What is a Repurchase Agreement?

Repurchase agreements are commonly used in the financial markets to raise short-term funds. They are particularly popular among banks, hedge funds, and other financial institutions. These agreements provide liquidity and allow market participants to manage their short-term cash needs or invest excess cash.

Definition, Examples, and Risks

Repurchase agreements are commonly used in the financial markets to raise short-term funds. They are particularly popular among banks and other financial institutions. The buyer of the securities, typically a cash-rich entity, provides liquidity to the seller, who may need immediate funds for various purposes.

There are different types of repurchase agreements, including overnight repos, term repos, and open repos. Overnight repos have a maturity of one day, while term repos have a maturity longer than one day, usually ranging from a few days to several months. Open repos have no fixed maturity date and can be terminated by either party at any time.

One of the main risks associated with repurchase agreements is counterparty risk. If the buyer of the securities defaults or becomes insolvent, the seller may not be able to repurchase the securities, resulting in a loss. To mitigate this risk, market participants often use collateralization, requiring the seller to provide additional securities or cash as collateral.

Repurchase Agreement Examples

Here are a few examples of repurchase agreements:

| Example 1 | Company A sells Treasury bonds to Company B with an agreement to repurchase them in 30 days at a slightly higher price. This allows Company A to raise short-term funds while Company B earns interest on the investment. |

|---|---|

| Example 2 | Bank X sells mortgage-backed securities to Bank Y with an agreement to buy them back in 14 days. Bank X uses the funds raised from the repo to meet its short-term funding needs, while Bank Y earns a return on the investment. |

| Example 3 | Investor C sells corporate bonds to Investor D with an agreement to repurchase them in 60 days. Investor C uses the cash raised from the repo to invest in other opportunities, while Investor D earns interest on the transaction. |

These examples illustrate how repurchase agreements can be used by various market participants to meet their financing or investment needs. By entering into a repo, both parties benefit from the transaction, with the seller gaining access to short-term funds and the buyer earning a return on their investment.

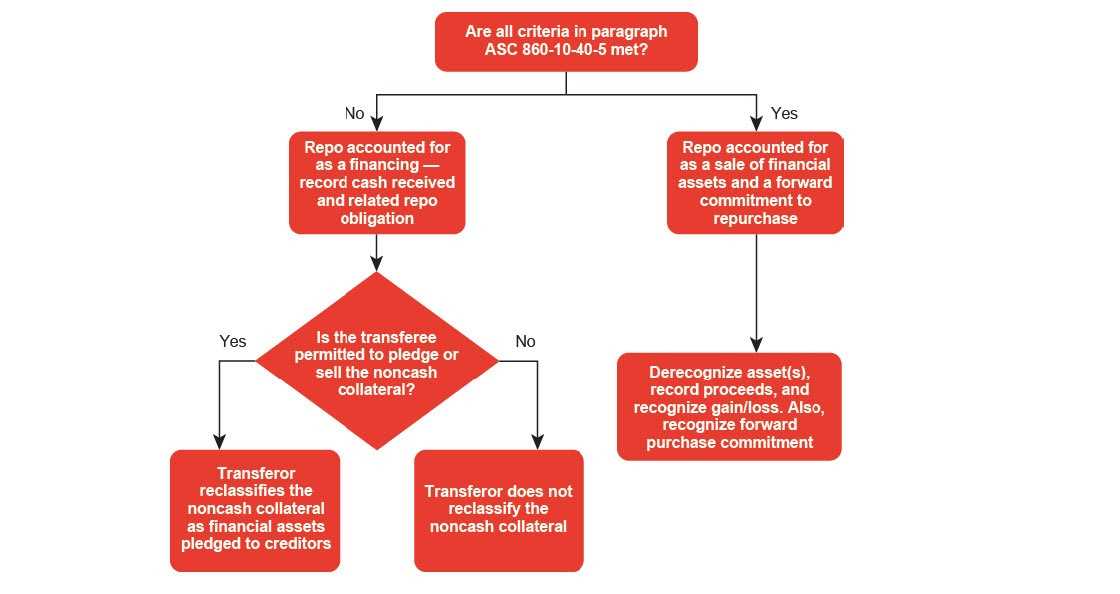

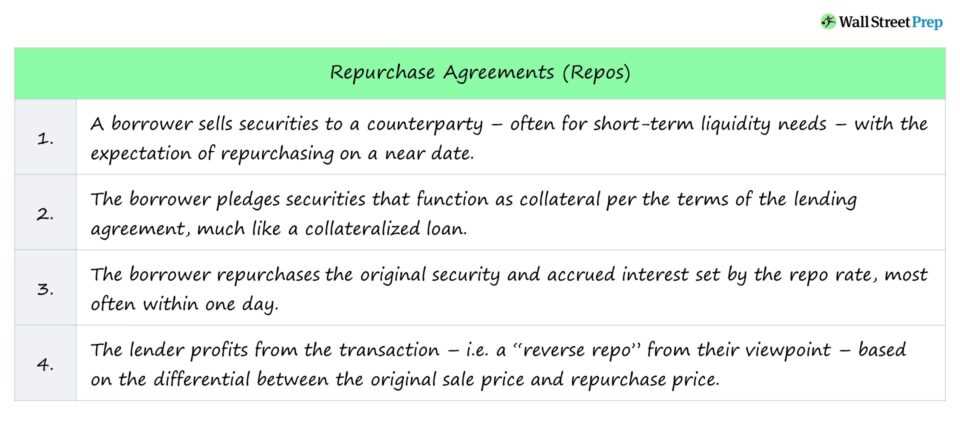

The mechanics of a repo transaction involve the following steps:

- The borrower and lender agree on the terms of the repo, including the repurchase price, interest rate, and maturity date.

- The borrower transfers the securities to the lender, who holds them as collateral.

- The lender transfers the agreed-upon amount of cash to the borrower.

- Throughout the term of the repo, the borrower pays the lender periodic interest payments based on the agreed-upon interest rate.

- On the maturity date, the borrower repurchases the securities from the lender at the repurchase price.

- The lender returns the securities to the borrower, and the borrower returns the cash to the lender.

Risks Associated with Repurchase Agreements

1. Counterparty Risk: One of the main risks associated with repurchase agreements is counterparty risk. This refers to the risk that the party selling the securities may default on their obligation to repurchase them. If the counterparty fails to fulfill their end of the agreement, the party holding the securities may face losses.

2. Market Risk: Another risk to consider is market risk. The value of the securities involved in a repurchase agreement can fluctuate over time due to changes in market conditions. If the value of the securities decreases significantly, the party holding them may face losses when repurchasing them at a higher price.

3. Liquidity Risk: Repurchase agreements are often used as a source of short-term funding. However, in times of financial stress or market volatility, the availability of funds may become limited. This can lead to liquidity risk, where the party selling the securities may struggle to find a counterparty willing to enter into a repurchase agreement.

4. Collateral Risk: In a repurchase agreement, the securities being sold act as collateral for the transaction. However, there is a risk that the value of the collateral may decline or become insufficient to cover the amount borrowed. This can result in a loss for the party lending the funds.

5. Legal and Regulatory Risk: Repurchase agreements are subject to legal and regulatory requirements. Failure to comply with these requirements can lead to legal and regulatory risk, including fines, penalties, and reputational damage.

To mitigate these risks, parties entering into repurchase agreements should conduct thorough due diligence on their counterparties, monitor market conditions, and establish appropriate risk management strategies. It is also important to have clear and well-documented agreements in place to ensure both parties understand their rights and obligations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.