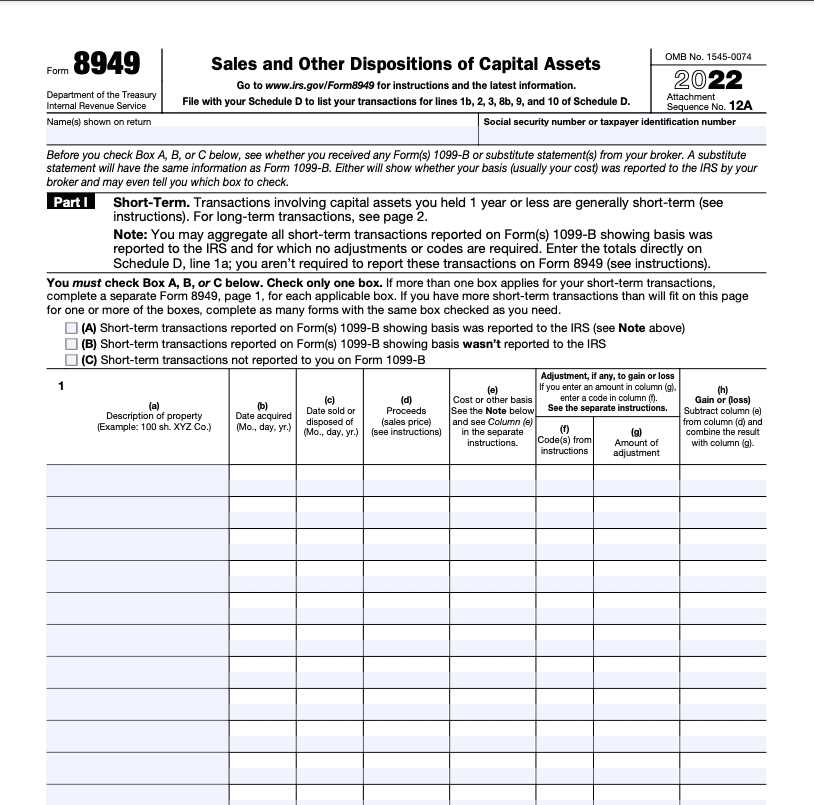

What is IRS Form 8949?

IRS Form 8949 is a tax form used by individuals, partnerships, and corporations to report sales and other dispositions of capital assets. It is used to calculate and report capital gains or losses from the sale of stocks, bonds, real estate, and other investment assets.

The form is divided into two parts: Part I for short-term capital gains and losses, and Part II for long-term capital gains and losses. Each part has separate sections for reporting transactions with different types of assets, such as stocks, bonds, real estate, and collectibles.

Why is IRS Form 8949 important?

IRS Form 8949 is important because it helps the IRS track and verify capital gains and losses reported by taxpayers. It ensures that taxpayers accurately report their income from the sale of capital assets and pay the appropriate amount of taxes on those gains.

By requiring taxpayers to report their capital gains and losses on Form 8949, the IRS can compare the information reported on the form with the information provided by brokers, financial institutions, and other third parties. This helps to prevent tax evasion and ensure compliance with tax laws.

How to fill out IRS Form 8949?

Filling out IRS Form 8949 requires careful attention to detail and accurate reporting of all relevant information. Here are the steps to fill out the form:

- Start by entering your name, Social Security number or taxpayer identification number, and the tax year you are filing for at the top of the form.

- Next, you will need to provide a description of the property or asset being sold, including the date acquired and the date sold.

- Indicate whether the transaction is a short-term or long-term capital gain or loss.

- Enter the proceeds from the sale of the asset and the cost or other basis of the asset.

- Calculate the gain or loss by subtracting the cost basis from the proceeds.

- Repeat these steps for each transaction and enter the total gain or loss for each section of the form.

- Transfer the totals to Schedule D, which is used to calculate the overall capital gains or losses for the tax year.

It is important to double-check all entries and ensure that the information reported on Form 8949 matches the information provided by brokers or financial institutions on Form 1099-B.

Additionally, it is recommended to keep records of all transactions and supporting documentation in case of an audit or further review by the IRS.

When is IRS Form 8949 Required?

