What is a Humped Yield Curve?

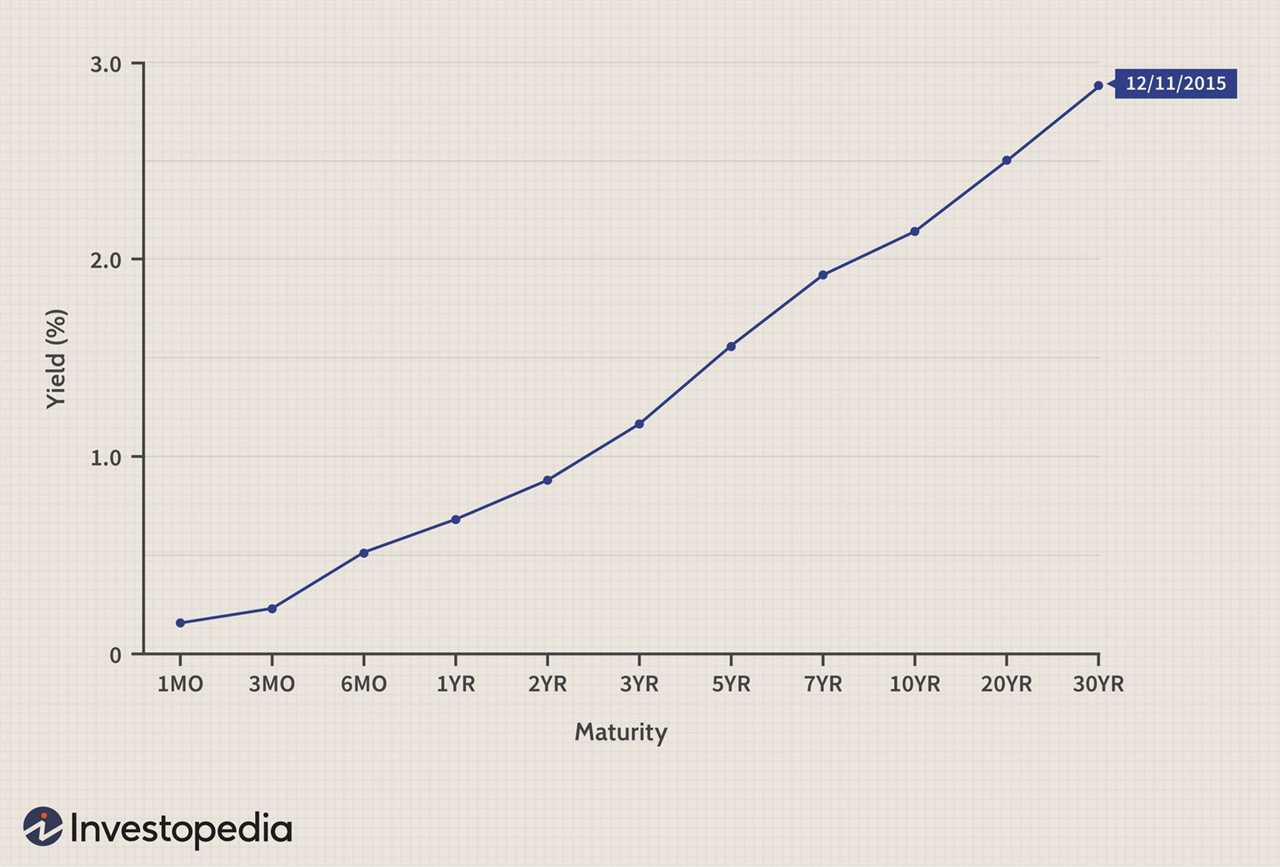

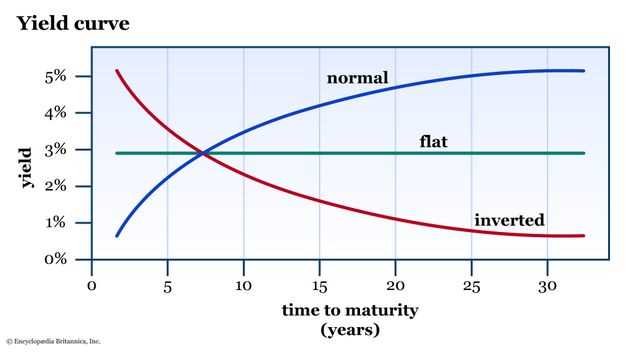

A humped yield curve is a term used in finance to describe a yield curve that has a pronounced hump or bump in the middle. A yield curve is a graphical representation of the interest rates on debt for a range of maturities. It shows the relationship between the interest rate (or cost of borrowing) and the time to maturity of the debt.

A humped yield curve is characterized by higher interest rates in the intermediate maturities compared to both shorter-term and longer-term maturities. This creates a hump shape in the curve when plotted on a graph.

The hump in the yield curve can occur due to various factors, including market expectations, economic conditions, and monetary policy. It is often seen as a sign of uncertainty or volatility in the market. Investors and analysts closely monitor the shape of the yield curve as it can provide insights into the future direction of interest rates and the overall health of the economy.

