Islamic Banking and Finance

Principles of Islamic Banking and Finance

Islamic banking and finance is guided by several key principles:

- Prohibition of Interest (Riba): Islamic banking prohibits the charging or payment of interest, as it is considered exploitative and unjust. Instead, Islamic financial institutions offer profit-sharing arrangements or charge fees for their services.

- Prohibition of Uncertainty (Gharar): Islamic banking discourages transactions that involve excessive uncertainty or ambiguity. Contracts must be clear and transparent, and risks should be shared by all parties involved.

- Prohibition of Gambling (Maysir): Islamic banking prohibits any form of gambling or speculative activities. Investments should be based on real economic activities and tangible assets.

- Prohibition of Financing Forbidden Activities: Islamic banking prohibits financing activities that are considered haram (forbidden) in Islam, such as alcohol, gambling, and pork production.

Types of Islamic Financial Products

Islamic banking offers a range of financial products and services that comply with Shariah principles. Some common types of Islamic financial products include:

- Murabaha: A cost-plus financing arrangement where the bank purchases an asset and sells it to the customer at a marked-up price, allowing the customer to pay in installments.

- Mudarabah: A profit-sharing partnership between the bank and the customer, where the bank provides the capital and the customer provides the expertise.

- Ijarah: A leasing arrangement where the bank purchases an asset and leases it to the customer for a specific period of time.

- Sukuk: Islamic bonds that represent ownership in a tangible asset or a project. Investors receive a share of the profits generated by the asset or project.

Benefits of Islamic Banking and Finance

Islamic banking and finance offers several benefits:

- Ethical and Socially Responsible: Islamic banking promotes ethical and socially responsible financial practices by prohibiting investments in activities that are harmful to society.

- Shared Risk and Reward: Islamic financial contracts promote a fair distribution of risk and reward between the bank and the customer.

- Financial Stability: Islamic banking encourages prudent financial practices, such as avoiding excessive debt and speculation, which can contribute to financial stability.

- Inclusive and Accessible: Islamic banking aims to provide financial services to a wide range of individuals and businesses, including those who may not have access to conventional banking services.

Definition

Islamic banking and finance refers to a system of banking and financial activities that are conducted in accordance with Islamic principles and guidelines. It is based on the principles of Shariah law, which prohibits the payment or receipt of interest (riba) and promotes ethical and socially responsible financial practices.

Islamic banking and finance operates on the concept of profit and loss sharing (PLS), where the bank and the customer share the risks and rewards of the investment. This is in contrast to conventional banking, which is based on fixed interest rates and predetermined returns.

Key Principles of Islamic Banking and Finance

1. Prohibition of Interest (Riba): Islamic banking and finance strictly prohibits the payment or receipt of interest. This is based on the belief that money should not generate more money without any productive economic activity.

2. Prohibition of Speculation (Gharar): Islamic banking and finance discourages speculative transactions that involve excessive uncertainty and risk. It promotes transparency and encourages transactions that are based on tangible assets and real economic activities.

3. Prohibition of Unethical Activities: Islamic banking and finance prohibits investments in activities that are considered unethical or harmful to society, such as gambling, alcohol, and pork products. It promotes ethical investments that contribute to the well-being of individuals and society as a whole.

