Non-Marketable Security: Definition

A non-marketable security refers to a financial instrument that cannot be easily bought or sold in the secondary market. Unlike marketable securities, which can be traded on exchanges or over-the-counter markets, non-marketable securities have limited liquidity and are typically held until maturity.

One of the main characteristics of non-marketable securities is their fixed interest rate or coupon payment. This means that the issuer promises to pay a predetermined amount of interest to the investor at regular intervals until the security matures.

Another important feature of non-marketable securities is their longer maturity periods. Unlike marketable securities, which often have shorter maturities, non-marketable securities can have terms ranging from a few years to several decades.

Investors who hold non-marketable securities may face challenges if they need to sell or liquidate their investments before maturity. Since there is no active secondary market for these securities, finding a buyer can be difficult, and the investor may have to accept a lower price or wait until the security matures to receive the full principal amount.

Overall, non-marketable securities offer certain advantages, such as stable income and lower price volatility compared to marketable securities. However, they also come with limitations in terms of liquidity and flexibility in trading.

| Key Points |

|---|

| – Non-marketable securities are financial instruments that cannot be easily bought or sold in the secondary market. |

| – They are typically issued by government entities and held by institutional investors. |

| – Non-marketable securities have fixed interest rates and longer maturity periods. |

| – They offer stable income but limited liquidity. |

Non-marketable securities are financial instruments that cannot be easily bought or sold in the secondary market. Unlike marketable securities, which can be traded on exchanges or over-the-counter markets, non-marketable securities have limited liquidity and are typically held until maturity.

Non-marketable securities are often issued by governments, such as savings bonds or treasury bills, or by corporations for specific purposes, such as employee stock options or restricted stock units. These securities are not listed on stock exchanges and are not easily transferable between investors.

One of the key characteristics of non-marketable securities is their lack of market value. Unlike marketable securities, which have a readily available market price, non-marketable securities do not have a transparent market value. This makes it difficult for investors to determine the current worth of their investments.

Non-marketable securities are typically held by long-term investors who are willing to forgo liquidity in exchange for other benefits, such as tax advantages or guaranteed returns. For example, savings bonds issued by the government offer a fixed interest rate and are backed by the full faith and credit of the government, making them a relatively safe investment option.

Overall, non-marketable securities play a unique role in the financial markets by offering investors alternative investment options that may provide certain benefits not found in marketable securities. However, due to their limited liquidity and lack of market value, these securities may not be suitable for all investors.

Non-Marketable Security: Examples

A non-marketable security refers to a financial instrument that cannot be easily bought or sold on a public exchange. These securities are typically issued by the government or other organizations and are not traded on the open market. Non-marketable securities are often held by individuals or institutions for long-term investment purposes.

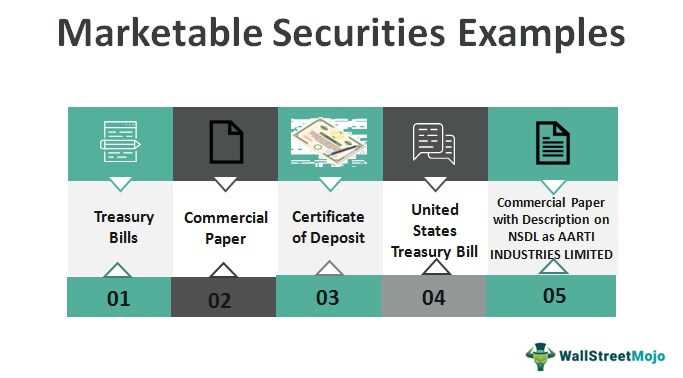

There are several examples of non-marketable securities:

| Security Type | Description |

|---|---|

| Savings Bonds | Savings bonds are issued by the government and are purchased at a discount to their face value. They earn interest over a fixed period of time and can be redeemed for their full value at maturity. Savings bonds are not traded on the open market and can only be bought or sold through the U.S. Treasury Department. |

| Treasury Bills | Treasury bills are short-term debt securities issued by the government. They have a maturity of less than one year and are sold at a discount to their face value. Treasury bills are considered one of the safest investments and are not traded on the open market. They are typically bought and sold through auctions conducted by the U.S. Treasury Department. |

| Certificates of Deposit | Certificates of deposit (CDs) are time deposits offered by banks and other financial institutions. They have a fixed term and earn a fixed interest rate. CDs are not traded on the open market and cannot be easily bought or sold before their maturity date. They are considered low-risk investments. |

| Mutual Funds | Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities. While mutual funds can be bought and sold on the open market, certain types of mutual funds, such as those offered by private investment firms, may be non-marketable and only available to a select group of investors. |

These are just a few examples of non-marketable securities. Other types include government savings accounts, annuities, and certain types of retirement accounts. Non-marketable securities offer investors the opportunity to hold assets that are not subject to the volatility of the open market and may provide stable returns over time.