Types of transactions that require Form 8949

Form 8949 is used to report various types of transactions, including:

- Sales of stocks, bonds, mutual funds, and other securities

- Sales of real estate properties

- Sales of business assets

- Exchanges of like-kind property

- Foreclosures and repossessions

- Gifts and inheritances of capital assets

It is important to note that not all transactions require the filing of Form 8949. Certain transactions, such as sales of personal items for a loss, are not required to be reported on this form.

Exceptions to filing Form 8949

There are a few exceptions to filing Form 8949. These include:

- Transactions that result in a capital loss of $200 or less ($500 or less for married individuals filing jointly)

- Transactions for which a separate form or schedule is provided (e.g., Form 1099-B or Form 1099-S)

- Transactions for which the entire gain is reported on another form (e.g., Form 4797 for the sale of business property)

It is important to consult the IRS guidelines and instructions to determine if a specific transaction requires the filing of Form 8949.

Overall, Form 8949 is an essential document for reporting capital asset transactions and ensuring compliance with the IRS tax regulations. It is important to accurately complete this form and include all necessary information to avoid any potential penalties or audits.

How to Fill Out IRS Form 8949?

Filling out IRS Form 8949 is an important step in accurately reporting your capital asset transactions for tax purposes. This form is used to report the sales and other dispositions of capital assets, such as stocks, bonds, and real estate, and is required to be filed with your individual income tax return.

Here is a step-by-step guide on how to fill out IRS Form 8949:

- Identify the type of transaction: Determine whether the transaction is a short-term or long-term capital gain or loss. Short-term capital gains or losses are for assets held for one year or less, while long-term capital gains or losses are for assets held for more than one year.

- Complete Part I: In Part I of Form 8949, you will need to provide information about the asset being sold or disposed of. This includes the date acquired, date sold or disposed of, the cost basis, and the amount realized from the sale.

- Complete Part II: If you have multiple transactions of the same type, you can use Part II to report additional transactions. You will need to provide the same information as in Part I for each transaction.

- Calculate the totals: Once you have completed Parts I and II, calculate the totals for each column and transfer them to Schedule D, which is used to report your overall capital gains and losses.

- Attach supporting documents: It is important to keep accurate records of your capital asset transactions and attach any necessary supporting documents, such as brokerage statements or purchase and sale agreements, to your tax return.

When filling out Form 8949, it is crucial to double-check all the information provided and ensure its accuracy. Any errors or omissions could result in delays in processing your tax return or potential penalties from the IRS.

It is recommended to consult with a tax professional or use tax software to ensure you are correctly filling out Form 8949 and reporting your capital asset transactions in accordance with IRS guidelines.

Important Considerations for IRS Form 8949

When filling out IRS Form 8949, there are several important considerations to keep in mind. These considerations can help ensure accuracy and compliance with tax regulations. Here are some key points to consider:

| 1. Organize your records: | Before filling out Form 8949, it is important to gather all the necessary records and documents related to your capital asset transactions. This includes information such as purchase and sale dates, cost basis, and proceeds from the sale. |

| 2. Understand the different categories: | Form 8949 requires you to report your capital asset transactions in different categories, such as short-term and long-term transactions. It is important to understand the criteria for each category and accurately classify your transactions accordingly. |

| 3. Report all transactions: | It is crucial to report all your capital asset transactions on Form 8949, even if you do not receive a Form 1099-B from your broker. Failure to report all transactions can result in penalties and potential audits. |

| 4. Double-check your calculations: | When filling out Form 8949, it is essential to double-check all your calculations to ensure accuracy. Mistakes in calculations can lead to discrepancies and potential issues with the IRS. |

| 5. Attach supporting documents: | It is recommended to attach any supporting documents, such as brokerage statements or transaction receipts, to your Form 8949. These documents can serve as evidence in case of an IRS audit. |

| 6. Seek professional help if needed: | If you are unsure about how to fill out Form 8949 or have complex capital asset transactions, it is advisable to seek professional help from a tax advisor or accountant. They can provide guidance and ensure compliance with tax laws. |

By considering these important factors, you can navigate the process of filling out IRS Form 8949 with confidence and accuracy. Remember to keep thorough records and consult with a professional if needed to ensure compliance with tax regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.