What is a Lock-Up Agreement?

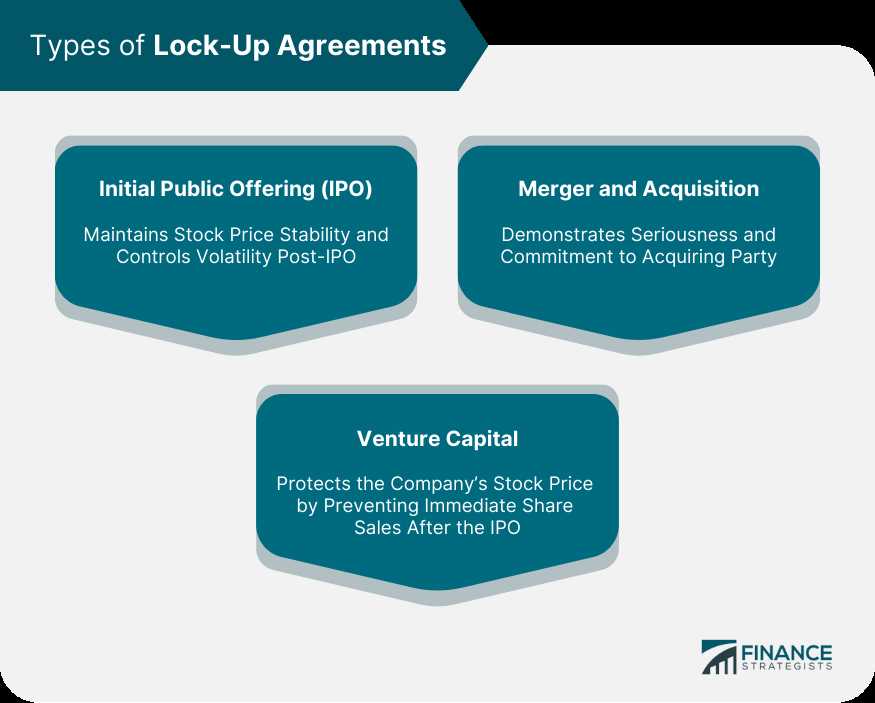

A lock-up agreement is a legally binding contract between a company and its shareholders that restricts the sale or transfer of company shares for a specified period of time. This agreement is typically entered into when a company goes public or undergoes a significant event, such as a merger or acquisition.

Definition of Lock-Up Agreement

During the lock-up period, shareholders are prohibited from selling, transferring, or otherwise disposing of their shares. This restriction helps to prevent a sudden influx of shares into the market, which could lead to a decline in stock price and volatility.

Purpose of Lock-Up Agreement

The primary purpose of a lock-up agreement is to provide stability and confidence to investors and the market during a critical period for the company. By restricting the sale of shares, the agreement helps to prevent a rapid decline in stock price, which could harm the company’s reputation and financial stability.

Lock-up agreements are especially common in initial public offerings (IPOs), where the company’s shares are being offered to the public for the first time. By preventing early investors and insiders from selling their shares immediately after the IPO, the company can demonstrate its commitment to long-term growth and stability.

Lock-up agreements also benefit existing shareholders by protecting their investment and preventing dilution of their ownership stake. By restricting the sale of shares, the agreement helps to maintain the value of existing shares and prevent a sudden decrease in ownership percentage.

Example of Lock-Up Agreement

For example, let’s say Company XYZ is planning to go public and has filed for an IPO. As part of the IPO process, the company enters into a lock-up agreement with its existing shareholders, including founders, executives, and early investors.

The lock-up agreement stipulates that these shareholders are prohibited from selling their shares for a period of 180 days after the IPO. This restriction helps to stabilize the market and prevent a sudden influx of shares, which could lead to a decline in stock price.

After the lock-up period expires, the shareholders are free to sell their shares on the open market, subject to any applicable securities laws and regulations.

Definition of Lock-Up Agreement

A lock-up agreement is a legally binding contract between a company and its shareholders, typically the company’s executives, employees, and early investors. This agreement restricts the sale or transfer of company shares for a specified period of time after an initial public offering (IPO) or other significant event, such as a merger or acquisition.

The lock-up period is usually set to prevent insiders from flooding the market with shares immediately after the company goes public, which could cause the stock price to plummet. By imposing a lock-up period, the company aims to stabilize the stock price and maintain investor confidence.

During the lock-up period, shareholders are prohibited from selling their shares or transferring them to another party without obtaining prior approval from the company. This restriction helps to ensure that the company’s stock remains relatively stable and that the market is not overwhelmed with an excessive supply of shares.

