Net Receivables: Definition, Calculation, and Example

Net receivables refer to the amount of money that a company expects to receive from its customers after deducting any allowances for doubtful accounts or bad debts. It represents the net amount of accounts receivable that the company anticipates collecting within a certain period of time.

Definition

Net receivables are a key financial metric used in accounting to assess the liquidity and financial health of a company. It represents the amount of money that a company is owed by its customers for goods or services provided on credit.

Calculation

The calculation of net receivables involves subtracting the allowance for doubtful accounts from the total accounts receivable. The allowance for doubtful accounts is an estimate of the amount of accounts receivable that the company believes will not be collected.

Example

Let’s say a company has total accounts receivable of $100,000 and an allowance for doubtful accounts of $5,000. The net receivables would be calculated as:

This means that the company expects to collect $95,000 from its customers after accounting for potential bad debts.

It is important for a company to closely monitor its net receivables as it indicates the effectiveness of its credit and collection policies. A high net receivables balance may suggest that the company is facing difficulties in collecting payments from its customers, while a low net receivables balance may indicate efficient credit management.

What are Net Receivables?

Net receivables are a financial metric used in accounting to measure the amount of money a company expects to receive from its customers after deducting any allowances for bad debts or uncollectible accounts. It represents the net amount of accounts receivable that a company anticipates collecting within a certain period of time.

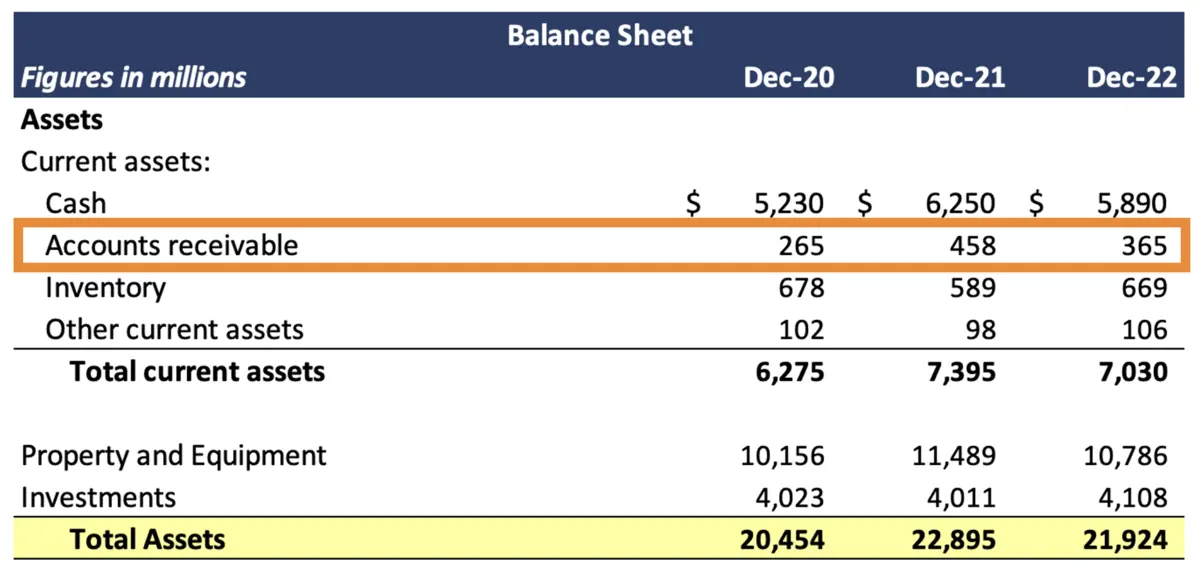

Accounts receivable refers to the money owed to a company by its customers for goods or services that have been delivered but not yet paid for. It is considered an asset on the company’s balance sheet. However, not all accounts receivable are collectible, as some customers may default on their payments or become insolvent.

