments. A higher ROIC indicates that a company is generating higher returns on its invested capital, which is generally considered favorable. Conversely, a lower ROIC may indicate that a company is not utilizing its capital effectively and may warrant further analysis.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.