What is Lockbox Banking?

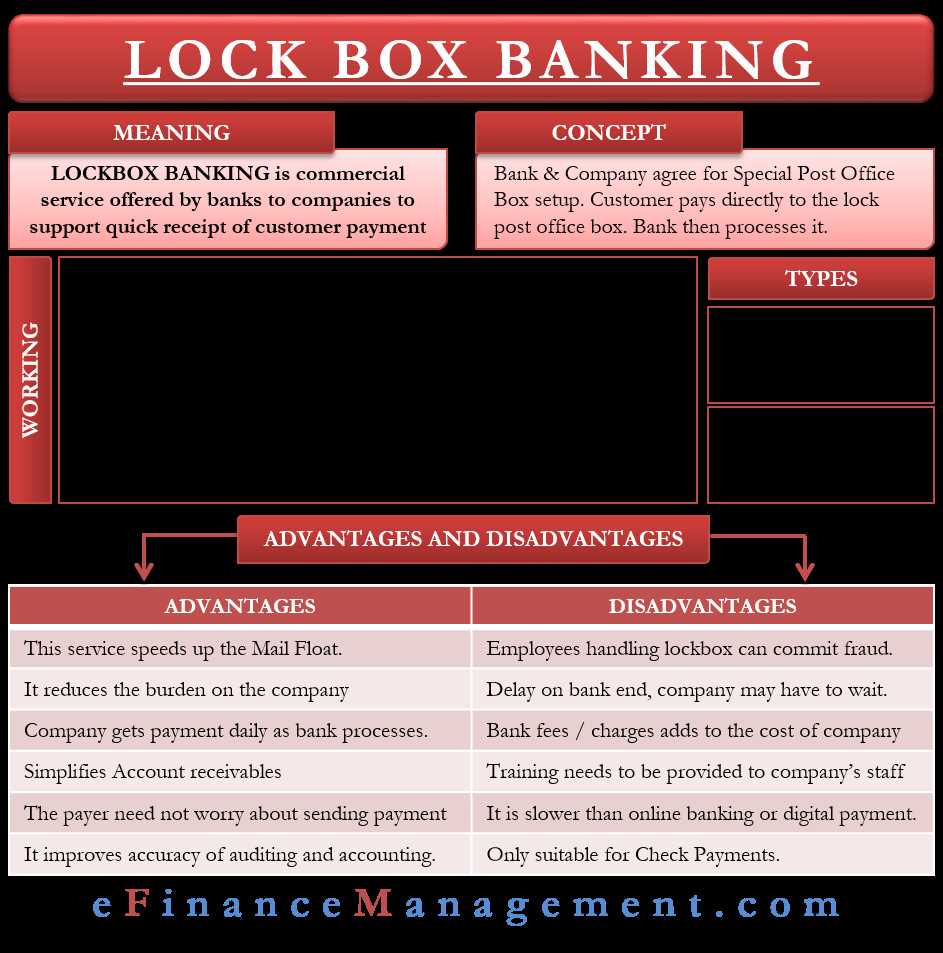

Lockbox banking is a service provided by banks to help businesses streamline their payment processing. It involves the use of a dedicated post office box where customers can send their payments, which are then collected by the bank and processed on behalf of the business.

When a business signs up for lockbox banking, they are assigned a unique post office box address. This address is provided to the business’s customers, who can then send their payments directly to the lockbox. The bank collects the payments from the lockbox, deposits them into the business’s account, and provides detailed reports of the transactions.

Lockbox banking is particularly useful for businesses that receive a large volume of payments through the mail. It eliminates the need for the business to manually process and deposit each payment, saving time and reducing the risk of errors. Additionally, the bank’s reporting capabilities provide businesses with valuable information about their cash flow and payment trends.

Overall, lockbox banking offers businesses a convenient and efficient way to manage their payment processing. By outsourcing this task to the bank, businesses can focus on their core operations and have peace of mind knowing that their payments are being handled securely and accurately.

Lockbox banking is a service provided by banks to help businesses streamline their payment processing. It involves the use of a post office box, or “lockbox,” where customers can send their payments. The bank then collects and processes these payments on behalf of the business.

Lockbox banking is especially beneficial for businesses that receive a large volume of payments through checks. Instead of having to manually process each check, the business can rely on the bank to handle this task efficiently.

When a customer sends a payment to the lockbox, it is collected by the bank’s staff. The checks are then sorted, opened, and the payment details are recorded. The bank also deposits the checks into the business’s account, ensuring that the funds are available as quickly as possible.

Lockbox banking offers several advantages for businesses. Firstly, it saves time and resources by eliminating the need for manual payment processing. This allows businesses to focus on their core operations instead of spending valuable time on administrative tasks.

Secondly, lockbox banking improves cash flow for businesses. Since the bank processes payments promptly, the funds are available for use more quickly. This can help businesses meet their financial obligations and manage their working capital more effectively.

Additionally, lockbox banking enhances the security of payment processing. By using a secure post office box, businesses can reduce the risk of theft or loss of payments. The bank’s staff is trained to handle payments securely and confidentially, ensuring the protection of sensitive financial information.

How Does Lockbox Banking Work?

Lockbox banking is a service provided by banks to help businesses streamline their payment processing. The process begins when a company’s customers send their payments to a designated lockbox address, which is typically a post office box controlled by the bank.

Once the payments are received at the lockbox, the bank collects and processes them on behalf of the company. This involves opening the envelopes, extracting the checks, and recording the payment details. The bank then deposits the funds into the company’s bank account.

To ensure accuracy and efficiency, lockbox banking often involves the use of advanced technology, such as automated check processing machines and optical character recognition (OCR) software. These tools help speed up the payment processing and reduce the risk of errors.

