Rebate Types: A Comprehensive Guide for Stock Traders

1. Volume Rebates

One of the most common types of rebates in stock trading is the volume rebate. This type of rebate rewards traders based on the amount of trading volume they generate. The more trades you execute, the higher the rebate percentage you can earn. Volume rebates are often tiered, meaning that the rebate percentage increases as your trading volume increases. This type of rebate can be particularly beneficial for active traders who execute a large number of trades.

2. Liquidity Rebates

Liquidity rebates are another type of rebate that stock traders can take advantage of. These rebates are based on the liquidity provided by the trader in the market. Liquidity refers to the ability to buy or sell a stock without significantly impacting its price. Traders who provide liquidity by placing limit orders or adding liquidity to the market can earn rebates. The rebate amount is typically based on the number of shares traded or the dollar value of the trades.

3. Maker-Taker Rebates

Maker-taker rebates are a popular type of rebate in stock trading. This rebate structure incentivizes traders to add liquidity to the market (makers) and penalizes those who remove liquidity from the market (takers). Makers earn rebates for providing liquidity, while takers pay fees for taking liquidity. The rebate amount for makers is typically higher than the fees charged to takers. This rebate type encourages traders to contribute to market liquidity and can be advantageous for those who frequently provide liquidity.

What are Rebate Types?

Common Rebate Types

There are several common rebate types that traders should be aware of:

Volume-Based Rebates:

Volume-based rebates are based on the total trading volume executed by a trader within a specific time period. The more a trader trades, the higher the rebate percentage they can receive. This type of rebate is particularly beneficial for active traders who execute a large number of trades.

Order Size Rebates:

Order size rebates are based on the size of the individual trades. Traders who execute larger trades can receive higher rebate percentages. This type of rebate is advantageous for traders who regularly trade large quantities of shares.

Strategy-Based Rebates:

Strategy-based rebates are offered to traders who employ specific trading strategies. These strategies can include market making, liquidity provision, or other types of high-frequency trading. Traders who use these strategies can receive rebates as an incentive to provide liquidity to the market.

Choosing the Right Rebate Type

Examples of Rebate Types in Stock Trading

Rebates are a common incentive offered to stock traders by brokers and exchanges. They can come in various forms and provide traders with financial benefits. Here are some examples of rebate types in stock trading:

Volume Rebates

Volume rebates are based on the trading volume of a trader. Brokers may offer rebates to traders who trade a certain number of shares or reach a specific trading volume within a specified time period. For example, a broker may offer a rebate of $0.01 per share traded for traders who trade more than 100,000 shares in a month.

Liquidity Rebates

Liquidity rebates are offered to traders who provide liquidity to the market by placing limit orders. These rebates incentivize traders to add liquidity to the market, which helps improve market efficiency. For example, a trader may receive a rebate of $0.002 per share for placing a limit order that is executed.

Market Maker Rebates

Market makers are traders who provide liquidity by continuously quoting bid and ask prices for a particular stock. They play a crucial role in maintaining market liquidity. To encourage market makers, exchanges may offer rebates based on the volume of trades executed as a market maker. The rebates can vary depending on the stock and exchange.

Short Sale Rebates

Short sale rebates are offered to traders who engage in short selling, which is the practice of selling borrowed shares with the expectation of buying them back at a lower price. Short sale rebates can help offset the costs associated with borrowing shares for short selling. The rebates are typically a percentage of the value of the shares borrowed.

Rebate vs. Discount: Which is Better for Stock Traders?

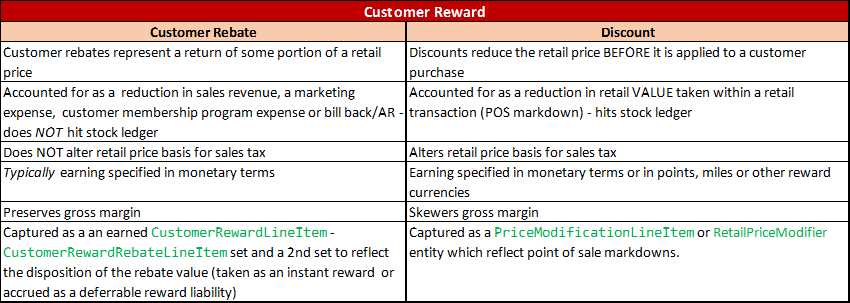

A rebate is a partial refund of a commission or fee paid by a trader to a broker. It is essentially a reward for executing a certain number of trades or meeting specific trading volume requirements. Rebates are typically offered by brokers as an incentive to attract and retain traders. The amount of the rebate is usually a percentage of the commission or fee paid, and it can vary depending on the broker and the trading activity of the trader.

On the other hand, a discount is a reduction in the commission or fee charged by a broker. Unlike a rebate, which is given after the trade is executed, a discount is applied upfront at the time of the trade. Discounts are often offered to high-volume traders or institutional investors who generate significant trading activity. The discount can be a fixed amount or a percentage of the commission or fee charged.

So, which option is better for stock traders? The answer depends on various factors, including the trading volume, trading strategy, and individual preferences of the trader. Rebates are generally more beneficial for traders who execute a high volume of trades or have a long-term trading strategy. They can help offset the costs of trading and increase overall profitability. Additionally, rebates can be particularly advantageous for traders who are charged high commissions or fees by their brokers.

On the other hand, discounts can be more advantageous for traders who execute a lower volume of trades or have a short-term trading strategy. By reducing the commission or fee charged upfront, discounts can help lower the overall trading costs and improve the trader’s profitability. However, it is important to note that not all brokers offer discounts, and they are typically only available to traders who meet certain criteria, such as high trading volume or institutional status.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.