Kelly Criterion: Definition, Formula, History, Goals

The Kelly Criterion is a mathematical formula that helps investors and gamblers determine the optimal amount of money to allocate to a particular investment or bet. It was developed by John L. Kelly Jr., a researcher at Bell Labs, in the 1950s. The goal of the Kelly Criterion is to maximize long-term growth while minimizing the risk of ruin.

Definition of Kelly Criterion

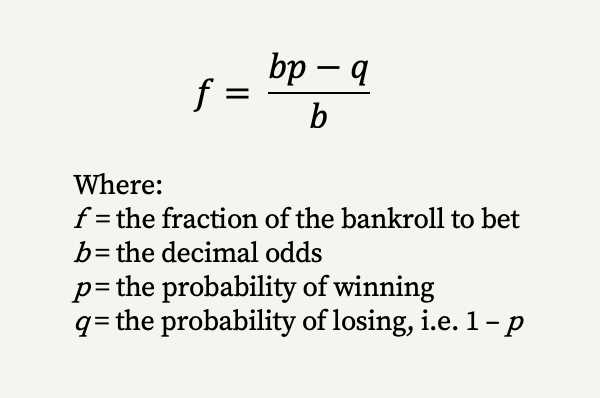

The Kelly Criterion is a formula that calculates the optimal fraction of a bankroll to wager on a particular investment or bet. It takes into account the probability of winning, the odds offered, and the potential payoff. The formula is as follows:

Where:

- f* is the fraction of the bankroll to wager

- b is the net odds received on the wager

- p is the probability of winning

Formula for Kelly Criterion

The Kelly Criterion formula calculates the optimal fraction of the bankroll to wager by subtracting the probability of losing from the probability of winning, and dividing it by the net odds received on the wager. This formula helps investors and gamblers make rational decisions based on their edge in a particular investment or betting opportunity.

For example, if an investor has a 60% chance of winning a bet with odds of 2:1, the Kelly Criterion formula would suggest wagering:

This means that the investor should wager 20% of their bankroll on this particular bet in order to maximize long-term growth.

History of Kelly Criterion

The Kelly Criterion was first introduced by John L. Kelly Jr. in a 1956 paper titled “A New Interpretation of Information Rate”. Kelly was interested in finding a formula that would maximize the rate of information transmission over a communication channel. However, the formula was later applied to the field of gambling and investing, where it gained popularity due to its ability to optimize risk and reward.

Today, the Kelly Criterion is widely used by professional gamblers, investors, and traders to make informed decisions about how much to wager or invest. It is considered a valuable tool for managing risk and maximizing long-term growth.

Definition of Kelly Criterion

The Kelly Criterion is a mathematical formula that is used to determine the optimal size of a series of bets in order to maximize long-term growth. It was developed by John L. Kelly Jr., a researcher at Bell Labs, in the 1950s. The criterion is widely used in the field of gambling and investment management.

The formula for the Kelly Criterion is:

Where:

- Kelly % is the percentage of the bankroll that should be bet

- b is the net odds received on the bet (the potential profit divided by the potential loss)

- p is the probability of winning

The Kelly Criterion suggests that if the calculated percentage is positive, the bet should be made. If the calculated percentage is negative, the bet should be skipped. The larger the positive percentage, the larger the bet should be.

Goals of the Kelly Criterion

The main goal of the Kelly Criterion is to maximize the long-term growth rate of an investment or bankroll. By determining the optimal bet size, the criterion aims to strike a balance between risk and reward. It helps to avoid excessive betting that could lead to significant losses, while also maximizing the potential for growth.

Another goal of the Kelly Criterion is to manage risk and protect against the possibility of ruin. By using the formula, investors and gamblers can make more informed decisions about how much to bet, taking into account the potential risks and rewards.

Formula for Kelly Criterion

The formula for the Kelly Criterion is:

Where:

- f is the fraction of the bankroll to bet

- b is the net odds received on the bet (the potential profit divided by the potential loss)

- p is the probability of winning

The Kelly Criterion suggests that the optimal fraction to bet is equal to the difference between the expected return and the expected loss, divided by the net odds received on the bet. This formula helps investors and gamblers make informed decisions about how much to bet or invest in order to maximize their long-term growth.

Example:

Using the Kelly Criterion formula, the optimal fraction to bet would be:

This means that you should bet 20% of your bankroll on this particular bet in order to maximize long-term growth.

History of Kelly Criterion

Kelly’s work on the criterion began when he was asked to help solve a gambling problem. He was approached by a group of mathematicians and gamblers who wanted to find a way to maximize their winnings while minimizing their risk. Kelly realized that the problem could be approached using mathematical principles and probability theory.

Kelly’s breakthrough came when he discovered that the optimal betting strategy should be based on the expected value of each bet. He realized that by maximizing the expected value, one could maximize long-term growth and minimize the risk of ruin.

Over the years, the Kelly Criterion has gained popularity among investors and gamblers alike. It has been used in various fields, including finance, sports betting, and even in the development of artificial intelligence algorithms. The criterion has proven to be a powerful tool for decision-making, providing a systematic approach to managing risk and maximizing returns.

Despite these limitations, the Kelly Criterion remains a valuable tool for decision-making and risk management. Its mathematical foundation and logical approach have made it a cornerstone of modern portfolio theory and investment strategies.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.