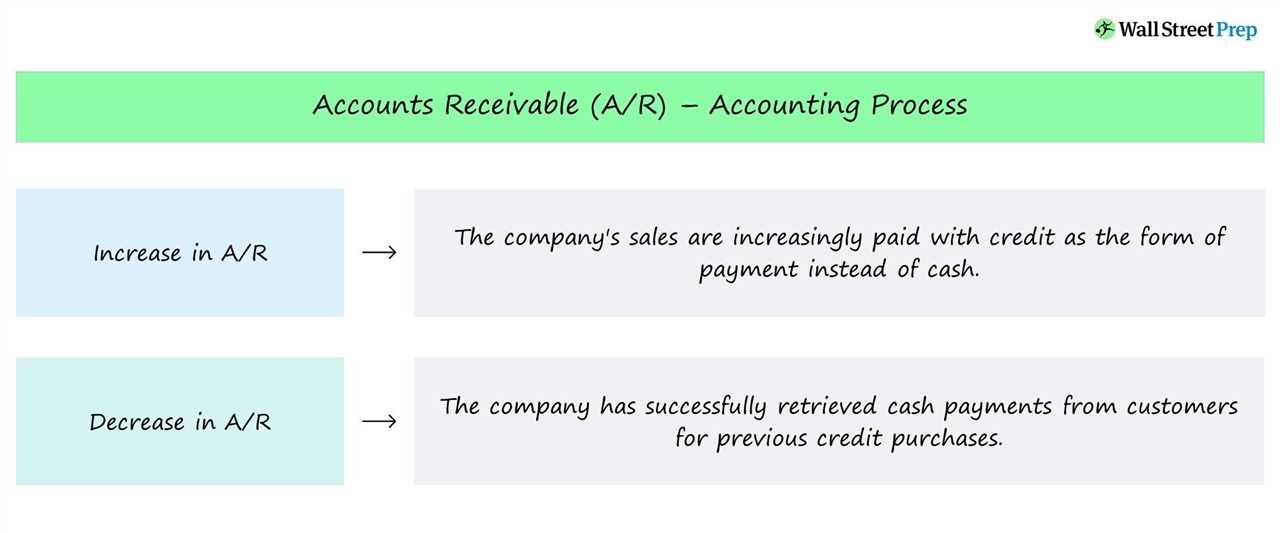

To account for the possibility of uncollectible accounts, companies create an allowance for bad debts. This allowance is an estimate of the amount of accounts receivable that is expected to be uncollectible. By deducting the allowance for bad debts from the total accounts receivable, the net receivables can be calculated.

Net receivables provide valuable information about a company’s ability to collect its outstanding debts and manage its cash flow. It is an important indicator of a company’s financial health and its ability to meet its short-term obligations. A high net receivables balance may indicate that a company is facing difficulties in collecting payments from its customers, while a low net receivables balance may suggest that a company has effective credit and collection policies in place.

Overall, net receivables play a crucial role in financial analysis and decision-making for both investors and creditors. They provide insights into a company’s liquidity, creditworthiness, and overall financial performance.

How to Calculate Net Receivables?

Calculating net receivables is an important task in accounting as it helps businesses understand their financial position and assess their ability to collect outstanding payments from customers. Net receivables represent the amount of money that a company expects to receive from its customers after deducting any allowances for doubtful accounts or bad debts.

To calculate net receivables, follow these steps:

Step 1: Determine the Gross Receivables

The first step is to determine the gross receivables, which is the total amount of money owed to the company by its customers. This includes all outstanding invoices, credit sales, and any other amounts due from customers.

Step 2: Subtract Allowance for Doubtful Accounts

The next step is to subtract the allowance for doubtful accounts from the gross receivables. The allowance for doubtful accounts is an estimate of the amount of money that the company is unlikely to collect from its customers. It is based on historical data, industry trends, and the company’s past experience with bad debts.

Step 3: Calculate Net Receivables

Once the allowance for doubtful accounts is subtracted, the remaining amount is the net receivables. This represents the amount of money that the company expects to collect from its customers.

It is important to regularly review and update the allowance for doubtful accounts to reflect any changes in the company’s collection experience or economic conditions. This ensures that the net receivables figure accurately reflects the company’s expected cash inflows.

By calculating net receivables, businesses can assess their liquidity and financial health. It helps them determine the effectiveness of their credit policies, identify potential risks, and make informed decisions about extending credit to customers.

Example of Net Receivables Calculation

Net receivables are an important metric in accounting that represents the amount of money a company is expected to receive from its customers after deducting any allowances for doubtful accounts or bad debts. Calculating net receivables allows businesses to assess the overall health of their accounts receivable and make informed decisions about credit policies and collection strategies.

Step 1: Gather the necessary information

To calculate net receivables, you will need the following information:

- Total accounts receivable: This includes all outstanding customer invoices and amounts owed to the company.

- Allowance for doubtful accounts: This is an estimate of the portion of accounts receivable that is expected to be uncollectible.

Step 2: Calculate the net receivables

Once you have the necessary information, you can calculate the net receivables using the following formula:

Step 3: Interpret the results

The resulting net receivables figure represents the amount of money that the company expects to collect from its customers. A higher net receivables value indicates a stronger accounts receivable position, while a lower value may suggest potential issues with customer payments or creditworthiness.

Example:

Let’s say a company has $100,000 in total accounts receivable and an allowance for doubtful accounts of $5,000. Using the formula mentioned above, the net receivables would be:

| Total Accounts Receivable | Allowance for Doubtful Accounts | Net Receivables |

|---|---|---|

| $100,000 | $5,000 | $95,000 |

Importance of Net Receivables in Accounting

One of the key reasons why net receivables are important is that they help in assessing the liquidity of a company. By analyzing the net receivables, accountants and financial analysts can determine how quickly a company can convert its receivables into cash. This information is vital for making informed decisions about a company’s financial stability and ability to meet its short-term obligations.

Moreover, net receivables also provide insights into a company’s credit policies and collection practices. By analyzing the average collection period, which is the time it takes for a company to collect its receivables, stakeholders can evaluate the effectiveness of a company’s credit and collection policies. This information can help identify areas for improvement and optimize the cash flow management process.

Net receivables are also crucial for assessing a company’s profitability. By comparing the net receivables to the company’s revenue, analysts can determine the effectiveness of the company’s sales and credit policies. If the net receivables are too high in relation to the revenue, it may indicate that the company is facing difficulties in collecting payments from its customers, which can impact its profitability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.