Overview of Luhn Algorithm

The Luhn Algorithm is a widely used method for credit card identity verification. It was developed by a computer scientist named Hans Peter Luhn in the 1950s and is still used today to ensure the accuracy of credit card numbers.

How does the Luhn Algorithm work?

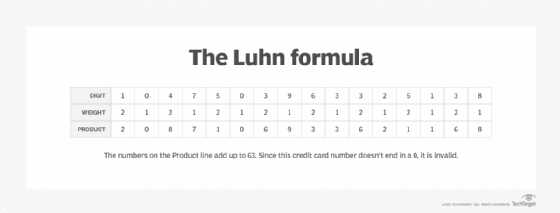

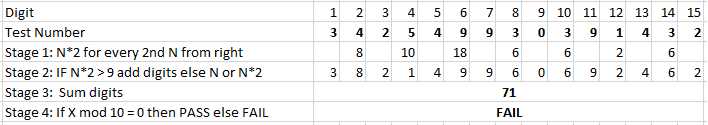

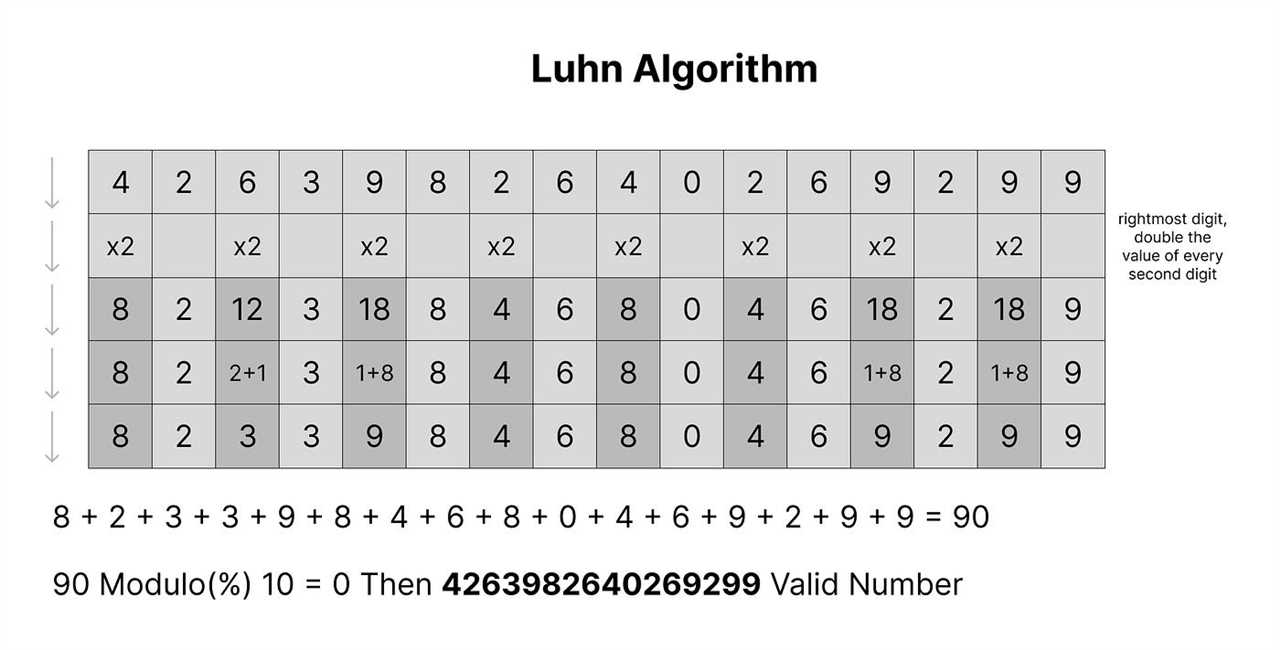

The Luhn Algorithm works by performing a series of mathematical calculations on a credit card number to determine its validity. It follows a simple process:

- Starting from the rightmost digit, double every second digit. If the result is greater than 9, subtract 9 from the result.

- Add up all the digits, including the doubled digits.

- If the total sum is divisible by 10, the credit card number is valid according to the Luhn Algorithm.

For example, let’s take the credit card number 45320151128336. Applying the Luhn Algorithm:

- Starting from the rightmost digit, double every second digit: 6 5 16 1 2 10 3 4 5 2 3 4 5 6.

