What is Profitability Index?

The profitability index is a financial metric used to evaluate the profitability of an investment or project. It measures the relationship between the costs and benefits of an investment, providing insight into its potential profitability.

By calculating the profitability index, investors and analysts can assess the value of an investment opportunity and determine whether it is worth pursuing. The profitability index is particularly useful when comparing multiple investment options, as it allows for a quantitative comparison of their profitability.

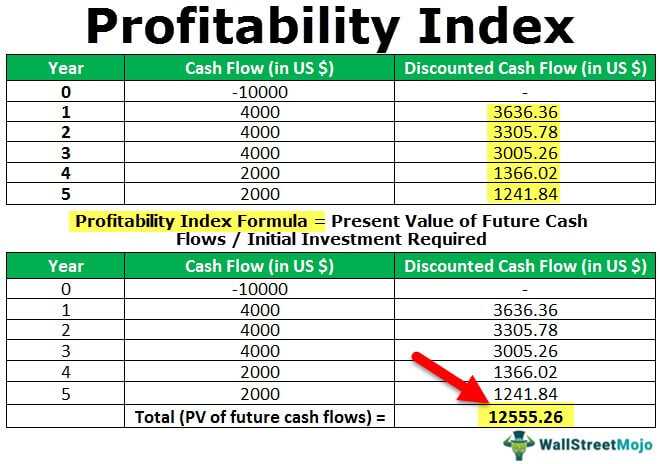

To calculate the profitability index, the present value of the investment’s future cash flows is divided by the initial investment cost. The resulting ratio provides an indication of the return on investment and helps investors make informed decisions about the viability of an investment.

Overall, the profitability index is a valuable tool for evaluating investment opportunities and assessing their potential profitability. By considering the costs and benefits of an investment, investors can make informed decisions and maximize their returns.

Components of Profitability Index

The profitability index is a financial metric used to assess the profitability of an investment project. It takes into account the time value of money and helps investors determine whether a project is worth pursuing or not. The profitability index is calculated by dividing the present value of future cash flows by the initial investment.

1. Present Value of Future Cash Flows

The present value of future cash flows represents the discounted value of the expected cash inflows and outflows generated by the investment project. It takes into account the time value of money, which means that a dollar received in the future is worth less than a dollar received today. To calculate the present value, the future cash flows are discounted using an appropriate discount rate.

2. Initial Investment

The initial investment refers to the amount of money required to start the investment project. It includes all the costs associated with acquiring and setting up the necessary assets, as well as any additional expenses incurred during the initial stages of the project. The initial investment is an important factor in determining the profitability of the project, as it represents the cash outflow at the beginning of the project.

By comparing the present value of future cash flows to the initial investment, the profitability index provides a measure of the return on investment. A profitability index greater than 1 indicates that the project is expected to generate positive net present value and is considered financially viable. On the other hand, a profitability index less than 1 suggests that the project is not expected to generate sufficient returns to cover the initial investment and may not be worth pursuing.

Overall, the components of the profitability index help investors evaluate the financial feasibility of an investment project by considering the expected cash flows and the initial investment. By using this metric, investors can make informed decisions about whether to proceed with a project or explore alternative investment opportunities.

Formula for Profitability Index

The formula for calculating the profitability index is a simple ratio that compares the present value of cash inflows to the present value of cash outflows. It is represented as:

| Profitability Index = | Present Value of Cash Inflows | ÷ | Present Value of Cash Outflows |

The present value of cash inflows refers to the total value of all future cash inflows from an investment, discounted to their present value using an appropriate discount rate. This takes into account the time value of money, as cash received in the future is worth less than the same amount of cash received today.

The present value of cash outflows, on the other hand, refers to the total value of all initial and ongoing cash outflows associated with the investment, also discounted to their present value using the same discount rate.

By dividing the present value of cash inflows by the present value of cash outflows, the profitability index provides a measure of the value created by the investment per unit of initial investment. A profitability index greater than 1 indicates that the investment is expected to generate positive value, while a profitability index less than 1 suggests that the investment may not be financially viable.

It is important to note that the profitability index is just one of many financial metrics used to evaluate investment opportunities. It should be used in conjunction with other measures, such as net present value (NPV) and internal rate of return (IRR), to make informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.