Key Strategies Employed by Institutional Investors

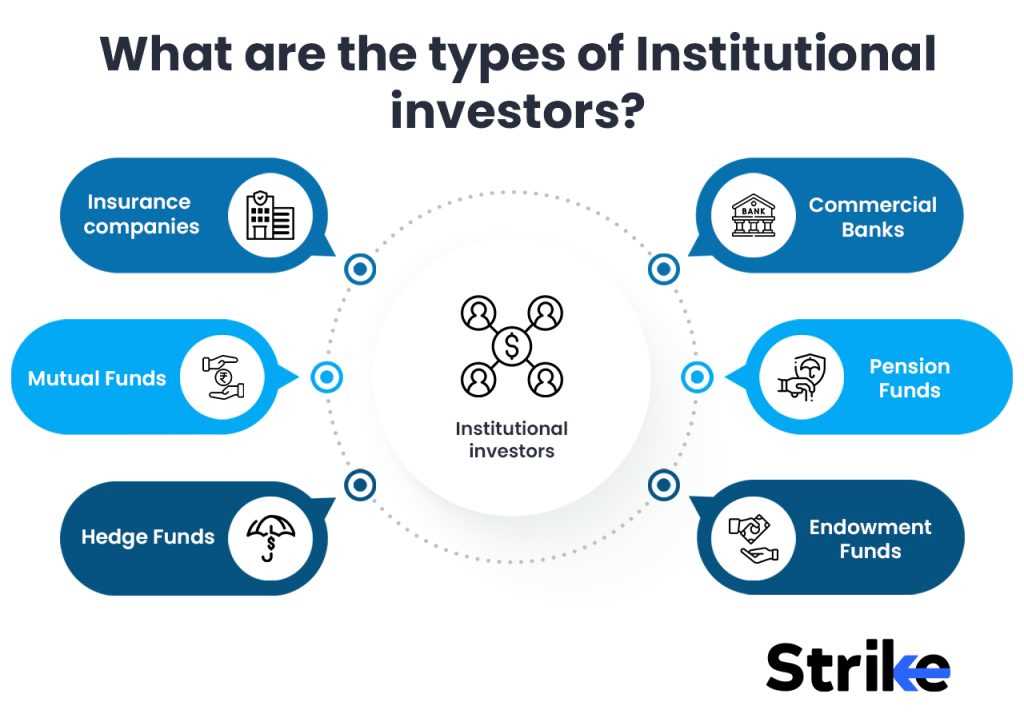

Institutional investors, such as pension funds, endowments, and insurance companies, employ various strategies to achieve their investment goals. These strategies are designed to maximize returns while managing risk and ensuring the long-term sustainability of their portfolios. Here are some key strategies commonly employed by institutional investors:

Diversification

One of the primary strategies employed by institutional investors is diversification. By spreading their investments across different asset classes, sectors, and geographies, institutional investors aim to reduce the impact of any single investment on their overall portfolio. Diversification helps to mitigate risk and increase the likelihood of achieving consistent returns over time.

Active Management

Institutional investors often engage in active management, where they actively make investment decisions based on market trends, economic conditions, and company-specific factors. This approach allows them to capitalize on opportunities and adjust their portfolios accordingly. Active management involves conducting thorough research, analyzing financial statements, and monitoring market trends to make informed investment decisions.

Long-Term Investing

Institutional investors typically have a long-term investment horizon. They focus on generating sustainable returns over an extended period, rather than seeking short-term gains. This long-term approach allows them to ride out market fluctuations and benefit from compounding returns. Institutional investors understand that successful investing requires patience and a focus on the underlying fundamentals of the investments.

Institutional investors often allocate a portion of their portfolios to alternative investments, such as private equity, hedge funds, and real estate. These investments provide diversification benefits and the potential for higher returns compared to traditional asset classes. Alternative investments also offer institutional investors access to unique investment opportunities that may not be available in public markets.