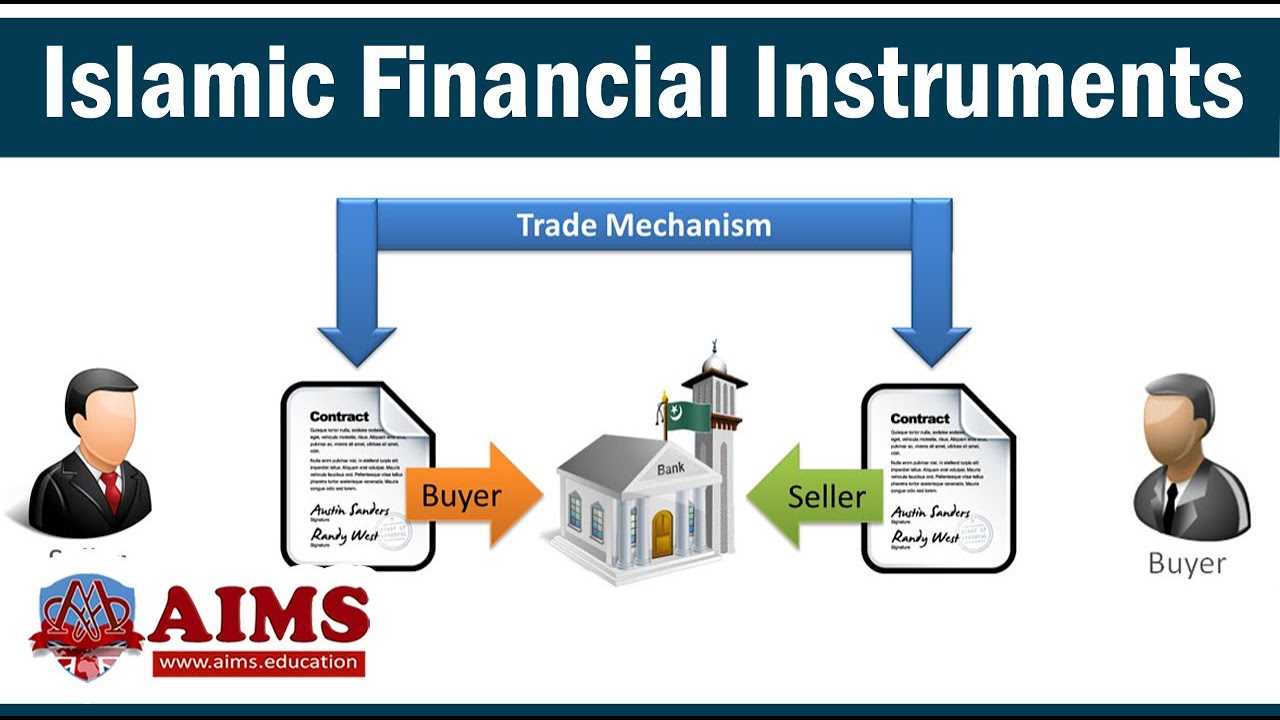

Islamic Financial Instruments

Islamic banking and finance offers a range of financial instruments that comply with Shariah principles. Some of the common Islamic financial instruments include:

- Murabaha: This is a cost-plus financing arrangement where the bank purchases an asset and sells it to the customer at a higher price, allowing the customer to pay in installments.

- Mudarabah: This is a profit-sharing partnership where the bank provides the capital and the customer provides the expertise. Profits are shared based on a pre-agreed ratio.

- Sukuk: These are Islamic bonds that represent ownership in an underlying asset. The returns are generated from the income generated by the asset.

- Ijarah: This is a leasing arrangement where the bank purchases an asset and leases it to the customer for a specific period of time.

History of Islamic Banking and Finance

The history of Islamic banking and finance can be traced back to the early days of Islam in the 7th century. The principles and practices of Islamic finance are rooted in the teachings of the Quran and the Hadith, which are the sayings and actions of the Prophet Muhammad.

During the time of the Prophet Muhammad, trade and commerce were an integral part of the Arabian society. However, the prevalent financial system at that time was based on usury and exploitation, which was considered unethical and exploitative by the Islamic teachings.

Since then, Islamic banking and finance have grown rapidly and expanded globally. Today, there are numerous Islamic banks, financial institutions, and investment funds operating in various countries around the world. Islamic finance has gained recognition and acceptance as an alternative financial system that adheres to ethical and Shariah-compliant principles.

Key Principles of Islamic Banking and Finance

Islamic banking and finance are based on several key principles, including:

- Prohibition of interest (riba): Islamic finance prohibits the charging or payment of interest on loans or investments. Instead, it promotes profit-sharing and risk-sharing arrangements.

- Prohibition of uncertainty (gharar): Islamic finance discourages transactions that involve excessive uncertainty or ambiguity.

- Prohibition of gambling (maysir): Islamic finance prohibits any form of gambling or speculative activities.

- Prohibition of unethical activities: Islamic finance prohibits investments in activities that are considered unethical or harmful, such as alcohol, gambling, and pork.

Islamic Banking and Finance Products

Islamic banking and finance offer a range of products and services that are compliant with Shariah principles. Some of the common products include:

- Murabaha: A cost-plus financing arrangement where the bank purchases an asset and sells it to the customer at a higher price, allowing the customer to pay in installments.

- Mudarabah: A profit-sharing arrangement where the bank provides the capital and the customer provides the expertise, and profits are shared based on a pre-agreed ratio.

- Ijarah: A leasing arrangement where the bank purchases an asset and leases it to the customer for a specified period.

- Sukuk: Islamic bonds that represent ownership in an underlying asset or project, providing investors with a share of the profits.

These are just a few examples of the products and services offered by Islamic banks and financial institutions. Islamic banking and finance continue to innovate and develop new products to meet the needs of their customers while adhering to Shariah principles.

Example of Islamic Banking and Finance

How Musharakah Works

In a Musharakah arrangement, all parties involved contribute capital to a business venture. This contribution can be in the form of cash, assets, or expertise. The profits and losses generated from the venture are shared among the partners based on the agreed-upon ratio.

Unlike conventional banking, where interest is charged on loans, Musharakah allows for a more equitable distribution of profits and losses. This aligns with the principles of Islamic finance, which emphasize fairness and shared risk.

Benefits of Musharakah

Musharakah offers several benefits to both the bank and the customer. For the bank, it provides an opportunity to diversify its investment portfolio and share the risk with the customer. It also encourages entrepreneurship and supports the growth of small and medium-sized enterprises.

For the customer, Musharakah provides access to financing without the burden of interest. It allows them to invest in a business venture while sharing the risk with the bank. This promotes a more ethical and sustainable approach to finance.

Overall, Musharakah is just one example of how Islamic banking and finance operates differently from conventional banking. It demonstrates the principles of fairness, shared risk, and ethical financing that are at the core of Islamic finance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.