What is HARP?

HARP, which stands for Home Affordable Refinance Program, is a government program designed to help homeowners refinance their mortgages. It was created in response to the housing crisis in 2008 and aims to provide relief to homeowners who are struggling to make their mortgage payments.

HARP is specifically designed for homeowners who have loans owned or guaranteed by Fannie Mae or Freddie Mac, the two government-sponsored enterprises that buy and sell mortgages. It is intended to help homeowners who are current on their mortgage payments but are unable to refinance due to declining home values.

By refinancing through HARP, homeowners can potentially lower their monthly mortgage payments, reduce their interest rates, and save money over the life of their loan. This can provide much-needed financial relief and help homeowners stay in their homes.

To qualify for HARP, homeowners must meet certain eligibility criteria, including having a loan-to-value ratio of 80% or higher, being current on their mortgage payments, and having a mortgage that was originated on or before May 31, 2009. Additionally, homeowners must not have previously refinanced through HARP, unless it was a Fannie Mae loan refinanced under HARP between March and May 2009.

If you are a homeowner who is struggling to make your mortgage payments or are unable to refinance due to negative equity, HARP may be a viable option for you. It is important to explore all available resources and consult with a mortgage professional to determine if you qualify for the program and how it can benefit you.

Overview of the Home Affordable Refinance Program

The Home Affordable Refinance Program (HARP) is a government initiative designed to help homeowners who are struggling with their mortgage payments. It was introduced in 2009 by the Federal Housing Finance Agency (FHFA) and is available to homeowners with loans owned or guaranteed by Fannie Mae or Freddie Mac.

HARP allows eligible homeowners to refinance their mortgage at a lower interest rate, even if they owe more on their home than it is currently worth. This program is particularly beneficial for homeowners who are underwater on their mortgage, meaning they owe more on their loan than the current market value of their home.

How Does HARP Work?

Under the Home Affordable Refinance Program, homeowners can refinance their mortgage through a participating lender. The lender will assess the homeowner’s eligibility based on certain criteria, such as loan-to-value ratio, payment history, and income verification.

If approved, the homeowner can refinance their mortgage to take advantage of lower interest rates, potentially reducing their monthly mortgage payments. This can provide much-needed financial relief for homeowners who are struggling to make ends meet.

