Types of Mortgage Rates

Fixed-Rate Mortgage

A fixed-rate mortgage is a type of mortgage where the interest rate remains the same for the entire duration of the loan. This means that your monthly payments will also remain constant over the life of the loan. Fixed-rate mortgages are popular among borrowers who prefer stability and predictability in their mortgage payments.

Adjustable-Rate Mortgage (ARM)

ARMs often come with lower initial interest rates compared to fixed-rate mortgages, making them attractive to borrowers who plan to sell or refinance their homes before the initial fixed-rate period ends.

Interest-Only Mortgage

An interest-only mortgage is a type of mortgage where you only pay the interest on the loan for a certain period, typically 5 to 10 years. During this period, your monthly payments will be lower since you are not paying down the principal balance. However, once the interest-only period ends, your monthly payments will increase significantly, as you will need to start paying both the principal and interest.

Interest-only mortgages can be beneficial for borrowers who have irregular income or expect to earn a higher income in the future. However, they also come with higher risks, as you will need to be prepared for the higher payments once the interest-only period is over.

Jumbo Mortgage

A jumbo mortgage is a type of mortgage that exceeds the loan limits set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These loan limits vary by location and are typically higher in more expensive housing markets.

What is a Mortgage Rate?

A mortgage rate is the percentage of interest that a lender charges on a mortgage loan. It is the cost of borrowing money to finance a home purchase. Mortgage rates can be fixed or adjustable. A fixed-rate mortgage has an interest rate that remains the same for the entire term of the loan, while an adjustable-rate mortgage (ARM) has an interest rate that can change periodically.

How are Mortgage Rates Determined?

Several factors influence mortgage rates, including:

| Economic Factors | The state of the economy, inflation rates, and the overall interest rate environment can all impact mortgage rates. When the economy is strong, mortgage rates tend to rise, and when the economy is weak, mortgage rates tend to fall. |

| Credit Score | |

| Loan Term | The length of the loan term can affect the mortgage rate. Generally, shorter-term loans have lower interest rates compared to longer-term loans. |

| Loan Amount | The loan amount can also impact the mortgage rate. In general, larger loan amounts may have higher interest rates. |

| Down Payment | A larger down payment can result in a lower mortgage rate, as it reduces the lender’s risk. |

Types of Mortgage Rates

1. Fixed Rate Mortgage

A fixed rate mortgage is a type of mortgage where the interest rate remains the same throughout the entire term of the loan. This means that your monthly mortgage payments will also remain the same, providing stability and predictability. Fixed rate mortgages are a popular choice for many borrowers because they offer peace of mind and protection against rising interest rates.

2. Adjustable Rate Mortgage (ARM)

3. Hybrid Mortgage

A hybrid mortgage is a combination of a fixed rate mortgage and an adjustable rate mortgage. It typically starts with a fixed rate for a certain number of years, such as 3, 5, 7, or 10, and then switches to an adjustable rate for the remaining term. Hybrid mortgages can offer the best of both worlds, providing stability in the early years and potential savings in the later years.

4. Interest-Only Mortgage

An interest-only mortgage is a type of mortgage where the borrower only pays the interest on the loan for a certain period, typically 5 or 10 years. After the interest-only period ends, the borrower must start making principal and interest payments, which can significantly increase the monthly payment. Interest-only mortgages can be beneficial for borrowers who expect their income to increase in the future or plan to sell the property before the interest-only period ends.

5. Jumbo Mortgage

A jumbo mortgage is a type of mortgage that exceeds the conforming loan limits set by Fannie Mae and Freddie Mac. These loan limits vary by location but are generally higher than the limits for conventional mortgages. Jumbo mortgages typically have higher interest rates and stricter qualification requirements, but they can be a good option for borrowers who need to finance a high-priced property.

Factors That Determine Mortgage Rates

1. Credit Score:

Your credit score plays a significant role in determining the interest rate you will be offered. Lenders use your credit score to assess your creditworthiness and determine the level of risk they are taking by lending you money. Generally, borrowers with higher credit scores are considered less risky and are offered lower interest rates.

The loan-to-value (LTV) ratio is the percentage of the loan amount compared to the appraised value of the property. Lenders use this ratio to assess the risk of the loan. A lower LTV ratio indicates that the borrower has more equity in the property, which reduces the risk for the lender. As a result, borrowers with lower LTV ratios are often offered lower interest rates.

3. Down Payment:

The size of your down payment can also impact the interest rate you are offered. A larger down payment demonstrates financial stability and reduces the amount of money the lender needs to finance. This lower loan amount can result in a lower interest rate.

4. Loan Term:

5. Economic Factors:

The overall state of the economy can also impact mortgage rates. Factors such as inflation, unemployment rates, and the Federal Reserve’s monetary policy can influence interest rates. In times of economic growth, interest rates tend to rise, while during economic downturns, interest rates may decrease.

