Fair Debt Collection Practices Act: Definition and Rules

The Fair Debt Collection Practices Act (FDCPA) is a federal law that sets guidelines and regulations for debt collectors in the United States. It was enacted in 1977 with the aim of protecting consumers from abusive and unfair debt collection practices.

Definition of Fair Debt Collection Practices Act

The FDCPA defines a debt collector as any person or company that regularly collects debts owed to others. This includes collection agencies, lawyers who collect debts on behalf of clients, and companies that buy delinquent debts and try to collect them. The law applies to personal, family, and household debts, including credit card debts, medical bills, and mortgages.

Rules and Regulations of Fair Debt Collection Practices Act

The FDCPA sets forth a number of rules and regulations that debt collectors must follow when attempting to collect a debt. These rules include:

- Debt collectors must identify themselves and disclose that they are attempting to collect a debt.

- They must provide written notice within five days of their initial communication, including information about the debt and the consumer’s rights.

- Debt collectors cannot contact consumers at inconvenient times or places, such as before 8 a.m. or after 9 p.m., unless the consumer agrees to it.

- They cannot contact consumers at work if they know that the employer does not allow such communication.

- Debt collectors cannot harass, oppress, or abuse consumers. This includes using threats, obscene language, or repeatedly calling with the intent to annoy or harass.

- They cannot use false, deceptive, or misleading practices to collect a debt. This includes misrepresenting the amount owed, falsely implying that they are attorneys, or threatening legal action they cannot take.

- Debt collectors must cease communication upon request if the consumer notifies them in writing that they do not want to be contacted anymore.

Key Provisions of Fair Debt Collection Practices Act

Some of the key provisions of the FDCPA include:

- Consumers have the right to dispute a debt and request verification of the debt within 30 days of receiving the initial notice.

- Debt collectors must cease collection activities until they provide verification of the debt.

- Consumers have the right to sue debt collectors who violate the FDCPA and may be entitled to damages, including actual damages, statutory damages, and attorney’s fees.

- State laws may provide additional protections for consumers, and debt collectors must comply with both federal and state laws.

Overall, the Fair Debt Collection Practices Act plays a crucial role in ensuring that debt collectors treat consumers fairly and ethically. It provides consumers with important rights and protections when dealing with debt collection efforts.

Definition of Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) is a federal law that was enacted in 1977 to protect consumers from abusive and unfair debt collection practices. It sets guidelines and regulations that debt collectors must follow when attempting to collect debts from consumers.

The FDCPA applies to third-party debt collectors, which are companies or individuals who collect debts on behalf of others. It does not apply to original creditors who are collecting their own debts.

The main purpose of the FDCPA is to prevent debt collectors from using deceptive, unfair, or abusive tactics to collect debts. It sets clear rules and restrictions on how debt collectors can communicate with consumers, what information they can disclose, and what actions they can take to collect debts.

If a debt collector violates the FDCPA, consumers have the right to take legal action against them. They can file a lawsuit and seek damages for any harm caused by the violation, including emotional distress and attorney’s fees.

