I Bond: A Complete Guide on How It Works and Where to Buy

So, how do I Bonds work? I Bonds are a type of inflation-protected bond, which means that their value is adjusted for inflation. This makes them a great option for investors who want to protect their purchasing power. The interest rate on I Bonds is a combination of a fixed rate and an inflation rate. The fixed rate remains the same throughout the life of the bond, while the inflation rate is adjusted every six months based on changes in the Consumer Price Index.

One of the main benefits of investing in I Bonds is that they are backed by the U.S. government, which means they are considered a very safe investment. They also offer a competitive interest rate compared to other low-risk investments. Additionally, the interest earned on I Bonds is exempt from state and local taxes, making them a tax-efficient investment option.

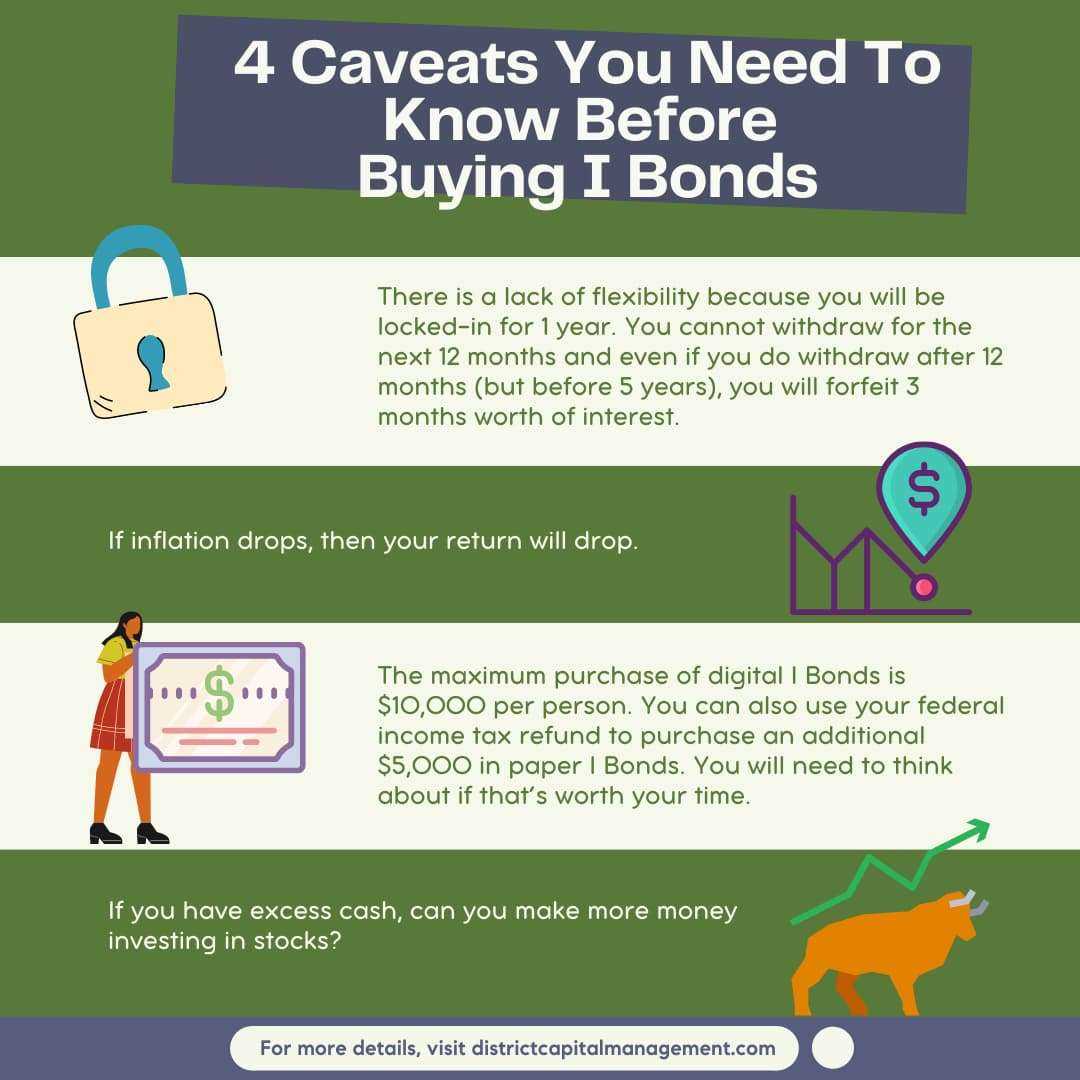

So, where can you buy I Bonds? I Bonds can be purchased directly from the U.S. Department of the Treasury through their website, TreasuryDirect.gov. The process is simple and can be done online. You will need to create an account, provide some personal information, and link a bank account to make your purchase. Once your account is set up, you can buy I Bonds in increments of $25, up to a maximum of $10,000 per calendar year.

