What is an Impaired Asset?

An impaired asset refers to an asset that has a value that is less than its carrying amount or book value. In other words, it is an asset that has suffered a significant decrease in value and is unlikely to recover its full value in the future.

Impairment of an asset can occur due to various factors such as changes in market conditions, technological advancements, legal or regulatory changes, or poor asset management. When an asset is impaired, it is necessary for the company to recognize this impairment in its financial statements.

Definition and Explanation

An impaired asset is an asset that has experienced a significant decline in value. This decline can be due to a variety of reasons, including changes in market conditions, obsolescence, damage, or poor performance. When an asset is impaired, it means that its fair value is less than its carrying amount or book value.

Impairment is a non-cash expense that is recognized in the financial statements of a company. It is important for companies to assess their assets regularly to determine if there are any indications of impairment. If an asset is impaired, the company must recognize the impairment loss in its financial statements.

Causes of Impairment

There are several factors that can cause an asset to become impaired. These include:

- Changes in market conditions: If the market value of an asset decreases significantly, it may be considered impaired.

- Technological advancements: If a company’s assets become obsolete due to technological advancements, they may be impaired.

- Legal or regulatory changes: Changes in laws or regulations can impact the value of certain assets, leading to impairment.

- Poor asset management: Inadequate management of assets can result in their deterioration or underperformance, leading to impairment.

Testing and Recording Impaired Assets

To determine if an asset is impaired, companies need to conduct impairment tests. These tests involve comparing the carrying amount of the asset to its recoverable amount, which is the higher of its fair value less costs to sell or its value in use.

Impaired assets are typically disclosed separately in the financial statements to provide transparency to stakeholders. This allows investors and creditors to assess the impact of impairment on the company’s financial position and performance.

Definition and Explanation

An impaired asset refers to an asset that has a reduced value or is no longer expected to generate the same level of cash flows as initially anticipated. This reduction in value can be caused by various factors, such as changes in market conditions, legal issues, technological advancements, or poor performance of the asset.

When an asset is impaired, it means that its carrying value on the balance sheet exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell or its value in use. Fair value is the price that would be received to sell an asset in an orderly transaction between market participants, while value in use is the present value of the estimated future cash flows generated by the asset.

The impairment of an asset is recognized in the financial statements to ensure that the asset is not overstated and that the financial position of the company is accurately represented. It is important for companies to assess their assets for impairment regularly and adjust their carrying values accordingly.

Impaired assets are typically disclosed in the financial statements, either in the notes to the financial statements or as a separate line item in the balance sheet. This disclosure provides transparency to investors and other stakeholders regarding the financial health of the company and the potential risks associated with its assets.

Causes of Impairment

Impairment of assets can occur due to various factors. Here are some common causes:

1. Technological Obsolescence

Technological advancements can render certain assets obsolete. For example, a computer system that is no longer compatible with the latest software or hardware may be considered impaired. This can happen when newer, more efficient technology is introduced, making the existing assets less valuable or useful.

2. Economic Factors

3. Legal and Regulatory Changes

Changes in laws and regulations can also result in asset impairment. For example, if a company operates in an industry that becomes heavily regulated, it may need to invest in costly upgrades or modifications to comply with new requirements. This can reduce the value of existing assets and lead to impairment.

4. Physical Damage or Wear and Tear

Physical damage or wear and tear can cause assets to become impaired. This can happen in industries where assets are subject to frequent use or exposure to harsh conditions. For instance, heavy machinery used in construction or mining may deteriorate over time, leading to impairment.

5. Changes in Customer Preferences

These are just a few examples of the causes of asset impairment. It is important for businesses to regularly assess the value and condition of their assets to identify any potential impairments and take appropriate measures to address them.

