Material Participation Tests Definition IRS Rules

Material participation tests are a set of rules defined by the Internal Revenue Service (IRS) that determine whether a taxpayer is actively involved in a business or rental activity. These tests are used to determine whether the taxpayer can claim certain tax benefits related to their involvement in the activity.

Material participation tests are important for taxpayers who are involved in business activities or rental properties. The IRS has established these tests to differentiate between active participation and passive participation. Active participation refers to the taxpayer being involved in the day-to-day operations and decision-making of the activity, while passive participation refers to the taxpayer having a more hands-off approach.

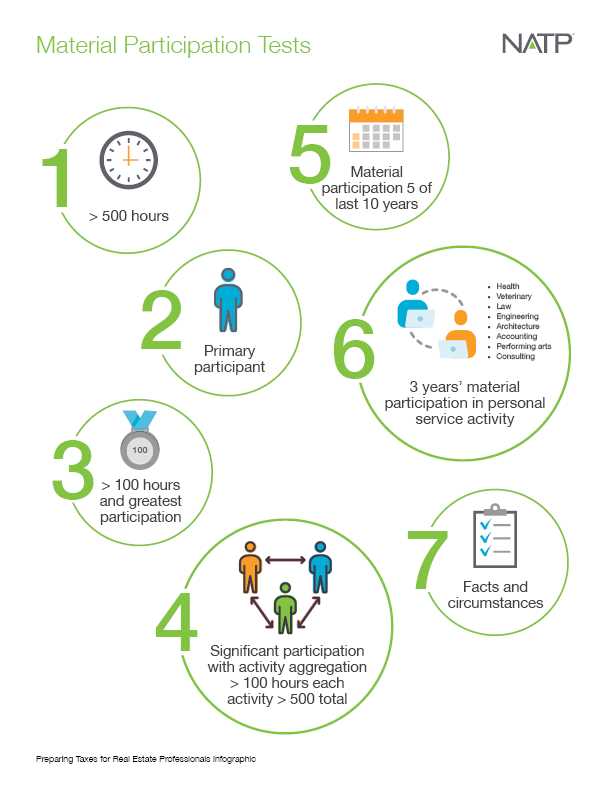

The IRS has provided several tests to determine material participation. These tests include:

- The 500-Hour Test: The taxpayer must participate in the activity for at least 500 hours during the tax year.

- The Substantial Participation Test: The taxpayer must participate in the activity for more than 100 hours during the tax year, and their participation must be more than any other individual.

- The Significant Participation Activity Test: The taxpayer must participate in the activity for more than 100 hours during the tax year, and their participation must be more than 500 hours in all other activities combined.

- The Material Participation Test: The taxpayer must participate in the activity for more than 500 hours during the tax year.

If a taxpayer meets any of these tests, they are considered to have materially participated in the activity and may be eligible for certain tax benefits, such as deducting losses from the activity against other income.

It is important for taxpayers to keep accurate records of their participation in the activity to support their claim of material participation. This can include keeping track of hours spent, documenting decision-making processes, and maintaining any other relevant documentation.

Overall, material participation tests play a crucial role in determining the level of involvement a taxpayer has in a business or rental activity. By meeting these tests, taxpayers can potentially benefit from various tax deductions and credits.

Material participation tests are a set of rules established by the IRS to determine whether a taxpayer is actively involved in a business or rental activity. These tests are important for determining whether the taxpayer qualifies for certain tax benefits, such as deducting losses from the activity.

There are several tests that can be used to determine material participation, including the hours test, the facts and circumstances test, and the significant participation activity test. The hours test requires the taxpayer to spend a certain number of hours per year participating in the activity, while the facts and circumstances test considers the taxpayer’s level of involvement and control over the activity. The significant participation activity test applies to rental activities and requires the taxpayer to participate in the activity for more than 500 hours per year.

Meeting one of these tests is necessary for a taxpayer to be considered materially participating in an activity. If a taxpayer does not meet any of the tests, they are considered to have a passive activity, which may limit their ability to deduct losses from the activity.

It is important for taxpayers to understand the material participation tests and how they apply to their specific situations. Keeping accurate records of hours spent on the activity and documenting the level of involvement and control can help support a claim of material participation. Consulting with a tax professional can also provide guidance on how to meet the tests and maximize tax benefits.

Passive Activities under TAX LAWS & REGULATIONS

Passive activities refer to any trade or business in which the taxpayer does not materially participate. According to the IRS rules, material participation is defined as involvement in the operations of the activity on a regular, continuous, and substantial basis. If a taxpayer does not meet the material participation tests, their activity is considered passive.

Passive activities are subject to different tax rules and regulations compared to active or material participation activities. The main distinction is that losses from passive activities can only be used to offset income from other passive activities. They cannot be used to offset income from active or material participation activities.

Passive activities are generally investments in businesses or rental properties where the taxpayer does not have a significant role in day-to-day operations. Examples of passive activities include rental real estate, limited partnerships, and certain types of businesses where the taxpayer has limited involvement.

One of the key reasons for the distinction between passive and material participation activities is to prevent taxpayers from using losses from passive activities to offset income from their regular jobs or businesses. This rule ensures that taxpayers are not able to artificially reduce their taxable income by claiming losses from passive activities.

Passive activities also have specific rules regarding the treatment of income and deductions. For example, rental income from passive activities is generally considered passive income and is subject to passive activity loss limitations. Deductions related to passive activities are also subject to certain limitations and can only be used to offset income from other passive activities.

It is important for taxpayers to understand the distinction between passive and material participation activities to properly report their income and deductions on their tax returns. Failing to accurately classify activities can result in penalties and interest from the IRS.

| Passive Activities | Material Participation Activities |

|---|---|

| Subject to passive activity loss limitations | Losses can be used to offset income from other activities |

| Income is considered passive income | Income is considered active or material participation income |

| Limited involvement in day-to-day operations | Regular, continuous, and substantial involvement in operations |

| Losses cannot be used to offset income from active or material participation activities | Losses can be used to offset income from other activities |

Exploring Passive Activities under [TAX LAWS & REGULATIONS catname]

![Exploring Passive Activities under [TAX LAWS & REGULATIONS catname]](/wp-content/uploads/2024/03/material-participation-tests-definition-irs-rules_3.jpg)

A passive activity is generally defined as any trade or business in which the taxpayer does not materially participate. Material participation is determined based on various tests established by the IRS.

One of the main tests used to determine material participation is the hours test. This test requires the taxpayer to participate in the activity for a certain number of hours during the tax year. The specific number of hours depends on the taxpayer’s overall level of participation in all activities.

If the taxpayer does not meet any of the material participation tests, the activity is considered passive. Passive activities are subject to special tax rules, including limitations on deducting losses and credits. These rules are designed to prevent taxpayers from using passive activities to offset income from other sources.

Passive activities can include rental real estate, limited partnerships, and certain types of businesses where the taxpayer has limited involvement. It is important for taxpayers to accurately classify their activities as passive or non-passive to ensure compliance with tax laws and regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.