- If the result is greater than 9, subtract 9 from the result: 6 5 7 1 2 1 3 4 5 2 3 4 5 6.

- Add up all the digits: 6 + 5 + 7 + 1 + 2 + 1 + 3 + 4 + 5 + 2 + 3 + 4 + 5 + 6 = 54.

- Since 54 is divisible by 10, the credit card number is valid according to the Luhn Algorithm.

Why is the Luhn Algorithm important?

The Luhn Algorithm is important because it helps prevent errors and detect fraudulent credit card numbers. By validating the credit card number, businesses can ensure that the information provided by customers is accurate and reduce the risk of accepting fraudulent transactions.

Additionally, the Luhn Algorithm is widely used in various industries, including banking, e-commerce, and payment processing, to ensure the integrity of credit card data and protect against unauthorized use.

Overall, the Luhn Algorithm provides a simple and effective method for credit card identity verification, helping businesses maintain the security and trust of their payment systems.

Benefits of Luhn Algorithm

The Luhn Algorithm offers several benefits for credit card identity verification:

1. Accuracy: The Luhn Algorithm is a reliable method for validating credit card numbers. It can quickly determine whether a given credit card number is valid or not, reducing the risk of accepting fraudulent transactions.

2. Efficiency: The Luhn Algorithm is a simple and efficient algorithm that can be implemented easily. It requires minimal computational resources and can be executed quickly, making it suitable for real-time credit card verification.

3. Cost-effective: Implementing the Luhn Algorithm for credit card identity verification can help businesses save costs by reducing the number of fraudulent transactions. By identifying invalid credit card numbers early on, businesses can avoid chargebacks and other associated costs.

4. Compatibility: The Luhn Algorithm is widely used and recognized in the industry. It is compatible with various credit card systems and can be easily integrated into existing payment processing systems without major modifications.

5. User-friendly: The Luhn Algorithm provides a seamless user experience by quickly validating credit card numbers during online transactions. It helps users avoid errors when entering their credit card information and ensures a smooth checkout process.

Overall, the Luhn Algorithm offers a secure and efficient solution for credit card identity verification, benefiting both businesses and consumers alike.

Implementation

Implementing the Luhn Algorithm for credit card identity verification is a straightforward process that can be done in any programming language. Here are the steps to implement the algorithm:

-

Step 1: Input Validation

Start by validating the input credit card number. Ensure that the number is numeric and meets the required length criteria for the specific credit card type.

-

Step 2: Reverse the Digits

Reverse the order of the digits in the credit card number. This is necessary for the subsequent steps of the algorithm.

-

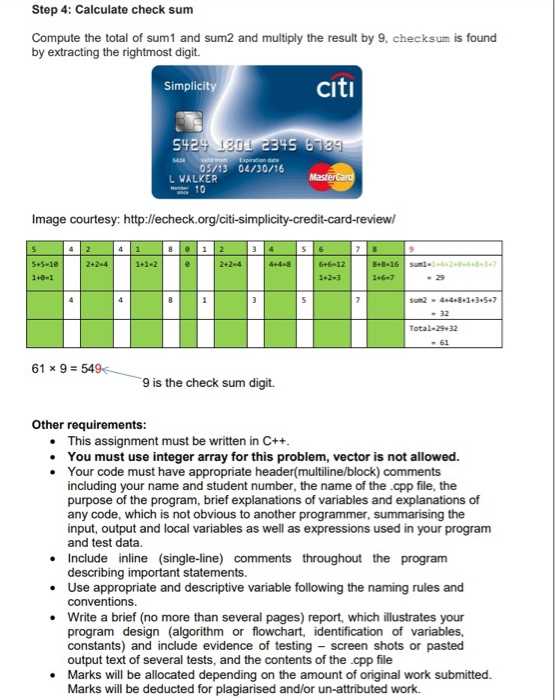

Step 3: Calculate the Checksum

Starting from the rightmost digit, double every second digit. If the result of doubling is greater than 9, subtract 9 from the result. Sum up all the digits, including the doubled ones.

-

Step 4: Check Validity

If the total sum obtained in Step 3 is divisible by 10, then the credit card number is valid according to the Luhn Algorithm. Otherwise, it is invalid.