Benefits of HARP

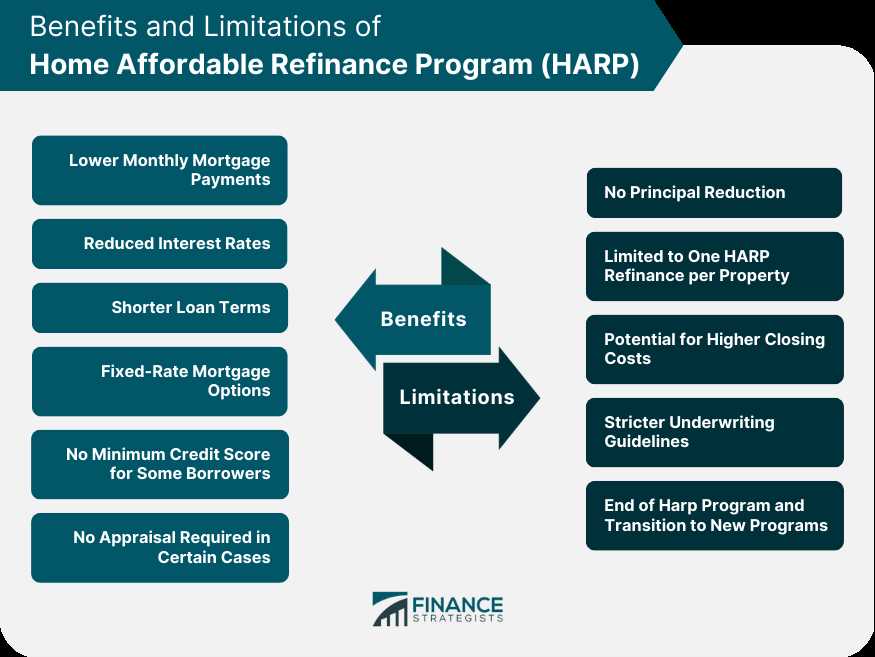

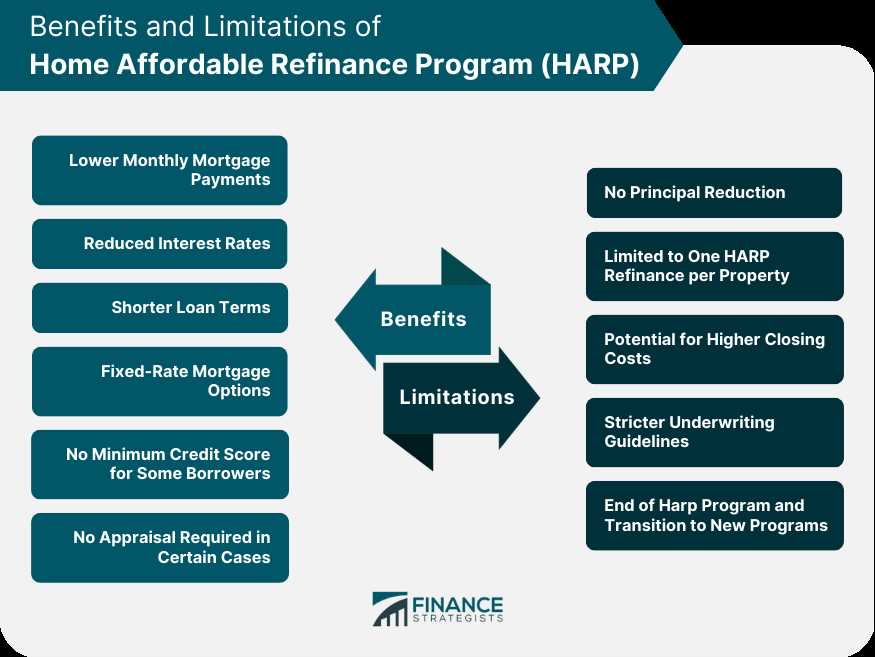

There are several benefits to participating in the Home Affordable Refinance Program:

- Lower Interest Rates: HARP allows homeowners to refinance their mortgage at a lower interest rate, which can result in significant savings over the life of the loan.

- Reduced Monthly Payments: By refinancing through HARP, homeowners may be able to lower their monthly mortgage payments, making it more affordable to stay in their homes.

- Stability and Security: HARP provides homeowners with the opportunity to stabilize their financial situation and avoid the risk of foreclosure.

It is important to note that the Home Affordable Refinance Program is set to expire on December 31, 2018. Therefore, homeowners who are eligible for HARP should take advantage of this program before it ends.

Benefits of HARP

The Home Affordable Refinance Program (HARP) offers numerous benefits for homeowners looking to refinance their mortgages. Here are some key advantages:

1. Lower Interest Rates

One of the main benefits of HARP is the opportunity to secure a lower interest rate on your mortgage. By refinancing through HARP, you may be able to reduce your monthly payments and save money in the long run.

2. No Appraisal Required

Unlike traditional refinancing options, HARP does not require a new appraisal of your home. This can save you time and money, as you won’t need to pay for an appraisal or wait for the results.

3. Flexible Underwriting Guidelines

HARP has more flexible underwriting guidelines compared to other refinancing programs. This means that even if you have a low credit score or a high loan-to-value ratio, you may still be eligible for HARP.

4. Streamlined Application Process

Applying for HARP is a straightforward and streamlined process. The program aims to make refinancing as easy as possible for homeowners, with minimal paperwork and documentation required.

5. Potential Savings on Mortgage Insurance

If you currently have private mortgage insurance (PMI) on your loan, refinancing through HARP may allow you to eliminate or reduce your PMI payments. This can result in additional savings each month.

Overall, HARP provides homeowners with the opportunity to refinance their mortgages and potentially save money. With lower interest rates, no appraisal required, flexible underwriting guidelines, a streamlined application process, and potential savings on mortgage insurance, HARP can be a valuable option for those looking to improve their financial situation.

Advantages of the Home Affordable Refinance Program

The Home Affordable Refinance Program (HARP) offers several advantages to homeowners who are struggling with their mortgage payments or who owe more on their home than it is currently worth. Here are some of the key advantages of HARP:

1. Lower Interest Rates

One of the main advantages of HARP is that it allows homeowners to refinance their mortgage at a lower interest rate. This can result in significant savings over the life of the loan and help homeowners reduce their monthly mortgage payments.

2. No Appraisal Required

Unlike traditional refinancing options, HARP does not require an appraisal of the property. This means that homeowners who have seen a decline in their home’s value may still be eligible to refinance through HARP.

3. Streamlined Application Process

HARP offers a streamlined application process, making it easier and faster for homeowners to refinance their mortgage. The program has simplified documentation requirements and may not require income verification or credit checks in some cases.

4. Extended Loan Terms

HARP allows homeowners to extend their loan terms, which can help reduce their monthly mortgage payments. This can be particularly beneficial for homeowners who are struggling to make ends meet or who need more time to pay off their mortgage.

Overall, the Home Affordable Refinance Program provides homeowners with a range of advantages, including lower interest rates, no appraisal requirements, a streamlined application process, and the option to extend loan terms. If you are a homeowner who is struggling with your mortgage payments or owe more on your home than it is currently worth, HARP may be a viable option for you.

How to Qualify for HARP

To qualify for the Home Affordable Refinance Program (HARP), there are certain eligibility requirements that you need to meet. These requirements include:

| 1. Loan Eligibility: | Your mortgage must be owned or guaranteed by Fannie Mae or Freddie Mac. You can check if your loan is owned by either of these entities by using their online tools. |

| 2. Loan-to-Value (LTV) Ratio: | Your current loan-to-value ratio must be greater than 80%. This means that you owe more on your mortgage than your home is currently worth. |

| 3. Payment History: | You must have a good payment history on your mortgage, with no late payments in the past six months and no more than one late payment in the past 12 months. |

| 4. Financial Stability: | You need to demonstrate that you have the financial ability to make the new mortgage payments. This includes providing proof of income, employment, and assets. |

| 5. Loan Origination Date: | Your mortgage must have been originated on or before May 31, 2009. This means that your loan was closed and funded by this date. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.