What is a Joint and Survivor Annuity?

A joint and survivor annuity is a type of annuity that provides guaranteed income for the lifetime of two individuals, typically a married couple. It is designed to ensure that both spouses continue to receive income even after one of them passes away.

With a joint and survivor annuity, the income payments continue for as long as either spouse is alive. This can provide a sense of security and financial stability, especially for couples who rely on the annuity as a source of retirement income.

Definition and Explanation

A joint and survivor annuity works by pooling the funds of both spouses and using them to purchase the annuity. The annuity contract specifies the amount of income that will be paid out to the couple on a regular basis. The income payments can be fixed or variable, depending on the terms of the annuity.

When one spouse passes away, the surviving spouse continues to receive the income payments for the rest of their life. The amount of the payments may be reduced after the death of the first spouse, depending on the terms of the annuity contract.

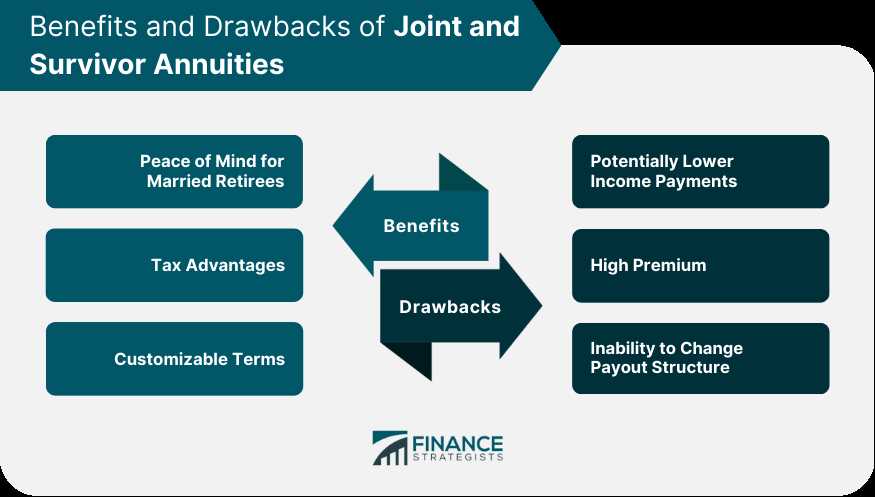

Benefits of a Joint and Survivor Annuity

There are several benefits to choosing a joint and survivor annuity:

1. Security for Spouses: A joint and survivor annuity provides financial security for both spouses, ensuring that they will continue to receive income even if one of them passes away.

2. Guaranteed Income for Life: With a joint and survivor annuity, the income payments continue for the lifetime of the surviving spouse, providing a reliable source of income throughout retirement.

3. Considerations for Joint and Survivor Annuities: When considering a joint and survivor annuity, it is important to carefully review the terms of the annuity contract, including the payout amounts and any potential reductions in income after the death of the first spouse.

Definition and Explanation

A Joint and Survivor Annuity is a type of annuity that provides income to two individuals, typically a married couple, for the duration of their lives. This annuity option ensures that both spouses receive income even after one of them passes away.

The survivor benefit can be set at various levels, such as 100%, 75%, or 50% of the original income amount. For example, if a joint and survivor annuity with a 100% survivor benefit is purchased, the surviving spouse will continue to receive the full income amount that was being paid to both spouses prior to the death of the primary annuitant.

This type of annuity is commonly used by couples who want to ensure that their spouse is financially secure even if they pass away first. It provides a reliable source of income for the surviving spouse, helping to maintain their standard of living and cover expenses.

In summary, a joint and survivor annuity is a financial product that provides income to both spouses for life. It offers security for spouses by ensuring that the surviving spouse continues to receive income after the death of the primary annuitant. However, the payout amount is usually reduced compared to single-life annuities due to the increased risk for the insurance company.

Benefits of a Joint and Survivor Annuity

A joint and survivor annuity offers several benefits for individuals who want to ensure financial security for their spouse or partner after their death. Here are some key advantages of choosing a joint and survivor annuity:

1. Security for Spouses

One of the primary benefits of a joint and survivor annuity is that it provides financial security for the surviving spouse or partner. In the event of the annuitant’s death, the surviving spouse will continue to receive regular annuity payments for the rest of their life. This can be particularly important for couples who rely on the annuity income to cover their living expenses.

2. Guaranteed Income for Life

With a joint and survivor annuity, both the annuitant and the surviving spouse are guaranteed a stream of income for life. This can provide peace of mind, knowing that they will have a stable source of income even if one of them passes away. This can be especially beneficial for couples who do not have other sources of retirement income or who want to ensure that their spouse is taken care of financially.

Additionally, the income from a joint and survivor annuity is typically fixed and predictable, which can help with budgeting and financial planning.