Types of Non-Marketable Securities

Non-marketable securities are financial instruments that cannot be easily bought or sold on the open market. They are typically issued by the government or corporations for specific purposes and have limited liquidity. There are several types of non-marketable securities, each with its own unique characteristics and features.

1. Savings Bonds

Savings bonds are one type of non-marketable security issued by the government. They are debt securities that individuals can purchase directly from the government at a fixed interest rate. Savings bonds have a specific maturity date and cannot be sold on the secondary market. They are often considered a safe investment option and are backed by the full faith and credit of the government.

2. Treasury Bills

3. Certificates of Deposit

Certificates of deposit (CDs) are non-marketable securities issued by banks and financial institutions. They are time deposits with a fixed maturity date and a specified interest rate. CDs are considered low-risk investments and offer higher interest rates compared to regular savings accounts. However, they cannot be easily bought or sold on the open market before their maturity date.

4. Municipal Bonds

Municipal bonds are non-marketable securities issued by state and local governments to fund public projects and infrastructure development. They are debt instruments that pay interest to investors over a specific period of time. Municipal bonds are generally exempt from federal taxes and may also be exempt from state and local taxes, making them attractive to investors seeking tax advantages. However, they are not easily tradable on the secondary market.

These are just a few examples of non-marketable securities. Other types include savings accounts, fixed annuities, and certain types of insurance policies. While non-marketable securities offer various benefits, such as stability and tax advantages, they lack the liquidity and flexibility of marketable securities.

Non-Marketable Security Vs. Marketable Security

Liquidity and Tradability

One of the key differences between non-marketable securities and marketable securities is their liquidity and tradability in the secondary market. Marketable securities are financial instruments that can be easily bought and sold in the secondary market, such as stocks and bonds traded on stock exchanges. These securities have high liquidity and can be quickly converted into cash.

On the other hand, non-marketable securities are financial instruments that cannot be easily traded in the secondary market. These securities are typically issued by the government or corporations for specific purposes and have restrictions on their transferability. Examples of non-marketable securities include savings bonds, treasury bills, and certain types of government-issued debt.

Investment Risk

Another difference between non-marketable securities and marketable securities is the level of investment risk associated with them. Marketable securities, being traded in the secondary market, are subject to market fluctuations and can experience price volatility. Investors in marketable securities need to closely monitor market conditions and make informed investment decisions.

Non-marketable securities, on the other hand, are often considered less risky because they are not exposed to market fluctuations. These securities are typically backed by the government or corporations with strong credit ratings, making them relatively safe investments. However, the returns on non-marketable securities are usually lower compared to marketable securities.

Investment Objectives

Non-marketable securities, on the other hand, are more suitable for conservative investors who prioritize capital preservation and are willing to accept lower returns. These securities provide a stable source of income and are often used as a means of long-term savings or funding specific financial goals.

Conclusion

Differences Between Non-Marketable and Marketable Securities

Non-marketable securities and marketable securities are two types of financial instruments that differ in terms of their liquidity and tradability. Here are the key differences between non-marketable and marketable securities:

Liquidity

One of the main differences between non-marketable and marketable securities is their liquidity. Marketable securities are highly liquid and can be easily bought and sold in the secondary market. They are typically traded on organized exchanges, such as stock exchanges, and can be quickly converted into cash without significant price impact.

On the other hand, non-marketable securities are not easily tradable in the secondary market. They are often issued by government entities or corporations for specific purposes and have restrictions on their transferability. Non-marketable securities are generally held until maturity and cannot be readily sold or transferred to other investors.

Tradability

Marketable securities are actively traded in the secondary market, allowing investors to buy and sell them at prevailing market prices. These securities have a well-established market and are subject to supply and demand dynamics, which determine their prices. Investors can easily enter or exit their positions in marketable securities based on their investment objectives and market conditions.

Non-marketable securities, on the other hand, have limited or no trading activity in the secondary market. They are often issued with specific terms and conditions that restrict their transferability. As a result, investors holding non-marketable securities may not have the option to sell or transfer their investments until maturity or until specific conditions are met.

Investor Base

Marketable securities have a wide investor base, including individual investors, institutional investors, and foreign investors. These securities are accessible to a broad range of market participants and can be traded by anyone with access to the relevant market. The large investor base for marketable securities contributes to their liquidity and price discovery.

Non-marketable securities, on the other hand, often have a limited investor base. They may be restricted to certain institutional investors or specific groups of individuals. The limited investor base for non-marketable securities can make it more challenging to find buyers or sellers in the secondary market, further reducing their liquidity.

Risk and Return

Marketable securities are generally associated with higher levels of risk and return compared to non-marketable securities. The active trading in the secondary market exposes marketable securities to market fluctuations and price volatility. Investors in marketable securities have the potential for higher returns but also face a higher risk of loss.

Non-marketable securities, on the other hand, are often considered less risky but offer lower returns compared to marketable securities. These securities are typically issued by government entities or corporations with strong credit ratings and stable cash flows. While non-marketable securities may provide a more stable income stream, they may not offer the same level of potential return as marketable securities.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.