When the yield curve is humped, it indicates that investors are demanding higher returns for taking on intermediate-term debt compared to shorter-term or longer-term debt. This can be due to a variety of factors, such as expectations of inflation, changes in market conditions, or shifts in investor sentiment.

It is important to note that the shape of the yield curve can change over time, and a humped yield curve is just one of the possible shapes. Other common shapes include upward-sloping (normal) yield curves, downward-sloping (inverted) yield curves, and flat yield curves.

Mechanics of a Humped Yield Curve

The shape of a yield curve is determined by the supply and demand dynamics in the bond market. When there is a higher demand for medium-term bonds compared to short-term and long-term bonds, the prices of medium-term bonds increase, and their yields decrease. This leads to a hump in the yield curve.

The mechanics of a humped yield curve can be explained through the concept of market expectations. When the market expects interest rates to increase in the future, investors tend to prefer shorter-term bonds to avoid being locked into lower yields. This increases the demand for short-term bonds and lowers their yields. On the other hand, when the market expects interest rates to decrease in the future, investors tend to prefer longer-term bonds to lock in higher yields. This increases the demand for long-term bonds and lowers their yields. The combination of these market expectations leads to a hump in the yield curve.

It is important to note that the mechanics of a humped yield curve can vary depending on the economic environment and market conditions. Factors such as inflation expectations, central bank policies, and economic indicators can all influence the shape of the yield curve. Traders and investors need to closely monitor these factors to make informed decisions about their fixed income portfolios.

Variations in Humped Yield Curves

A humped yield curve is a type of yield curve that deviates from the normal shape of a yield curve, which typically slopes upward from left to right. In a humped yield curve, the interest rates for medium-term bonds are higher than both short-term and long-term bonds, creating a hump in the middle of the curve.

Types of Humped Yield Curves

There are several variations of humped yield curves, each indicating different market conditions and expectations. These variations include:

- Normal Humped Yield Curve: This is the most common type of humped yield curve, where the interest rates for medium-term bonds are higher than both short-term and long-term bonds. It typically reflects a period of uncertainty or market expectations of future interest rate changes.

- Steep Humped Yield Curve: This type of humped yield curve has a significant difference in interest rates between short-term and medium-term bonds. It usually indicates expectations of future inflation or higher interest rates.

- Flat Humped Yield Curve: In a flat humped yield curve, the interest rates for short-term, medium-term, and long-term bonds are relatively similar. It suggests market expectations of stable interest rates in the near future.

Factors Influencing Humped Yield Curves

Several factors can contribute to the formation of humped yield curves:

- Market Sentiment: Investor sentiment and expectations about future economic conditions can influence the shape of the yield curve. If investors anticipate changes in interest rates or economic uncertainty, it can lead to a humped yield curve.

- Monetary Policy: Central banks’ actions, such as adjusting interest rates or implementing quantitative easing measures, can impact the yield curve shape. Changes in monetary policy can affect short-term interest rates more than long-term rates, leading to a humped yield curve.

- Economic Indicators: Economic indicators, such as inflation rates, GDP growth, and unemployment rates, can influence market expectations and shape the yield curve. If there are concerns about inflation or economic instability, it can result in a humped yield curve.

- Supply and Demand: The supply and demand dynamics in the bond market can also affect the shape of the yield curve. If there is high demand for medium-term bonds, their prices may increase, leading to lower yields and a humped yield curve.

Fixed Income Trading Strategy & Education

What is a Humped Yield Curve?

A humped yield curve is a term used to describe a yield curve that has a hump in the middle, indicating that interest rates for medium-term bonds are higher than both short-term and long-term bonds. This type of yield curve is considered to be abnormal and can signal a variety of market conditions and expectations.

Mechanics of a Humped Yield Curve

The mechanics of a humped yield curve involve the relationship between bond yields and their respective maturities. In a humped yield curve, short-term bond yields are typically lower due to lower risk and lower inflation expectations. Long-term bond yields are also lower due to the expectation of lower future interest rates. The hump in the curve occurs when medium-term bond yields are higher, reflecting higher risk and inflation expectations.

Investors and traders analyze the shape of the yield curve to make informed decisions about bond investments. A humped yield curve can indicate a variety of market conditions, such as expectations of economic growth, inflation, and interest rate changes. Traders may use this information to adjust their fixed income trading strategies accordingly.

Variations in Humped Yield Curves

While the basic concept of a humped yield curve remains the same, there can be variations in its shape and characteristics. Some variations include a steep hump, a flat hump, or an asymmetrical hump. These variations can provide additional insights into market conditions and expectations.

| Advantages | Disadvantages |

|---|---|

| Opportunity to earn higher yields on medium-term bonds | Higher risk associated with medium-term bonds |

| Insights into market expectations for economic growth and inflation | Complexity in analyzing and interpreting the shape of the curve |

| Potential for adjusting trading strategies based on curve movements | Uncertainty in predicting future changes in the curve |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.