What is Loan-to-Value Ratio?

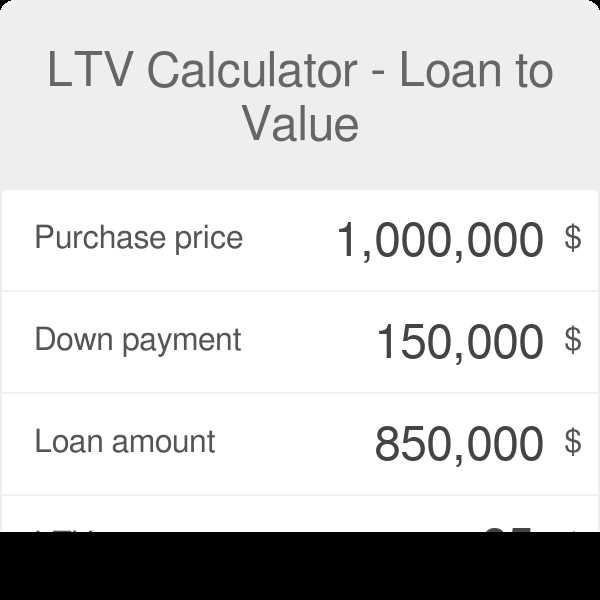

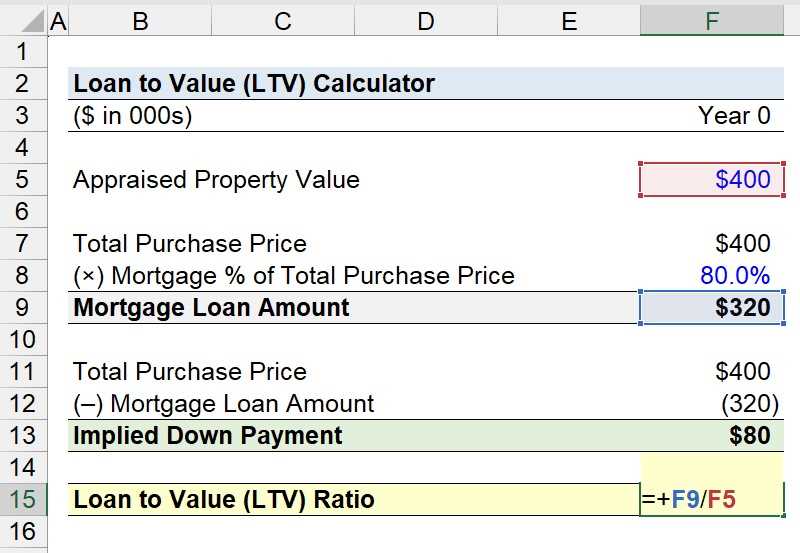

The Loan-to-Value (LTV) ratio is a financial term used by lenders to assess the risk of providing a mortgage loan. It is calculated by dividing the loan amount by the appraised value of the property. The resulting percentage represents the amount of the loan in relation to the value of the property.

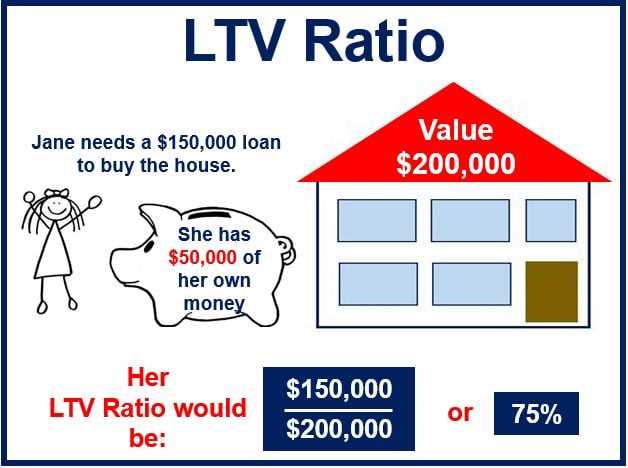

For example, if a borrower wants to purchase a property worth $200,000 and requests a mortgage loan of $150,000, the LTV ratio would be 75% ($150,000 / $200,000 = 0.75 or 75%). This means that the borrower is seeking a loan that covers 75% of the property’s value, and the remaining 25% would be the down payment.

Lenders typically have maximum LTV ratio requirements for different types of loans. For example, conventional mortgage loans often have a maximum LTV ratio of 80%, meaning borrowers must provide a minimum down payment of 20%. Government-backed loans, such as FHA loans, may have higher maximum LTV ratios, allowing borrowers to make smaller down payments.

What is Loan-to-Value Ratio?

The Loan-to-Value ratio is calculated by dividing the loan amount by the appraised value of the property and multiplying the result by 100. For example, if you are applying for a mortgage loan of $200,000 and the appraised value of the property is $250,000, the LTV ratio would be 80%.

Lenders use the LTV ratio as a risk assessment tool. The higher the LTV ratio, the riskier the loan is considered to be. This is because a higher LTV ratio indicates that the borrower has less equity in the property and is therefore more likely to default on the loan. On the other hand, a lower LTV ratio indicates that the borrower has more equity in the property and is less likely to default.

Importance of LTV in Mortgage

The LTV ratio plays a crucial role in the mortgage process for both lenders and borrowers. For lenders, it helps them determine the level of risk associated with a particular loan application. Lenders typically have maximum LTV ratios that they are willing to accept, and borrowers with higher LTV ratios may face stricter loan terms or even be denied a loan altogether.

For borrowers, the LTV ratio affects the interest rate they are offered. Generally, borrowers with lower LTV ratios are considered less risky and are therefore offered lower interest rates. This can result in significant savings over the life of the loan.

In addition, a lower LTV ratio may also allow borrowers to avoid private mortgage insurance (PMI) requirements. PMI is typically required for borrowers with LTV ratios above 80% and is an additional cost that borrowers must pay to protect the lender in case of default.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.