Married Filing Jointly: Exploring the Definition, Advantages, and Disadvantages

Married Filing Jointly is a tax filing status that allows married couples to combine their incomes and deductions when filing their federal income tax return. This status is available to couples who are legally married as of the last day of the tax year, regardless of whether they live together or not.

Definition

When a couple chooses to file jointly, they report their combined income, deductions, and credits on a single tax return. This means that both spouses are equally responsible for the accuracy and completeness of the information provided on the return.

By filing jointly, couples can take advantage of certain tax benefits that are not available to those who file separately. These benefits include a higher standard deduction, lower tax rates, and eligibility for various tax credits and deductions.

Advantages

- Higher standard deduction: When married couples file jointly, they are eligible for a higher standard deduction compared to those who file separately. This can result in a lower taxable income and potentially lower tax liability.

- Lower tax rates: The tax brackets for married couples filing jointly are typically wider than those for individuals or married couples filing separately. This means that a larger portion of their income may be taxed at lower rates.

Disadvantages

- Joint and several liability: When filing jointly, both spouses are jointly and severally liable for any taxes owed, as well as any errors or omissions on the tax return. This means that if one spouse fails to report income or claims incorrect deductions, both spouses may be held responsible.

- Loss of certain deductions and credits: Some deductions and credits may be limited or unavailable to married couples filing jointly. For example, if one spouse has a high income, it may reduce or eliminate the ability to claim certain deductions or credits.

- Financial implications of divorce: If a couple files jointly and later divorces, they will still be jointly liable for any taxes owed on the joint return. This can create financial complications and potential disputes during the divorce process.

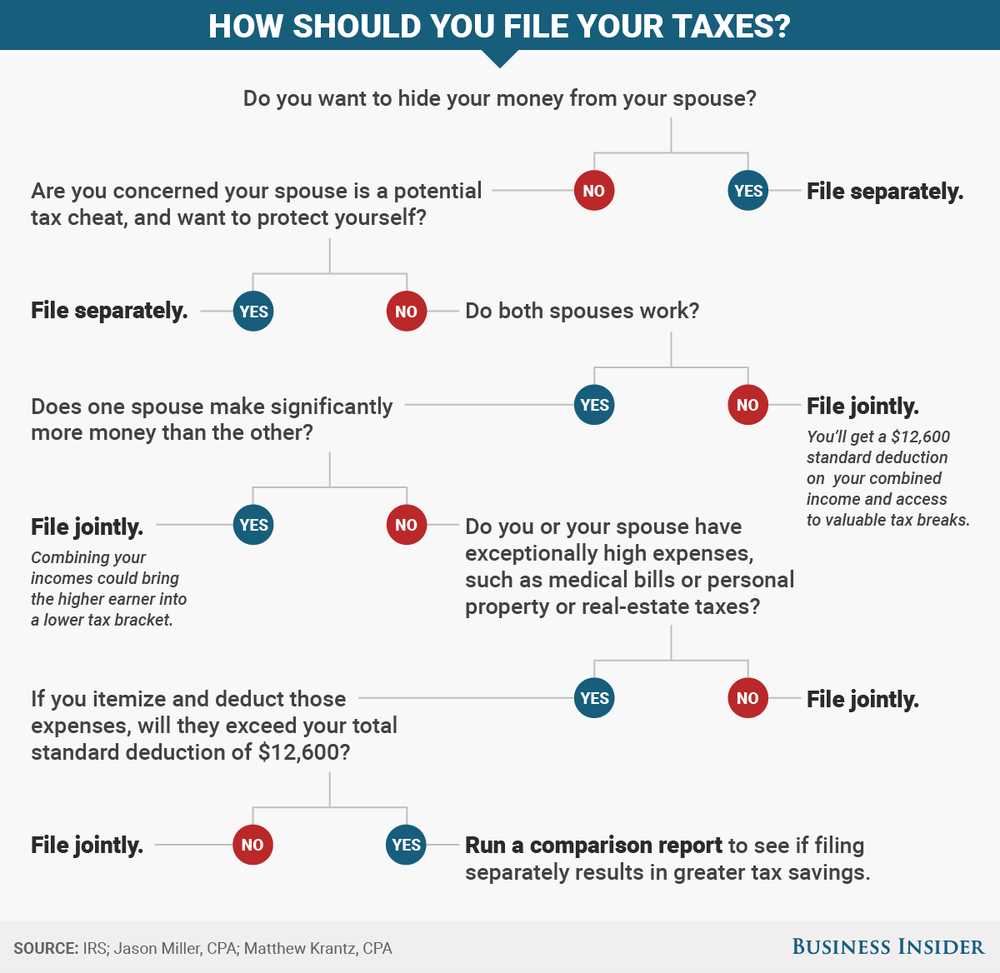

Overall, married couples should carefully consider their individual financial situations and consult with a tax professional to determine whether filing jointly or separately is more advantageous for them. While filing jointly can provide certain tax benefits, it is important to weigh these advantages against the potential disadvantages and individual circumstances.

