Non-Operating Income: Definition, Examples, and Purpose

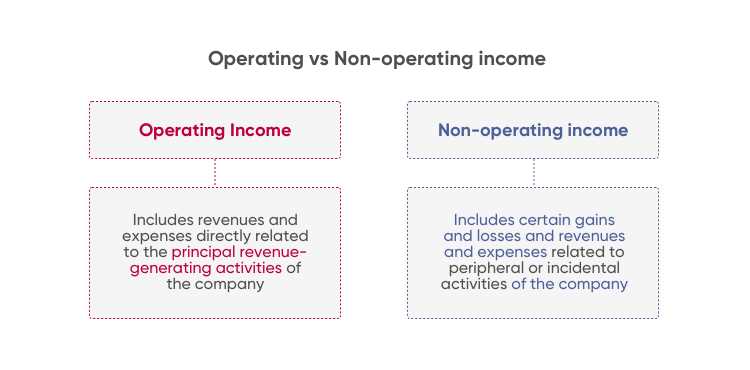

Non-operating income refers to the revenue or gains generated by a company that are not directly related to its core business operations. It is the income derived from activities that are not considered part of the company’s primary operations.

Examples of non-operating income include:

- Investment income: This includes dividends, interest, and capital gains earned from investments made by the company.

- Gain on sale of assets: When a company sells its assets, such as property or equipment, at a higher price than their book value, it generates a gain.

- Foreign exchange gains: If a company operates in multiple countries and deals with different currencies, it may earn profits from fluctuations in exchange rates.

- Insurance settlements: If a company receives a payout from an insurance claim, it is considered non-operating income.

The purpose of non-operating income is twofold:

- Diversification of revenue streams: Non-operating income provides a source of revenue that is independent of the company’s core operations. This diversification can help mitigate risks associated with fluctuations in the primary business.

- Enhancement of profitability: Non-operating income can contribute to the overall profitability of a company by providing additional income streams. This can help improve financial performance and increase shareholder value.

What is Non-Operating Income?

Non-operating income refers to the revenue or income that a company generates from activities that are not directly related to its core operations. It is the income that is derived from sources other than the primary business activities of a company.

Non-operating income can come from various sources, such as investments, interest income, rental income, gains from the sale of assets, and other miscellaneous sources. These sources of income are not considered part of the company’s day-to-day operations but can still contribute to its overall financial performance.

While non-operating income can provide additional revenue for a company, it is important to note that it is not sustainable or predictable in the long term. It is considered to be more volatile and can fluctuate significantly from year to year. Therefore, investors and analysts often focus more on the company’s operating income, which is derived from its core business activities, to assess its ongoing profitability and financial stability.

Examples of Non-Operating Income

Non-operating income refers to the income that a company generates from activities that are not directly related to its core operations. These activities can include investments, sales of assets, and other miscellaneous sources of income. Here are some examples of non-operating income:

1. Investment Income

Companies often invest their excess cash in various financial instruments such as stocks, bonds, and mutual funds. The income generated from these investments, such as dividends and interest, is considered non-operating income. For example, if a company owns shares of another company and receives dividends from those shares, it would be classified as non-operating income.

2. Gain on Sale of Assets

When a company sells its assets, such as property, equipment, or investments, at a higher price than their original cost, it generates a gain on the sale. This gain is considered non-operating income because it is not generated from the company’s core operations. For instance, if a company sells a piece of land for a higher price than its purchase price, the profit from the sale would be classified as non-operating income.

3. Foreign Exchange Gains

Companies that engage in international business may have transactions denominated in foreign currencies. Fluctuations in exchange rates can result in gains or losses when these transactions are settled. If a company realizes a gain due to favorable exchange rate movements, it would be classified as non-operating income. For example, if a company converts foreign currency into its domestic currency and realizes a gain due to a favorable exchange rate, the gain would be considered non-operating income.

4. Insurance Proceeds

Insurance proceeds received by a company as a result of an insurance claim can be classified as non-operating income. For instance, if a company’s property is damaged in a fire and it receives insurance proceeds to cover the damages, the amount received would be considered non-operating income.

5. Royalties and Licensing Fees

Companies that own intellectual property, such as patents, trademarks, and copyrights, may earn income through licensing agreements and royalty payments. This income is considered non-operating because it is not generated from the company’s core operations. For example, if a company licenses its trademark to another company and receives royalty payments, the income would be classified as non-operating income.

| Example | Type of Non-Operating Income |

|---|---|

| Dividends received from investments | Investment Income |

| Profit from the sale of a building | Gain on Sale of Assets |

| Foreign exchange gain on currency conversion | Foreign Exchange Gains |

| Insurance proceeds received for a damaged vehicle | Insurance Proceeds |

| Royalty payments received for the use of a patent | Royalties and Licensing Fees |

These are just a few examples of non-operating income. It is important for companies to accurately classify their income to provide a clear picture of their financial performance to investors and stakeholders.

Purpose of Non-Operating Income

Non-operating income plays a crucial role in financial statements as it provides important information about a company’s overall financial performance. While operating income reflects the core operations of a business, non-operating income represents the additional sources of revenue or gains that are not directly related to the main business activities.

The purpose of reporting non-operating income is to give investors, analysts, and other stakeholders a comprehensive view of a company’s financial health and performance. By separating non-operating income from operating income, financial statements allow users to evaluate the profitability and sustainability of a company’s core business operations separately from other income sources.

Non-operating income can come from various sources, such as investment gains, interest income, rental income, and gains from the sale of assets. These income sources are typically considered non-recurring or incidental to the main business operations. However, they can still have a significant impact on a company’s overall financial performance.

By disclosing non-operating income separately, financial statements provide transparency and help users assess the stability and sustainability of a company’s earnings. This information is particularly important for investors who want to understand the true profitability of a company and its ability to generate consistent income.

Furthermore, non-operating income can also be an indicator of a company’s diversification strategy and risk management. If a company generates a significant portion of its income from non-operating sources, it may suggest that the company is relying heavily on external factors or investments rather than its core business operations. This information can be useful for investors and analysts in assessing the overall risk profile of a company.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.