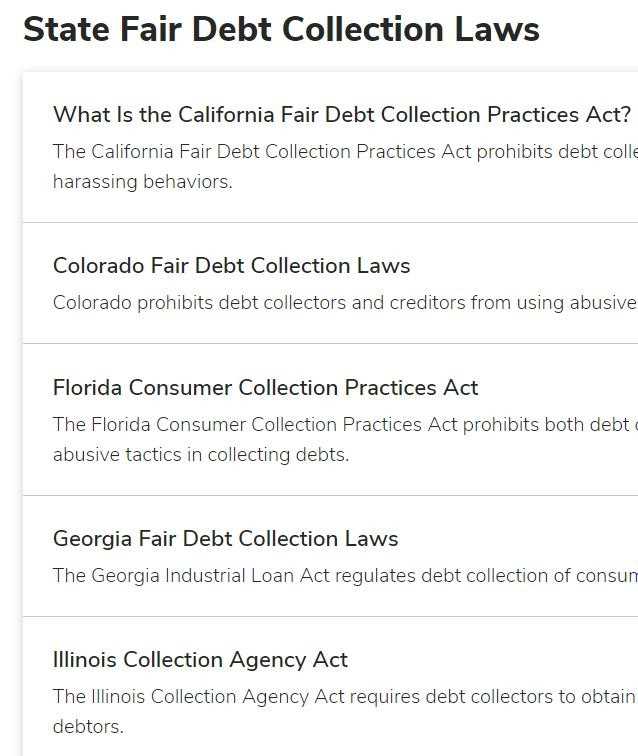

In addition to the FDCPA, some states have their own debt collection laws that provide additional protections for consumers. These laws may impose stricter regulations on debt collectors or provide additional remedies for consumers who have been subjected to unfair or abusive debt collection practices.

Overall, the Fair Debt Collection Practices Act plays a crucial role in ensuring that consumers are treated fairly and respectfully by debt collectors. It provides important rights and protections for consumers and holds debt collectors accountable for their actions.

Rules and Regulations of Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive and deceptive practices by debt collectors. The FDCPA sets out specific rules and regulations that debt collectors must follow when attempting to collect a debt. These rules are designed to ensure fair treatment of consumers and prevent harassment or unfair practices.

Key Provisions

There are several key provisions of the FDCPA that debt collectors must adhere to:

- Prohibited Actions: The FDCPA prohibits debt collectors from engaging in certain actions, such as making false statements or threats, using obscene or profane language, or contacting consumers at inconvenient times or places.

- Validation of Debts: Debt collectors must provide consumers with written notice within five days of their initial communication, informing them of their right to dispute the debt. If the consumer disputes the debt in writing within 30 days, the debt collector must cease collection efforts until the debt is verified.

- Harassment and Abuse: Debt collectors are prohibited from engaging in any conduct that is intended to harass, oppress, or abuse the consumer. This includes repeated phone calls, using threats or intimidation, or publishing a consumer’s name on a “bad debt” list.

- Deceptive Practices: Debt collectors cannot use any false, deceptive, or misleading representations in connection with the collection of a debt. This includes misrepresenting the amount owed, falsely implying that the collector is affiliated with the government, or threatening legal action that cannot be taken.

- Third-Party Communications: Debt collectors are generally prohibited from discussing a consumer’s debt with anyone other than the consumer, their spouse, or their attorney. They may only contact third parties to obtain location information about the consumer.

Key Provisions of the Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) is a federal law that regulates the practices of debt collectors and protects consumers from abusive and unfair debt collection practices. It sets guidelines and restrictions on how debt collectors can communicate with consumers and collect debts. Here are some key provisions of the FDCPA:

Prohibition of Harassment or Abuse

The FDCPA prohibits debt collectors from engaging in any conduct that is intended to harass, oppress, or abuse the consumer. This includes using threats, obscene language, or repeatedly calling with the intention to annoy or harass.

Prohibition of False or Misleading Representations

Debt collectors are not allowed to use any false, deceptive, or misleading representations in an attempt to collect a debt. They cannot misrepresent the amount owed, the consequences of non-payment, or their identity as a debt collector.

Validation of Debts

Under the FDCPA, debt collectors are required to provide consumers with a written validation notice within five days of their initial communication. This notice must include the amount of the debt, the name of the creditor, and the consumer’s rights to dispute the debt.

Prohibition of Unfair Practices

The FDCPA prohibits debt collectors from engaging in any unfair practices. This includes collecting any amount that is not authorized by law, depositing post-dated checks prematurely, or communicating with consumers at inconvenient times or places.

Right to Cease Communication

Consumers have the right to request that debt collectors cease communication with them. Once the debt collector receives this request in writing, they must stop all communication, except to inform the consumer of any legal action taken or to provide verification of the debt.

Enforcement and Remedies

The FDCPA provides consumers with the right to sue debt collectors who violate its provisions. If a violation is proven, consumers may be entitled to damages, including actual damages, statutory damages, and attorney’s fees.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.