Lock-up agreements are commonly used in the financial industry, especially in the context of IPOs. They are designed to protect the interests of both the company and its shareholders. For the company, a lock-up agreement helps to maintain a stable stock price and avoid volatility in the market. For shareholders, the agreement provides an opportunity to benefit from potential future price appreciation once the lock-up period expires.

| Key Points |

|---|

| – A lock-up agreement is a legally binding contract that restricts the sale or transfer of company shares for a specified period of time. |

| – The purpose of a lock-up agreement is to stabilize the stock price and maintain investor confidence after an IPO or other significant event. |

| – Shareholders are prohibited from selling or transferring their shares during the lock-up period without prior approval from the company. |

| – Lock-up agreements are temporary restrictions and typically last for 90 to 180 days. |

Purpose of Lock-Up Agreement

A lock-up agreement is a legally binding contract between a company and its shareholders, typically executives, insiders, and early investors, that restricts the sale of company shares for a specified period of time after an initial public offering (IPO) or another significant event, such as a merger or acquisition.

The purpose of a lock-up agreement is to provide stability and confidence to the market by preventing large-scale sell-offs of company shares immediately after a public offering or other significant event. By restricting the sale of shares, the agreement helps to prevent a sudden decrease in share price and potential market volatility.

Additionally, lock-up agreements can also be used to incentivize key employees and executives to remain with the company for a certain period of time. By restricting the sale of their shares, these individuals are encouraged to stay with the company and work towards its long-term success.

In some cases, lock-up agreements may include exceptions or provisions that allow for the sale of shares under certain circumstances, such as a change in control of the company or the need for liquidity due to financial hardship. However, these exceptions are typically limited and subject to approval by the company’s board of directors or other governing body.

Overall, the purpose of a lock-up agreement is to provide stability, protect shareholder interests, and maintain investor confidence during times of significant change or transition for a company.

Example of Lock-Up Agreement

A lock-up agreement is a legally binding contract between a company’s shareholders and underwriters that restricts the sale or transfer of shares for a specified period of time after an initial public offering (IPO) or other significant event. This agreement is commonly used to prevent insiders, such as company executives and large shareholders, from flooding the market with their shares immediately after the company goes public.

Here is an example to illustrate how a lock-up agreement works:

- Company XYZ is planning to go public and hires an investment bank to underwrite the IPO.

- Prior to the IPO, the investment bank negotiates a lock-up agreement with the company’s executives and major shareholders.

- The lock-up agreement states that these insiders cannot sell or transfer their shares for a period of 180 days after the IPO.

- This lock-up period is intended to provide stability to the company’s stock price and prevent a sudden decrease in value due to a large number of shares hitting the market at once.

- After the lock-up period expires, the insiders are free to sell or transfer their shares, which may result in increased trading volume and potentially impact the stock price.

Lock-up agreements are beneficial for both the company going public and its shareholders. For the company, it helps to maintain investor confidence and stabilize the stock price during the initial post-IPO period. For shareholders, it can prevent a sudden decrease in share value and allow them to potentially sell their shares at a higher price once the lock-up period ends.

Stock Trading Strategy & Education

Stock trading strategies can vary greatly depending on the individual’s goals, risk tolerance, and investment style. Some traders may prefer a more aggressive approach, while others may opt for a more conservative strategy. Regardless of the chosen strategy, education is essential in order to make informed decisions and minimize risks.

There are various educational resources available to traders, including books, online courses, webinars, and mentorship programs. These resources can provide valuable insights into different trading strategies, technical analysis, fundamental analysis, risk management, and other important aspects of stock trading.

One popular stock trading strategy is the lock-up agreement. A lock-up agreement is a contractual provision that restricts the sale of a company’s shares by insiders, such as employees, founders, and early investors, for a certain period of time after an initial public offering (IPO) or other significant event. This agreement is typically put in place to prevent a sudden influx of shares into the market, which could potentially cause the stock price to decline.

The purpose of a lock-up agreement is to provide stability and confidence to investors, as it demonstrates that key stakeholders are committed to the success of the company and are not looking to quickly cash out their shares. This can be particularly important for newly public companies, as it helps to establish a positive perception in the market and attract potential investors.

For example, let’s say a tech company XYZ recently went public and its employees and early investors hold a significant number of shares. In order to prevent a massive sell-off of shares immediately after the IPO, the company may implement a lock-up agreement that restricts these insiders from selling their shares for a period of six months. This allows the market to absorb the newly issued shares and helps to stabilize the stock price.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.