What is Lease Rate?

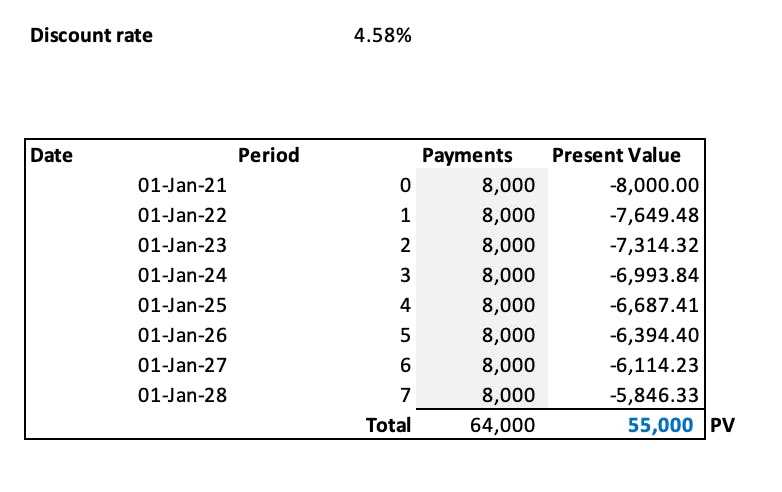

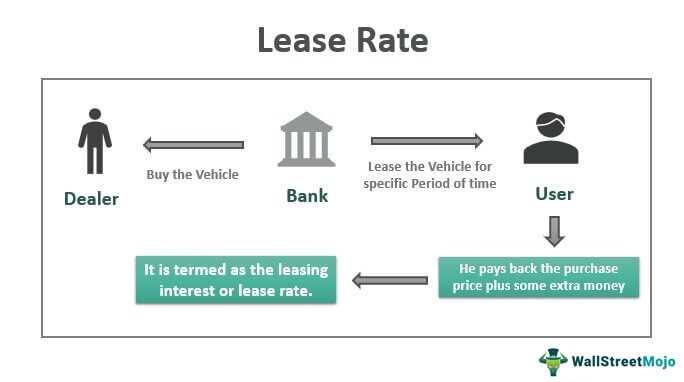

Lease rate refers to the cost associated with leasing a particular asset or property. It is the amount of money that the lessee (the person or company renting the asset) pays to the lessor (the owner of the asset) for the right to use the asset for a specified period of time. The lease rate is typically expressed as a percentage of the asset’s value or as a fixed monthly or annual payment.

Lease rates are commonly used in various industries, such as real estate, automotive, and equipment leasing. They are an essential component of lease agreements and play a crucial role in determining the financial implications of leasing for both parties involved.

Types of Lease Rate

There are different types of lease rates that can be used depending on the nature of the asset being leased and the specific requirements of the parties involved. Some common types of lease rates include:

| Type of Lease Rate | Description |

|---|---|

| Operating Lease Rate | |

| Capital Lease Rate |

- Negotiating Power: Having knowledge of lease rates gives individuals and businesses an advantage when negotiating lease agreements. They can compare different lease offers and negotiate for more favorable terms based on the lease rate.

Types of Lease Rate

- Fixed Lease Rate: This type of lease rate remains constant throughout the entire lease term. It provides stability and predictability for both the lessor and the lessee.

- Step-Up Lease Rate: With a step-up lease rate, the rate increases at predetermined intervals during the lease term. This can be beneficial for the lessor, as it provides a higher return over time.

- Step-Down Lease Rate: Conversely, a step-down lease rate decreases at predetermined intervals. This type of lease rate may be used when the lessor wants to incentivize the lessee to continue leasing the property.

- Percentage Lease Rate: In a percentage lease rate, the lessee pays a base rent plus a percentage of their sales. This type of lease rate is commonly used in retail settings, where the lessor wants to share in the lessee’s success.

- Gross Lease Rate: With a gross lease rate, the lessee pays a fixed amount that includes both rent and other expenses, such as utilities and maintenance. This type of lease rate provides simplicity and convenience for the lessee.

- Net Lease Rate: In contrast, a net lease rate requires the lessee to pay not only rent but also a portion of the property’s operating expenses, such as taxes, insurance, and maintenance. This type of lease rate shifts more financial responsibility to the lessee.

Operating Lease Rate

An operating lease rate is a type of lease rate that allows a company to use an asset for a specific period of time without having to take ownership of it. This type of lease is commonly used for equipment or machinery that has a shorter useful life.

Advantages of Operating Lease Rate

- Lower Costs: Operating leases often have lower monthly payments compared to other types of leases or financing options. This can help businesses manage their cash flow more effectively.

- Upgraded Technology: With an operating lease, companies can easily upgrade to newer and more advanced equipment at the end of the lease term. This allows businesses to stay competitive and take advantage of the latest technology without the burden of ownership.

Considerations for Operating Lease Rate

While operating leases offer several advantages, there are some considerations to keep in mind:

- No Ownership: With an operating lease, the company does not have ownership rights to the asset. This means that they cannot claim depreciation or other tax benefits associated with ownership.

- Limited Control: Since the company does not own the asset, they have limited control over its use and modifications. This may not be suitable for businesses that require complete control over their equipment.

- Long-Term Costs: While monthly payments may be lower, the total cost of an operating lease over the long term may be higher compared to purchasing the asset outright.

Overall, operating lease rates can be a beneficial option for businesses that require flexibility, lower costs, and the ability to upgrade equipment. However, it is important to carefully consider the specific needs and financial implications before entering into an operating lease agreement.

Capital Lease Rate

The capital lease rate is typically lower than the operating lease rate because the lessee bears more of the risk associated with the asset. This type of lease is often used for long-term assets, such as buildings or machinery, where the lessee intends to use the asset for a significant portion of its useful life.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.