What is the ISM Manufacturing Index?

Definition and Calculation of the ISM Manufacturing Index

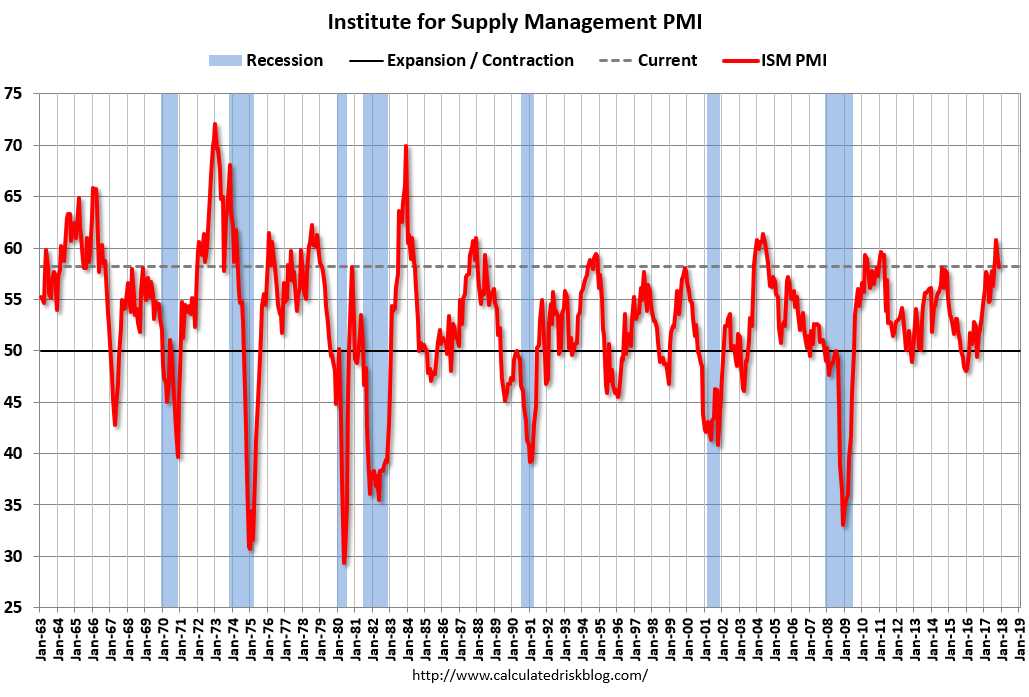

The ISM Manufacturing Index is calculated using a diffusion index, which is a mathematical formula that converts survey responses into a single numeric value. The index is based on a scale of 0 to 100, with a reading above 50 indicating expansion in the manufacturing sector, and a reading below 50 indicating contraction.

The survey asks purchasing managers to rate various factors on a scale of 1 to 100, with 50 being neutral. The factors include new orders, production, employment, supplier deliveries, and inventories. The responses are then weighted and aggregated to calculate the overall index.

For example, if the majority of purchasing managers report an increase in new orders, production, and employment, while also reporting slower supplier deliveries and higher inventories, the index would likely be above 50, indicating expansion.

The ISM Manufacturing Index is considered a leading indicator of economic activity, as it provides an early indication of changes in the manufacturing sector. Since manufacturing is a key component of the overall economy, the index can provide valuable insights into the direction of economic growth or contraction.

Investors and traders closely monitor the ISM Manufacturing Index as it can impact financial markets. A higher-than-expected reading can be seen as positive for the economy and may lead to increased investor confidence, potentially resulting in higher stock prices. Conversely, a lower-than-expected reading can be seen as negative and may lead to decreased investor confidence and lower stock prices.

Overall, the ISM Manufacturing Index is an important tool for economists, investors, traders, and policymakers to gauge the health of the manufacturing sector and make informed decisions based on its findings.

Trading Strategies Based on the ISM Manufacturing Index

Traders and investors can use the ISM Manufacturing Index to inform their trading strategies. For example, a trader may look for opportunities to buy stocks in manufacturing companies when the index is above 50, indicating expansion. Conversely, they may look for opportunities to sell stocks in manufacturing companies when the index is below 50, indicating contraction.

Additionally, traders may use the ISM Manufacturing Index as a confirmation tool for other technical indicators or fundamental analysis. For example, if a trader identifies a bullish trend in a manufacturing stock based on technical analysis, they may look for a positive ISM Manufacturing Index reading to confirm their analysis and potentially enter a long position.