How Do I Bonds Work?

Fixed Interest Rate

When you purchase an I Bond, it will earn a fixed interest rate for the entire life of the bond. This rate is set at the time of purchase and remains constant. The fixed interest rate is determined by the Treasury Department and is based on current market conditions.

The fixed interest rate is added to the bond’s value twice a year, on the bond’s semi-annual anniversary date. This means that the bond’s value will increase over time, providing a steady stream of income for the bondholder.

Inflation Rate Component

In addition to the fixed interest rate, I Bonds also have an inflation rate component. This component is adjusted every six months to reflect changes in the Consumer Price Index for All Urban Consumers (CPI-U), which measures inflation.

If the CPI-U increases, the bond’s value will be adjusted upward to keep pace with inflation. However, if the CPI-U decreases, the bond’s value will not be adjusted downward. This feature ensures that the purchasing power of the bondholder’s investment is protected against inflation.

The inflation rate component is added to the bond’s value on the bond’s semi-annual anniversary date, along with the fixed interest rate. This means that the bond’s value will increase by both the fixed interest rate and the inflation rate component.

Example:

Let’s say you purchase an I Bond with a fixed interest rate of 1% and an inflation rate component of 2%. After one year, the bond’s value would increase by 1% (fixed interest rate) + 2% (inflation rate component) = 3%.

Interest and Tax Considerations

Interest on I Bonds is exempt from state and local income taxes. However, it is subject to federal income tax. If you use the bond proceeds to pay for qualified higher education expenses, the interest may be tax-free at the federal level.

I Bonds have a minimum holding period of one year, and if you redeem the bond before five years, you will forfeit the last three months of interest. After five years, you can redeem the bond at any time without penalty.

Overall, I Bonds are a flexible and secure investment option that can help protect your savings from inflation while earning a competitive return. They offer a unique combination of a fixed interest rate and an inflation rate component, making them an attractive choice for long-term investors.

Benefits of Investing in I Bonds

Investing in I Bonds can offer several benefits for individuals looking to grow their savings and protect their investments. Here are some key advantages of investing in I Bonds:

1. Inflation Protection

2. Safety

I Bonds are backed by the U.S. government, making them one of the safest investment options available. The U.S. Treasury guarantees the principal and interest payments on I Bonds, providing investors with peace of mind knowing that their investment is secure.

3. Tax Advantages

Interest earned on I Bonds is exempt from state and local income taxes. Additionally, if the proceeds from I Bonds are used for qualified education expenses, the interest may also be exempt from federal income taxes. This can provide significant tax advantages for investors.

4. Flexibility

I Bonds have a minimum holding period of one year, but they can be held for up to 30 years. This flexibility allows investors to choose the length of time that best suits their financial goals. Additionally, I Bonds can be redeemed after one year with a small penalty, providing liquidity if needed.

5. Diversification

Investing in I Bonds can be a valuable addition to a diversified investment portfolio. I Bonds offer a low-risk, fixed-income investment option that can help balance out the volatility of other investments, such as stocks or real estate.

Where Can I Buy I Bonds?

Investing in I Bonds is a great way to diversify your investment portfolio and earn a competitive interest rate. If you’re interested in purchasing I Bonds, there are several options available to you.

1. TreasuryDirect: The easiest and most convenient way to buy I Bonds is through the TreasuryDirect website. TreasuryDirect is an online platform provided by the U.S. Department of the Treasury where you can purchase and manage your I Bonds directly. To get started, you’ll need to create an account on the TreasuryDirect website and provide some personal information. Once your account is set up, you can buy I Bonds electronically and hold them in your account.

2. Banks and Credit Unions: Many banks and credit unions also offer I Bonds for sale. You can visit your local bank or credit union branch and inquire about purchasing I Bonds. Keep in mind that not all financial institutions offer I Bonds, so it’s a good idea to call ahead and check if they have them available. If they do, you’ll need to provide some personal information and complete the necessary paperwork to buy the bonds.

3. Payroll Savings Plan: If you’re a U.S. government employee, you may have the option to purchase I Bonds through a payroll savings plan. This allows you to contribute a portion of your salary towards the purchase of I Bonds. Check with your employer or human resources department to see if this option is available to you.

Overall, I Bonds can be a valuable addition to your investment portfolio, providing a safe and reliable way to earn interest. With the various options available to purchase I Bonds, you can choose the method that best suits your needs and preferences.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.