Married Filing Jointly is a tax filing status that allows married couples to combine their income and file a single tax return. This status is available to couples who are legally married on the last day of the tax year, regardless of whether they live together or not.

Advantages of Married Filing Jointly

There are several advantages to filing jointly as a married couple:

- Tax brackets: When filing jointly, couples can take advantage of lower tax brackets compared to filing separately. This means that they may pay less in taxes overall.

- Tax deductions and credits: Filing jointly allows couples to combine their deductions and credits, potentially increasing their tax savings. This can be especially beneficial if one spouse has significant deductions or credits.

- Social Security benefits: Married couples filing jointly may be eligible for higher Social Security benefits compared to couples filing separately.

- IRA contributions: Filing jointly may allow couples to contribute to a traditional IRA even if one spouse does not have earned income.

Disadvantages of Married Filing Jointly

While there are advantages, there are also some potential disadvantages to consider:

- Joint and several liability: Both spouses are jointly and severally liable for any taxes owed, even if one spouse earned all the income. This means that the IRS can go after either spouse for the full amount of the tax debt.

- Loss of certain deductions: Some deductions and credits are phased out or not available when filing jointly, which could result in a higher tax liability.

Overall, married couples should carefully evaluate their financial situation and consider the advantages and disadvantages before deciding to file jointly. Consulting with a tax professional can also provide valuable guidance and help ensure that the tax return is filed correctly.

Advantages of Married Filing Jointly

Married filing jointly is a tax filing status that is available to married couples who choose to combine their income and file a single tax return. This filing status offers several advantages that can help couples save money on their taxes.

1. Lower Tax Rates

One of the main advantages of married filing jointly is that it often results in lower tax rates compared to filing separately. The tax brackets for married couples filing jointly are typically wider, which means that a larger portion of their income is taxed at lower rates. This can result in a lower overall tax liability for the couple.

2. Higher Standard Deduction

Married couples filing jointly also benefit from a higher standard deduction compared to those filing separately. The standard deduction is a set amount that reduces the couple’s taxable income. By filing jointly, the couple can take advantage of a higher standard deduction, which can further reduce their tax liability.

3. Eligibility for Certain Tax Credits and Deductions

Married couples filing jointly may be eligible for certain tax credits and deductions that are not available to those filing separately. For example, they may qualify for the Earned Income Tax Credit, which is a refundable credit designed to help low to moderate-income individuals and families. Additionally, they may be able to claim deductions for education expenses, mortgage interest, and medical expenses.

4. Simplified Filing Process

Filing jointly can also simplify the tax filing process for married couples. Instead of having to prepare and file two separate tax returns, they only need to file one joint return. This can save time and reduce the chances of making errors or overlooking important information. It also eliminates the need to determine which spouse should claim certain deductions or credits.

5. Social Security Benefits

For couples who are eligible for Social Security benefits, filing jointly can help maximize their benefits. The amount of Social Security benefits that are subject to taxation is based on the couple’s combined income. By filing jointly, the couple’s combined income may be lower, resulting in a lower portion of their Social Security benefits being taxable.

| Advantages of Married Filing Jointly |

|---|

| Lower tax rates |

| Higher standard deduction |

| Eligibility for certain tax credits and deductions |

| Simplified filing process |

| Social Security benefits |

Disadvantages of Married Filing Jointly

While there are many advantages to filing taxes jointly as a married couple, there are also some disadvantages to consider. Here are a few potential drawbacks of the married filing jointly status:

- Loss of Individual Control: When you file jointly, both spouses are equally responsible for the accuracy and completeness of the tax return. This means that if one spouse makes a mistake or underreports income, both spouses can be held liable for any resulting penalties or interest. This loss of individual control can be a source of stress and tension in some marriages.

- Higher Tax Bracket: When you file jointly, your combined income is used to determine your tax bracket. This means that if both spouses have high incomes, filing jointly could push you into a higher tax bracket, resulting in a higher overall tax liability. This can be a significant disadvantage for couples with large income disparities.

- Joint and Several Liability: Filing jointly means that both spouses are jointly and severally liable for any taxes owed. This means that if one spouse fails to pay their portion of the tax liability, the other spouse can be held responsible for the full amount. This can be a concern in situations where one spouse has a history of financial irresponsibility or if there is a risk of divorce or separation.

- Loss of Privacy: When you file jointly, both spouses’ income and financial information are included on the same tax return. This means that both spouses have access to each other’s financial information, which may be a concern for couples who prefer to keep their finances separate or who have different levels of financial transparency.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.