6. Type of Mortgage:

The type of mortgage you choose can also affect the interest rate. Fixed-rate mortgages have a set interest rate for the entire loan term, while adjustable-rate mortgages (ARMs) have interest rates that can fluctuate over time. Generally, fixed-rate mortgages offer more stability and may have slightly higher interest rates compared to ARMs.

How to Get the Best Mortgage Rate

Getting the best mortgage rate is crucial when you’re looking to buy a home. A lower interest rate can save you thousands of dollars over the life of your loan. Here are some tips to help you secure the best mortgage rate:

1. Improve Your Credit Score:

One of the most important factors that lenders consider when determining your mortgage rate is your credit score. A higher credit score usually leads to a lower interest rate. To improve your credit score, make sure to pay your bills on time, keep your credit card balances low, and avoid opening new credit accounts.

2. Shop Around:

3. Increase Your Down Payment:

A larger down payment can help you secure a better mortgage rate. Lenders often offer lower rates to borrowers who have a higher down payment because it reduces the lender’s risk. If possible, try to save up for a larger down payment before applying for a mortgage.

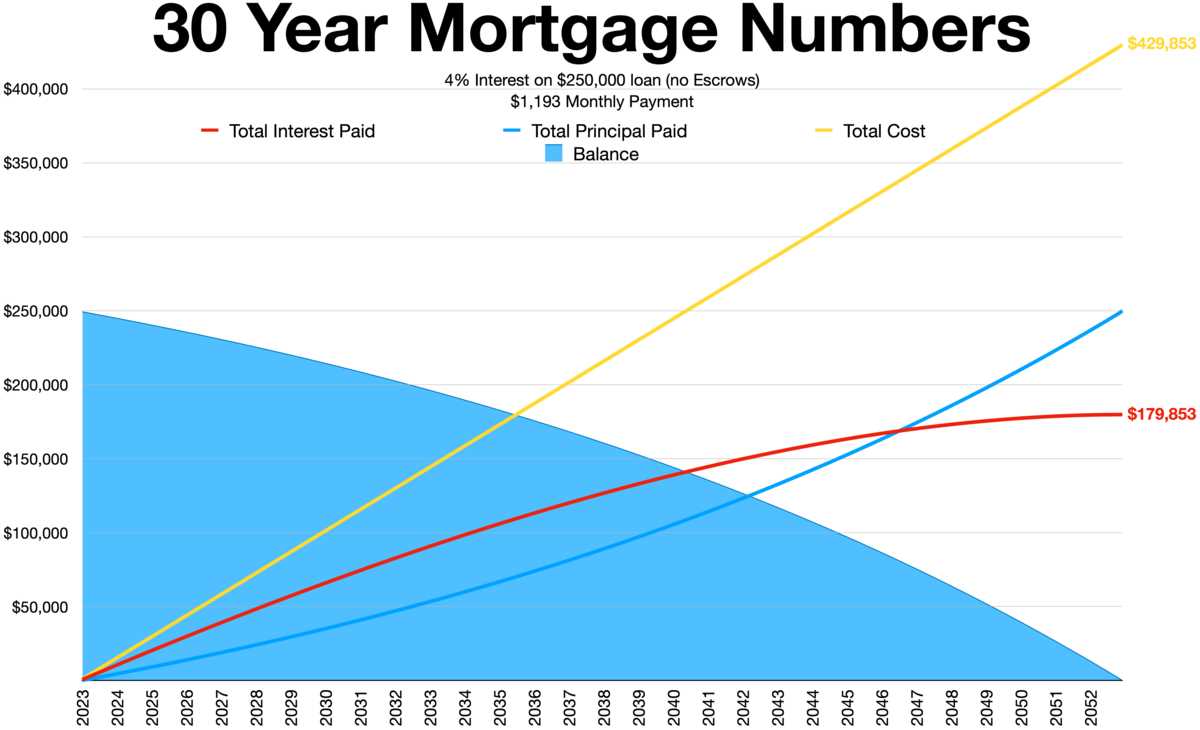

4. Consider a Shorter Loan Term:

While a 30-year mortgage may seem appealing because of its lower monthly payments, it often comes with a higher interest rate. Consider opting for a shorter loan term, such as a 15-year mortgage, to secure a lower interest rate. Although your monthly payments may be higher, you’ll save money in the long run.

5. Pay for Points:

Some lenders offer the option to pay for points, which allows you to lower your interest rate. Each point typically costs 1% of the loan amount and can reduce your interest rate by a certain percentage. If you have the funds available, paying for points upfront can result in long-term savings.

6. Maintain a Stable Employment and Income:

Lenders prefer borrowers who have a stable employment history and a steady source of income. Having a stable job and income can increase your chances of getting a lower mortgage rate. Avoid changing jobs or taking on new debt before applying for a mortgage.

By following these tips, you can increase your chances of getting the best mortgage rate possible. Remember to do your research, compare rates, and consider all factors before making a decision. A lower mortgage rate can save you money and make your dream of homeownership more affordable.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.