After the payments have been processed, the bank provides the company with detailed reports and remittance information. This allows the company to reconcile its accounts receivable and update its records accordingly.

Lockbox banking can be customized to meet the specific needs of each business. For example, some companies may require the bank to scan and digitize the payment documents for easy retrieval and storage. Others may request additional services, such as invoice matching or exception handling.

Overall, lockbox banking offers businesses a convenient and efficient way to handle their incoming payments. By outsourcing the payment processing to the bank, companies can focus on their core operations and save time and resources.

| Benefits of Lockbox Banking |

|---|

| 1. Faster access to funds: Lockbox banking accelerates the collection and deposit of payments, allowing businesses to access their funds more quickly. |

| 2. Improved cash flow management: With lockbox banking, companies can better manage their cash flow by receiving timely and accurate information about their incoming payments. |

| 3. Reduced administrative burden: By outsourcing payment processing to the bank, businesses can reduce the time and effort spent on manual tasks, such as opening mail and recording payments. |

| 4. Enhanced security: Lockbox banking provides a secure and controlled environment for handling payments, reducing the risk of theft or loss. |

| 5. Customizable services: Banks can tailor lockbox banking services to meet the specific needs of each business, providing additional features and functionalities as required. |

The Process of Lockbox Banking Explained

1. Receipt of Payments

The first step in the lockbox banking process is the receipt of payments. When customers make payments, they send them directly to the lockbox provider’s address instead of the business’s address. This ensures that the payments are received and processed quickly and securely.

2. Collection and Processing

The lockbox provider uses advanced technology, such as automated scanners and optical character recognition (OCR), to streamline the collection and processing of payments. This helps to minimize errors and ensure accurate and efficient processing.

3. Deposit and Reconciliation

After the payments have been processed, the lockbox provider deposits the funds into the business’s bank account. They also provide the business with detailed reports and electronic files that contain information about each payment, including the customer’s information and the payment amount.

The business can then use these reports and files to reconcile the payments with their internal records and update their accounts receivable. This helps to streamline the reconciliation process and ensure accurate financial reporting.

4. Reporting and Access

In addition to providing detailed reports and electronic files, lockbox providers also offer online access to payment information. This allows businesses to view and download the payment data in real-time, making it easier to track and manage their incoming payments.

Lockbox providers may also offer additional services, such as check imaging, which allows businesses to view scanned images of the checks online. This can be useful for verifying payment details and resolving any discrepancies.

5. Exception Handling

In some cases, there may be exceptions or issues with the payments received. For example, a payment may be missing crucial information or may not match the amount owed. In such cases, the lockbox provider will notify the business and work with them to resolve the issue.

Lockbox providers have dedicated teams that specialize in exception handling and customer service. They can help businesses resolve payment discrepancies, answer customer inquiries, and ensure that all payments are processed accurately and efficiently.

Overall, the process of lockbox banking simplifies and streamlines the payment collection and processing for businesses. It reduces the administrative burden and allows businesses to focus on their core operations while ensuring timely and secure handling of incoming payments.

Benefits of Lockbox Banking

Lockbox banking offers numerous benefits for businesses of all sizes. Here are some of the key advantages:

1. Improved Cash Flow

Lockbox banking helps improve cash flow by reducing the time it takes for businesses to receive and process payments. Instead of waiting for checks to arrive in the mail and manually depositing them, businesses can have their payments sent directly to a lockbox. This allows for faster access to funds and quicker availability for use in daily operations.

2. Increased Efficiency

By outsourcing the payment processing to a lockbox service provider, businesses can free up valuable time and resources. Instead of spending hours on manual data entry and check processing, employees can focus on more important tasks, such as customer service and business growth. This increased efficiency can lead to cost savings and improved productivity.

3. Enhanced Security

Lockbox banking provides an added layer of security for businesses. With a lockbox, payments are sent to a secure location, often at a bank or a third-party service provider. This reduces the risk of theft or loss during the payment collection process. Additionally, lockbox services typically employ advanced security measures, such as encryption and secure data transmission, to protect sensitive payment information.

4. Streamlined Reconciliation

Lockbox banking simplifies the reconciliation process for businesses. Instead of manually matching payments to invoices and updating accounting records, businesses can rely on the lockbox service provider to handle these tasks. The provider will often provide detailed reports and electronic data files that can be easily integrated into the business’s accounting system, saving time and reducing errors.

5. Improved Customer Satisfaction

Lockbox banking can help improve customer satisfaction by providing faster payment processing and reducing the risk of payment delays or errors. Customers appreciate the convenience of being able to send payments directly to a lockbox, knowing that their payments will be processed efficiently and accurately. This can lead to stronger customer relationships and increased loyalty.

Why Lockbox Banking is a Smart Choice for Businesses

Lockbox banking is a smart choice for businesses for several reasons. Firstly, it offers convenience and efficiency. With lockbox banking, businesses can streamline their payment processing by outsourcing it to a third-party provider. This eliminates the need for businesses to manually process payments, saving them time and resources.

Secondly, lockbox banking enhances cash flow management. By outsourcing payment processing to a lockbox provider, businesses can ensure that their payments are collected and deposited quickly. This helps businesses to have a more accurate and up-to-date view of their cash flow, enabling them to make better financial decisions.

Furthermore, lockbox banking offers advanced reporting and reconciliation capabilities. Lockbox providers typically offer detailed reporting on payment activity, allowing businesses to easily track and reconcile their payments. This helps businesses to maintain accurate financial records and simplifies the auditing process.

Lastly, lockbox banking can be easily integrated with existing accounting systems. Many lockbox providers offer integration options with popular accounting software, making it seamless for businesses to incorporate lockbox banking into their existing financial processes.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.