By following these steps, you can easily implement the Luhn Algorithm to verify the identity of credit card numbers. This algorithm is widely used in the banking and financial industry to prevent fraudulent transactions and ensure the accuracy of credit card information.

Step-by-step Guide

Implementing the Luhn Algorithm for credit card identity verification involves the following steps:

- Obtain the credit card number that needs to be verified.

- Remove any spaces or dashes from the credit card number.

- Starting from the rightmost digit, double the value of every second digit. If the result is greater than 9, subtract 9 from the result.

- Sum up all the digits in the modified credit card number.

- If the total sum is divisible by 10, then the credit card number is valid. Otherwise, it is invalid.

Let’s illustrate these steps with an example:

Suppose we have a credit card number: 4532 7654 3210 9876.

- Remove the spaces and dashes: 4532765432109876.

- Starting from the rightmost digit, double every second digit: 4 5 6 2 6 10 3 2 0 9 8 6.

- If any of the doubled digits are greater than 9, subtract 9: 4 5 6 2 6 1 3 2 0 9 8 6.

- Sum up all the digits: 4 + 5 + 6 + 2 + 6 + 1 + 3 + 2 + 0 + 9 + 8 + 6 = 52.

- Since 52 is divisible by 10, the credit card number is valid.

By following these steps, you can easily verify the validity of any credit card number using the Luhn Algorithm.

Integration with Existing Systems

Implementing the Luhn Algorithm for credit card identity verification can be seamlessly integrated into existing systems, making it an efficient and effective solution for businesses.

By integrating the Luhn Algorithm into your existing systems, you can enhance the security and accuracy of credit card transactions. This algorithm can be easily incorporated into various payment gateways, e-commerce platforms, and financial systems.

Integration with existing systems involves a few simple steps:

- Assess compatibility: Determine if your current system is compatible with the Luhn Algorithm. Most modern systems can easily integrate this algorithm without any major modifications.

- Implement API: Utilize the available APIs and libraries to implement the Luhn Algorithm into your system. These APIs provide the necessary functions and methods to validate credit card numbers.

- Test and validate: Thoroughly test the integration to ensure that the Luhn Algorithm is working correctly. Validate the credit card numbers during transactions to prevent fraudulent activities.

- Monitor and update: Continuously monitor the performance of the Luhn Algorithm integration and update it as needed. Stay up-to-date with any changes or enhancements to the algorithm to maintain the highest level of security.

By integrating the Luhn Algorithm into your existing systems, you can streamline your credit card verification process, reduce the risk of fraud, and provide a secure payment experience for your customers.

Use Cases

The Luhn Algorithm for credit card identity verification has a wide range of use cases across various industries. Here are some examples of how the algorithm can be applied:

1. E-commerce: The Luhn Algorithm can be used to validate credit card numbers during online transactions, ensuring that only valid cards are accepted as payment. This helps prevent fraudulent activities and protects both the customers and the merchants.

2. Financial Institutions: Banks and other financial institutions can utilize the Luhn Algorithm to verify the authenticity of credit card information provided by customers. This helps in reducing the risk of identity theft and fraudulent transactions.

3. Telecommunications: Mobile network operators can use the Luhn Algorithm to validate credit card information provided by customers for recurring payments or to verify the identity of customers during SIM card activation or registration processes.

4. Healthcare: The Luhn Algorithm can be employed in the healthcare industry to validate credit card information provided by patients for medical bill payments. This ensures that the payments are made using valid credit cards and reduces the chances of payment fraud.

5. Travel and Hospitality: Airlines, hotels, and travel agencies can utilize the Luhn Algorithm to validate credit card information provided by customers for booking flights, hotel reservations, or other travel-related services. This helps in preventing fraudulent bookings and ensures the security of transactions.

6. Subscription Services: Streaming platforms, online gaming platforms, and other subscription-based services can use the Luhn Algorithm to validate credit card information provided by customers during the registration or payment process. This helps in preventing unauthorized access to the services and ensures that only valid payment methods are accepted.

7. Government Agencies: Government agencies that collect payments, such as tax departments or licensing authorities, can employ the Luhn Algorithm to validate credit card information provided by individuals or businesses. This helps in ensuring that the payments are made using valid credit cards and reduces the risk of fraudulent activities.

By implementing the Luhn Algorithm, businesses and organizations can enhance the security of their transactions, protect against fraud, and provide a seamless and trustworthy experience to their customers.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.