The Basics of the Normal Yield Curve

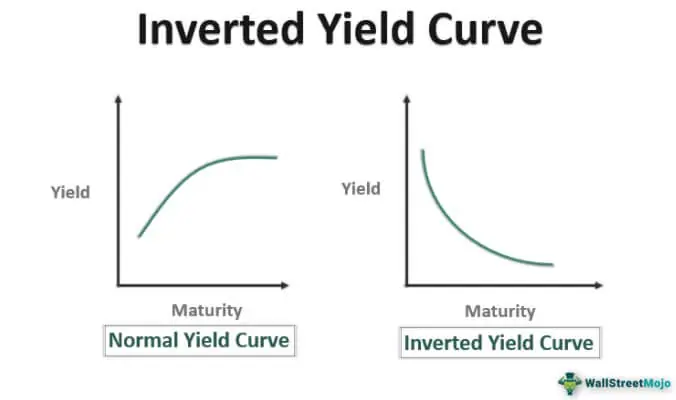

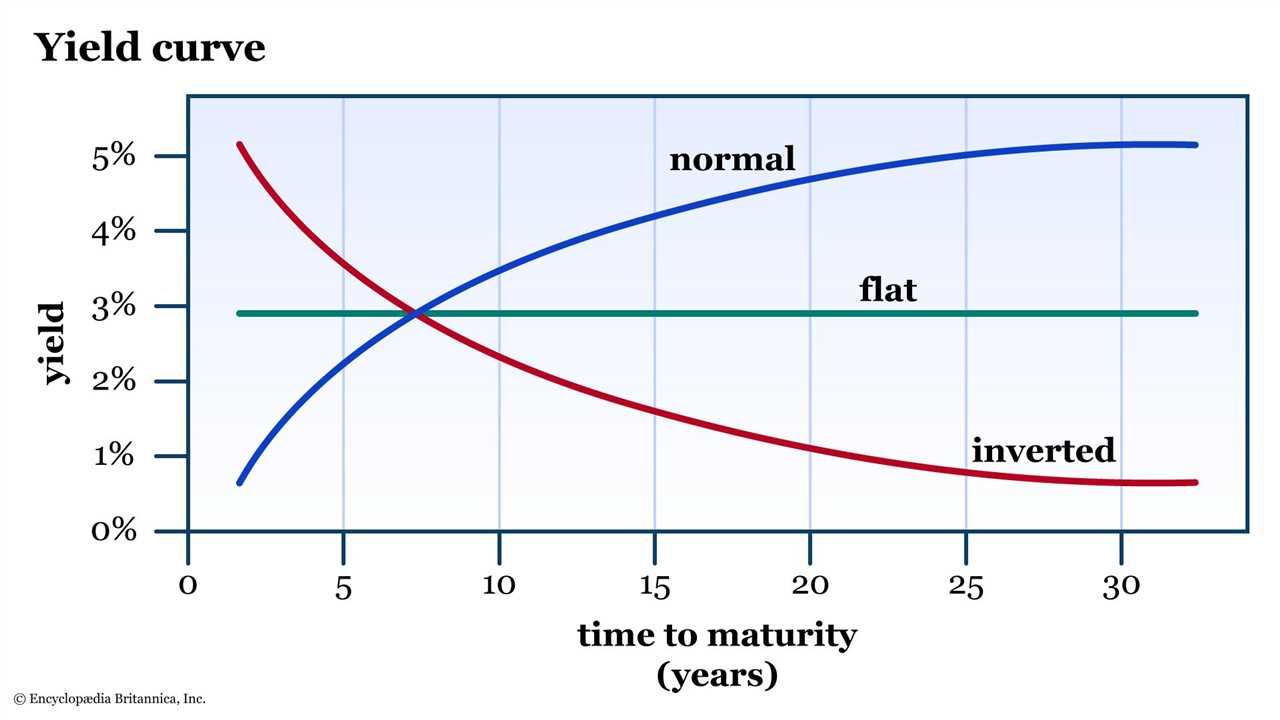

There are three main types of yield curves: normal, flat, and inverted. In a normal yield curve, longer-term bonds have higher yields compared to shorter-term bonds. This is because investors demand higher compensation for the increased risk associated with holding longer-term bonds.

The normal yield curve reflects a healthy and growing economy. It indicates that investors have confidence in the future and are willing to invest in longer-term bonds. This is because they expect higher returns in the long run due to economic growth and higher inflation.

On the other hand, a flat yield curve occurs when the yields on short-term and long-term bonds are approximately the same. This suggests that investors have a neutral outlook on the economy and expect little change in interest rates in the future.

An inverted yield curve, on the other hand, is a rare occurrence where short-term bonds have higher yields than long-term bonds. This is seen as a warning sign of an impending economic downturn or recession.

The normal yield curve is influenced by various factors, including monetary policy, inflation expectations, and market sentiment. Central banks play a crucial role in shaping the yield curve through their control over short-term interest rates.

Investors and traders closely monitor the yield curve as it provides valuable insights into the bond market and the overall health of the economy. Changes in the shape of the yield curve can indicate shifts in market expectations and impact investment strategies.

The Mechanics of Fixed Income Trading

1. Market Participants

Fixed income trading involves various market participants, including institutional investors, hedge funds, banks, and individual investors. These participants trade fixed income securities either on exchanges or over-the-counter (OTC) markets.

Institutional investors, such as pension funds and insurance companies, are significant players in fixed income trading due to their large investment portfolios. Hedge funds and banks also play a crucial role, utilizing their expertise and resources to execute trades and manage risks.

2. Trading Platforms

Fixed income trading can take place on different platforms, depending on the type of security and the preferences of the market participants. The two primary trading platforms are exchanges and OTC markets.

Exchanges provide a centralized marketplace where buyers and sellers can trade fixed income securities. These exchanges have specific rules and regulations, ensuring transparency and fair trading practices. Examples of fixed income exchanges include the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE).

OTC markets, on the other hand, are decentralized platforms where trading occurs directly between buyers and sellers. These markets offer more flexibility and customization in terms of trading terms and conditions. Examples of OTC fixed income markets include the bond market and the interbank market.

3. Trading Process

The trading process in fixed income markets involves several steps:

- Order Placement: Market participants place orders to buy or sell fixed income securities, specifying the quantity, price, and other relevant details.

- Order Matching: On exchanges, orders are matched automatically based on price and time priority. In OTC markets, brokers or dealers facilitate the matching process.

- Trade Execution: Once the orders are matched, the trade is executed, and ownership of the securities is transferred from the seller to the buyer.

- Settlement: After the trade execution, the settlement process begins, where the buyer pays for the securities, and the seller delivers the securities.

4. Market Liquidity

Market liquidity is a crucial aspect of fixed income trading. It refers to the ease with which fixed income securities can be bought or sold without significantly impacting their prices. Highly liquid markets allow for efficient trading, while illiquid markets can lead to higher transaction costs and price volatility.

The liquidity of fixed income securities depends on various factors, including the trading volume, the number of market participants, and the availability of market makers. Government bonds and highly rated corporate bonds tend to be more liquid compared to lower-rated or less actively traded securities.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.