Overall, institutional investors employ a combination of diversification, active management, long-term investing, and alternative investments to achieve their investment objectives. These strategies allow them to navigate the complexities of the financial markets and generate consistent, risk-adjusted returns for their stakeholders.

Investment Approach of Institutional Investors

Institutional investors, such as pension funds, insurance companies, and endowments, have a unique investment approach that sets them apart from individual investors. Their investment strategies are often shaped by their long-term goals, risk tolerance, and regulatory requirements.

Long-Term Focus:

Diversification:

Institutional investors understand the importance of diversification in managing risk. They spread their investments across different asset classes, such as stocks, bonds, real estate, and alternative investments, to reduce the impact of any single investment on their overall portfolio. Diversification helps them achieve a balance between risk and return and minimize the potential for significant losses.

Active Management:

Institutional investors often employ active management strategies, where they actively make investment decisions and adjust their portfolios based on market conditions and their research. They have dedicated teams of investment professionals who analyze market trends, conduct in-depth research, and make informed investment decisions. This active management approach allows them to identify opportunities and make timely adjustments to their portfolios.

Alternative Investments:

Institutional investors also allocate a portion of their portfolios to alternative investments, such as private equity, hedge funds, and real estate. These investments offer the potential for higher returns and diversification benefits. However, they also come with higher risks and may require specialized knowledge and expertise to evaluate and manage effectively.

Environmental, Social, and Governance (ESG) Factors:

Conclusion:

The investment approach of institutional investors is characterized by a long-term focus, diversification, active management, allocation to alternative investments, and consideration of ESG factors. These strategies are designed to achieve their long-term goals, manage risk, and generate consistent returns over time.

Factors Influencing Institutional Investors’ Decision-making

Institutional investors are major players in the financial markets, managing large sums of money on behalf of their clients. Their investment decisions are influenced by a variety of factors, which can be categorized into several key areas:

| 1. Economic Factors | 2. Market Conditions | 3. Regulatory Environment |

|---|---|---|

|

Institutional investors closely monitor economic indicators such as GDP growth, inflation rates, and interest rates. These factors provide insights into the overall health of the economy and can impact investment decisions. For example, during periods of economic expansion, institutional investors may be more willing to take on higher levels of risk and invest in growth-oriented assets. |

Market conditions play a crucial role in institutional investors’ decision-making. Factors such as market volatility, liquidity, and investor sentiment can influence the attractiveness of different investment opportunities. Institutional investors may adjust their strategies based on market conditions, such as increasing or decreasing allocations to certain asset classes. |

The regulatory environment can significantly impact institutional investors’ decision-making. Changes in regulations, such as tax laws or investment restrictions, can affect the attractiveness of certain investment strategies or asset classes. Institutional investors must stay up-to-date with regulatory developments and adjust their investment approach accordingly. |

| 4. Risk Management | 5. Long-Term Objectives | 6. Client Preferences |

|

Risk management is a critical consideration for institutional investors. They employ various risk management techniques, such as diversification, hedging, and stress testing, to protect their portfolios against potential losses. Institutional investors carefully assess the risk-reward tradeoff of different investment opportunities and incorporate risk management strategies into their decision-making process. |

Institutional investors typically have long-term investment objectives, such as generating stable returns, preserving capital, or funding future liabilities. These objectives guide their investment decisions and influence the allocation of assets across different investment strategies. Institutional investors often take a multi-asset approach, diversifying their portfolios to achieve their long-term objectives. |

Client preferences and mandates play a significant role in institutional investors’ decision-making. Institutional investors must align their investment strategies with the specific requirements and preferences of their clients. This may include considerations such as ethical or socially responsible investing, investment restrictions, or specific return objectives. Institutional investors must carefully balance client preferences with their own investment expertise and market opportunities. |

Overall, institutional investors’ decision-making is a complex process that takes into account a wide range of factors. By carefully considering economic factors, market conditions, regulatory environment, risk management, long-term objectives, and client preferences, institutional investors aim to make informed investment decisions that align with their goals and deliver value to their clients.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.