What is an Interest Rate Collar?

An interest rate collar is a financial strategy that allows individuals or businesses to limit their exposure to interest rate fluctuations. It involves the use of options to create a range, or collar, within which interest rates are effectively fixed. This can be particularly useful for borrowers or investors who want to protect themselves against rising interest rates, while still being able to benefit from lower rates.

Definition and Explanation

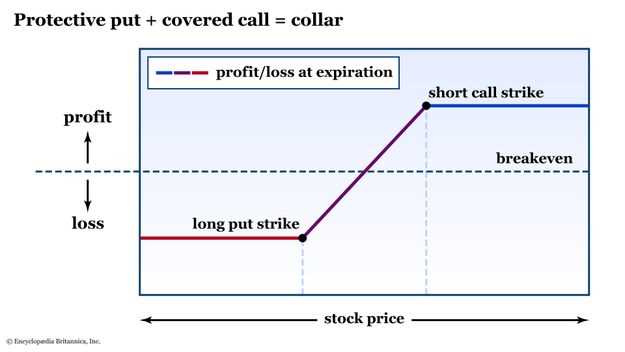

An interest rate collar consists of two main components: a cap and a floor. The cap sets the maximum interest rate that the borrower or investor will pay, while the floor sets the minimum interest rate they will receive. These levels are typically set based on the current market rates at the time the collar is established.

The cap and floor are created using options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period of time. In the case of an interest rate collar, the underlying asset is typically a financial instrument such as a bond or loan.

How Does an Interest Rate Collar Work?

When an interest rate collar is established, the borrower or investor purchases a cap option and sells a floor option. This combination allows them to limit their exposure to interest rate fluctuations within a certain range.

If interest rates rise above the cap level, the borrower or investor is protected because they will only pay the maximum rate specified by the cap. Conversely, if interest rates fall below the floor level, they will still receive the minimum rate specified by the floor.

However, if interest rates remain within the range between the cap and the floor, the borrower or investor will not be affected by the collar. They will pay or receive the market rate, depending on whether they are a borrower or investor.

Example of an Interest Rate Collar

Let’s say a company wants to borrow money to finance a project and is concerned about rising interest rates. They decide to establish an interest rate collar with a cap of 5% and a floor of 3%. If interest rates rise above 5%, the company will only pay a maximum of 5% on their loan. If interest rates fall below 3%, the company will still receive a minimum of 3% on their loan. However, if interest rates remain between 3% and 5%, the company will pay or receive the market rate.

By using an interest rate collar, the company is able to limit their exposure to interest rate fluctuations and have more certainty in their borrowing costs.

Overall, an interest rate collar can be a valuable tool for managing interest rate risk and providing stability in uncertain market conditions.

Definition and Explanation

An interest rate collar is a financial strategy used by individuals or businesses to protect against interest rate fluctuations. It involves the use of options contracts to limit the potential losses or gains associated with changes in interest rates.

When interest rates are expected to rise, an interest rate collar can be used to limit the potential increase in borrowing costs. Conversely, when interest rates are expected to fall, an interest rate collar can be used to limit the potential decrease in investment returns.

An interest rate collar typically involves the use of two options: a cap and a floor. The cap option sets a maximum interest rate, while the floor option sets a minimum interest rate. The collar is created by purchasing the cap option and selling the floor option.

Interest rate collars are commonly used in industries such as real estate, construction, and manufacturing, where long-term borrowing or investment is common. They provide a way to manage interest rate risk and ensure stability in financial planning.

How Does an Interest Rate Collar Work?

An interest rate collar is a financial derivative that helps protect against interest rate fluctuations. It is a combination of two options: a cap and a floor. The cap option sets a maximum interest rate, while the floor option sets a minimum interest rate. The collar is created by buying a cap option and selling a floor option with the same expiration date and notional amount.

When interest rates rise above the cap rate, the cap option provides compensation to the buyer. On the other hand, when interest rates fall below the floor rate, the seller of the floor option compensates the buyer. The collar effectively limits the interest rate risk for both parties involved.

Overall, the interest rate collar provides a way for borrowers to limit their interest rate risk while allowing lenders or investors to generate income from selling options. It is a useful tool in managing interest rate exposure in various financial transactions, such as loans, bonds, and mortgages.

Example of an Interest Rate Collar

Let’s consider an example to better understand how an interest rate collar works. Imagine that a company, XYZ Corp, has taken out a loan with a variable interest rate. The current interest rate on the loan is 5%, but XYZ Corp is concerned that interest rates may rise in the future, which would increase their borrowing costs.

To protect themselves from rising interest rates, XYZ Corp decides to enter into an interest rate collar agreement with a financial institution. The collar agreement sets a range of interest rates within which XYZ Corp’s loan interest rate will be fixed.

The collar agreement specifies that the lower limit of the interest rate range is 4% and the upper limit is 6%. If the interest rate on the loan falls below 4%, XYZ Corp will continue to pay the variable interest rate. However, if the interest rate rises above 6%, XYZ Corp’s interest rate will be fixed at 6%.

Now, let’s assume that the interest rate on XYZ Corp’s loan increases to 7%. Without the collar agreement, XYZ Corp would have to pay the higher interest rate. However, thanks to the interest rate collar, XYZ Corp’s interest rate is fixed at 6%, saving them from the increased borrowing costs.

In summary, an interest rate collar provides a company with protection against rising interest rates by setting a range within which the interest rate on a loan will be fixed. This allows the company to budget and plan for their borrowing costs, providing stability and reducing financial risk.

Advanced Concepts in Interest Rate Collars

1. Volatility

Volatility plays a crucial role in the pricing and effectiveness of interest rate collars. It refers to the degree of fluctuation in interest rates over a given period. Higher volatility increases the potential gains or losses associated with an interest rate collar.

Traders and investors need to carefully analyze historical volatility and make predictions about future volatility to determine the appropriate collar structure. This analysis involves statistical models and sophisticated financial tools.

2. Correlation

For example, if there is a strong positive correlation between interest rates and inflation, a trader might choose to include an inflation index in the collar structure to hedge against inflation risk.

3. Option Pricing Models

Black-Scholes and Binomial models are commonly used option pricing models. Traders and investors rely on these models to determine the appropriate premium for the collar and assess the potential risks and rewards.

It is important to note that option pricing models are based on certain assumptions and simplifications. Traders and investors should carefully consider the limitations and uncertainties associated with these models when using them to price interest rate collars.

4. Hedging Strategies

Interest rate collars can be used as part of a broader hedging strategy to manage interest rate risk. Traders and investors can combine collars with other financial instruments, such as interest rate swaps or futures contracts, to create a more comprehensive risk management strategy.

By diversifying their hedging strategies, market participants can mitigate the impact of unexpected interest rate movements and protect their portfolios from potential losses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.