Definition and Calculation of the ISM Manufacturing Index

Calculation Methodology

The ISM Manufacturing Index is calculated based on a survey of purchasing managers from various industries across the country. These purchasing managers are asked a series of questions about key aspects of their business, such as new orders, production levels, employment, supplier deliveries, and inventories.

The responses to these questions are then compiled and weighted to create a composite index. The index is constructed in a way that a reading above 50 indicates expansion in the manufacturing sector, while a reading below 50 indicates contraction. The higher the index reading, the stronger the expansion, and vice versa.

Components of the Index

The ISM Manufacturing Index consists of several sub-indices that provide more detailed information about specific aspects of the manufacturing sector. These sub-indices include:

- New Orders Index: Measures the level of new orders received by manufacturers.

- Production Index: Reflects the level of production activity in the manufacturing sector.

- Employment Index: Indicates the level of employment in the manufacturing sector.

- Supplier Deliveries Index: Measures the speed of deliveries from suppliers to manufacturers.

- Inventories Index: Reflects the level of inventories held by manufacturers.

It is important to note that the ISM Manufacturing Index is a leading indicator, meaning that it provides insights into future economic trends. As such, it is closely watched by market participants and can have a significant impact on financial markets.

The ISM Manufacturing Index is a key economic indicator that provides valuable insights into the health and performance of the manufacturing sector in the United States. It is widely regarded as a reliable gauge of economic activity and is closely monitored by investors, policymakers, and economists.

As a diffusion index, the ISM Manufacturing Index measures the level of business activity in the manufacturing sector. It is based on a monthly survey of purchasing managers from various industries, who are asked to provide information on key factors such as new orders, production levels, employment, supplier deliveries, and inventories.

The index is calculated using a 50-point threshold, with a reading above 50 indicating expansion in the manufacturing sector, while a reading below 50 suggests contraction. This makes it a valuable tool for assessing the overall direction and momentum of the economy, as well as identifying potential turning points.

One of the main reasons why the ISM Manufacturing Index is considered important is its ability to provide early signals of economic trends. Changes in the index can indicate shifts in business conditions, such as changes in demand, production levels, and employment. This information can be crucial for businesses, investors, and policymakers in making informed decisions and adjusting their strategies accordingly.

Moreover, the ISM Manufacturing Index is closely watched by the Federal Reserve, as it provides insights into the overall health of the economy. The Federal Reserve uses this information to assess the need for monetary policy adjustments, such as interest rate changes, in order to maintain price stability and promote sustainable economic growth.

For investors, the ISM Manufacturing Index can be a valuable tool for assessing the performance of the manufacturing sector and identifying potential investment opportunities. A strong reading in the index may indicate a favorable environment for manufacturing companies, while a weak reading may suggest challenges and potential risks.

Trading Strategies Based on the ISM Manufacturing Index

The ISM Manufacturing Index is a key economic indicator that provides valuable insights into the health of the manufacturing sector. Traders and investors can use this index to develop trading strategies and make informed decisions in the financial markets.

Here are some trading strategies that can be based on the ISM Manufacturing Index:

1. Trend Following Strategy:

Traders can use the ISM Manufacturing Index to identify the overall trend in the manufacturing sector. If the index is consistently above 50, it indicates expansion in the sector, and traders can consider going long on manufacturing-related stocks or commodities. Conversely, if the index is consistently below 50, it indicates contraction, and traders can consider shorting manufacturing-related assets.

2. Reversal Strategy:

When the ISM Manufacturing Index reaches extreme levels, it can signal a potential reversal in the manufacturing sector. For example, if the index has been consistently rising and reaches a very high level, it may indicate that the sector is overbought and due for a correction. Traders can look for opportunities to short manufacturing-related assets in anticipation of a reversal.

3. News Trading Strategy:

Traders can also use the ISM Manufacturing Index to trade on news releases. When the index is released, if it significantly deviates from market expectations, it can cause volatility in the financial markets. Traders can take advantage of this volatility by entering trades in the direction of the surprise. For example, if the index comes out higher than expected, traders can go long on manufacturing-related assets.

4. Correlation Strategy:

The ISM Manufacturing Index can also be used in correlation with other economic indicators or asset classes. For example, traders can compare the ISM Manufacturing Index with the ISM Non-Manufacturing Index to get a broader view of the overall economy. Additionally, traders can analyze the correlation between the ISM Manufacturing Index and the performance of specific stocks or commodities to identify trading opportunities.

It is important to note that trading strategies based on the ISM Manufacturing Index should be used in conjunction with other technical and fundamental analysis tools. Traders should also consider the overall market conditions and risk management principles when implementing these strategies.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.