Testing and Recording Impaired Assets

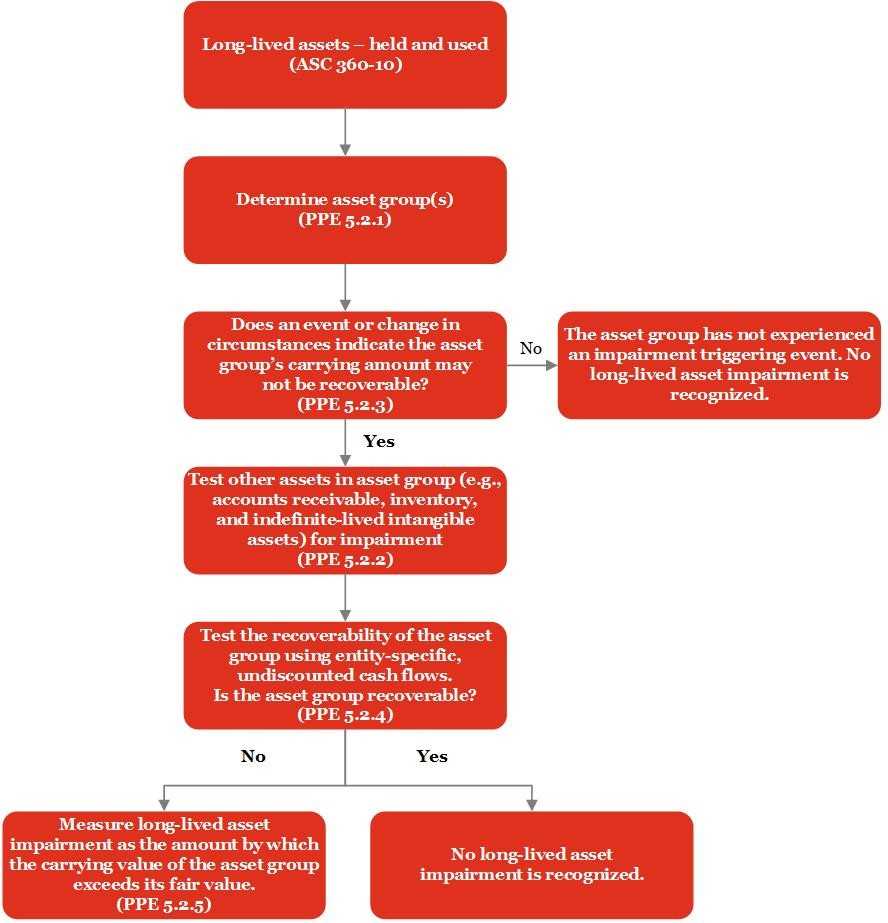

Testing and recording impaired assets is an essential process for companies to accurately reflect the value of their assets on their financial statements. This process involves assessing whether an asset’s carrying value exceeds its recoverable amount and determining the extent of impairment.

1. Testing for Impairment

The first step in testing for impairment is to identify the potential impaired assets. This can be done by reviewing the company’s assets and considering any indicators of impairment, such as significant changes in market conditions, technological advancements, or legal or regulatory changes.

Once potential impaired assets are identified, the next step is to estimate their recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell or its value in use. Fair value is determined based on market prices, while value in use is calculated by discounting the asset’s future cash flows.

2. Recording Impairment Losses

Impairment losses are recorded in the company’s financial statements as an expense. The specific account used to record the impairment loss depends on the type of asset impaired. For example, if a tangible asset, such as machinery or equipment, is impaired, the impairment loss is recorded in the depreciation expense account.

Once the impairment loss is recorded, the carrying amount of the impaired asset is reduced to its recoverable amount. This new carrying amount is then used for future depreciation or amortization calculations.

It is important to note that impairment losses are recognized immediately in the financial statements, rather than being spread out over time. This ensures that the financial statements provide an accurate representation of the company’s assets and their value.

Companies are required to disclose information about impaired assets in their financial statements, including the nature of the impairment, the amount of impairment losses recognized, and the carrying amount of the impaired assets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.