3. Considerations for Joint and Survivor Annuities

While joint and survivor annuities offer many advantages, there are some considerations to keep in mind. For example, the payout amount for a joint and survivor annuity is typically lower than for a single-life annuity. This is because the annuity payments must continue for the lifetime of both the annuitant and the surviving spouse, which increases the risk for the insurance company.

It’s also important to carefully consider the financial stability and reputation of the insurance company offering the annuity. You want to ensure that they will be able to fulfill their obligations and continue making payments to you and your spouse for the duration of the annuity.

Furthermore, it’s crucial to understand the terms and conditions of the annuity contract, including any potential fees or penalties for early withdrawal or changes to the annuity. Consulting with a financial advisor or annuity specialist can help you navigate these considerations and make an informed decision.

Security for Spouses

A joint and survivor annuity provides security for spouses by ensuring that they continue to receive income even after the death of the primary annuitant. This can be particularly important for couples who rely on the annuity as a source of retirement income.

When the primary annuitant passes away, the surviving spouse will continue to receive a portion of the annuity payments for the rest of their life. The exact amount will depend on the terms of the annuity contract, but it is typically a percentage of the original payment amount.

Protection Against Longevity Risk

One of the main benefits of a joint and survivor annuity is that it provides protection against longevity risk. Longevity risk refers to the risk of outliving your retirement savings.

With a joint and survivor annuity, the annuity payments continue for the lifetime of both spouses, regardless of how long they live. This means that even if one spouse lives well beyond their life expectancy, they will still receive income from the annuity.

Considerations for Joint and Survivor Annuities

While joint and survivor annuities offer many benefits, there are some considerations to keep in mind. One important factor is the reduced payout amount compared to a single life annuity.

Because the annuity payments continue for the lifetime of both spouses, the initial payment amount is typically lower than it would be for a single life annuity. This is because the insurance company is taking on the risk of paying out for a longer period of time.

Overall, a joint and survivor annuity can provide security and peace of mind for couples who rely on their annuity as a source of retirement income. By ensuring that the surviving spouse continues to receive income, even after the death of the primary annuitant, it can help to protect against financial uncertainty and provide stability for the future.

Guaranteed Income for Life

A Joint and Survivor Annuity provides a guaranteed income for life for both spouses, even after one spouse passes away. This is one of the key benefits of this type of annuity.

With a Joint and Survivor Annuity, the surviving spouse will continue to receive regular payments for the rest of their life, ensuring financial security and stability. This can be especially important for couples who rely on both incomes to cover their expenses.

The guaranteed income for life feature provides peace of mind, as it eliminates the risk of outliving retirement savings. It ensures that both spouses will have a steady stream of income, regardless of how long they live.

Considerations for Joint and Survivor Annuities

1. Age and Health of the Spouses

The age and health of both spouses play a crucial role in determining the suitability of a joint and survivor annuity. If one spouse is significantly older or has health issues, it may impact the overall payout amount and the financial stability of the annuity.

2. Financial Needs and Goals

3. Payout Options

Joint and survivor annuities offer various payout options, such as a fixed percentage or a level dollar amount. It is important to carefully evaluate these options and choose one that aligns with the financial objectives and circumstances of both spouses.

4. Cost of Living Adjustments

Consider whether the joint and survivor annuity includes cost of living adjustments (COLAs). COLAs can help protect against inflation and ensure that the income from the annuity keeps pace with rising expenses over time.

5. Death Benefit Provisions

Review the death benefit provisions of the joint and survivor annuity. Some annuities may provide a lump-sum payment or a continuation of payments to the surviving spouse, while others may have more limited death benefit options.

6. Financial Stability of the Insurance Company

Before purchasing a joint and survivor annuity, it is important to research and assess the financial stability of the insurance company offering the annuity. Look for companies with strong ratings from reputable rating agencies to ensure the long-term security of the annuity.

| Considerations for Joint and Survivor Annuities |

|---|

| Age and Health of the Spouses |

| Financial Needs and Goals |

| Payout Options |

| Cost of Living Adjustments |

| Death Benefit Provisions |

| Financial Stability of the Insurance Company |

By carefully considering these factors, individuals can make informed decisions when selecting a joint and survivor annuity that best suits their needs and provides financial security for both spouses.

Reduced Payout Amount

To illustrate this, let’s consider an example. Suppose a 65-year-old individual purchases a joint and survivor annuity with their 60-year-old spouse. The insurance company will determine the payout based on the joint life expectancy of a 65-year-old and a 60-year-old. Since the joint life expectancy is longer than the life expectancy of a single individual, the annuity payments will be spread out over a longer period, resulting in a reduced payout amount.

While the reduced payout amount may seem like a disadvantage, it is important to consider the security and peace of mind that a joint and survivor annuity provides. By ensuring that both spouses receive a guaranteed income for life, even after one of them passes away, the joint and survivor annuity offers financial protection and stability.

| Pros | Cons |

|---|---|

| – Provides security for spouses | – Reduced payout amount |

| – Guaranteed income for life |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.