Growth Investing: A Comprehensive Guide to the Investing Strategy

Growth investing is a popular investment strategy that focuses on investing in companies that have the potential for above-average growth in revenue, earnings, and stock price. This strategy involves identifying companies that are expected to experience significant growth in the future and investing in their stocks.

One of the key principles of growth investing is the belief that companies with strong growth potential will outperform the broader market over the long term. Growth investors typically look for companies that are in expanding industries or have innovative products or services that can disrupt the market.

When implementing a growth investing strategy, it is important to conduct thorough research and analysis to identify companies with strong growth prospects. This involves analyzing financial statements, industry trends, competitive advantages, and management teams. Growth investors also pay close attention to factors such as revenue growth, earnings growth, and return on equity.

However, growth investing also comes with risks and challenges. One of the main risks is the potential for overvaluation. Growth stocks are often priced at a premium due to high investor expectations, which can lead to a sharp decline in stock price if the company fails to meet those expectations. Additionally, growth investing requires a long-term perspective, as it may take time for the company’s growth potential to materialize.

There are several strategies that growth investors can use to identify potential growth stocks. These include analyzing financial ratios such as price-to-earnings ratio and price-to-sales ratio, conducting industry analysis, and researching company-specific factors such as product pipeline and competitive positioning. It is important for growth investors to have a disciplined approach and to focus on companies with sustainable competitive advantages and strong growth prospects.

Growth investing is a popular investment strategy that focuses on investing in companies that have the potential for significant growth in the future. This strategy is based on the belief that these companies will continue to increase their earnings and expand their operations, leading to an increase in their stock prices.

Key Characteristics of Growth Stocks

Growth stocks are typically characterized by certain key traits that make them attractive to growth investors. These traits include:

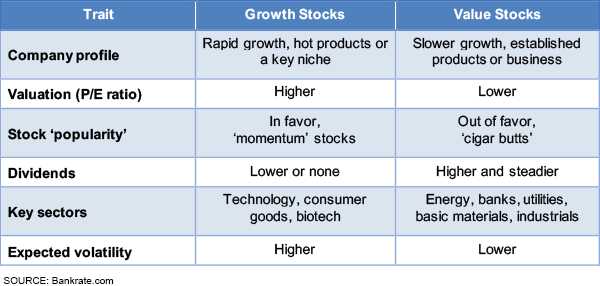

- High Price-to-Earnings (P/E) Ratio: Growth stocks often have a higher P/E ratio compared to other stocks. This is because investors are willing to pay a premium for the potential future earnings growth of these companies.

- Innovative and Disruptive: Growth stocks are often found in industries that are characterized by innovation and disruption. These companies are at the forefront of technological advancements and are constantly introducing new products or services that have the potential to revolutionize their respective industries.

Investment Approach

One common strategy used by growth investors is to invest in a diversified portfolio of growth stocks. By spreading their investments across multiple companies and industries, investors can reduce the risk associated with investing in individual stocks.

Growth investors also pay close attention to the fundamentals of the companies they invest in. They analyze factors such as revenue growth, profit margins, and competitive advantages to determine the growth potential of a company.

Benefits of Growth Investing

Growth investing is a popular strategy among investors looking to maximize their returns over the long term. This approach focuses on investing in companies that have the potential for significant growth in their earnings and stock prices. While growth investing can be more volatile than other strategies, it offers several benefits that make it an attractive option for many investors.

1. Potential for High Returns

One of the main benefits of growth investing is the potential for high returns. By investing in companies that are expected to experience rapid growth, investors have the opportunity to earn substantial profits. These companies often operate in industries that are expanding quickly or have a competitive advantage that allows them to outperform their peers. As a result, their stock prices can increase significantly over time, leading to impressive returns for growth investors.

2. Long-Term Wealth Creation

3. Diversification Opportunities

4. Access to Innovative Companies

5. Flexibility and Adaptability

| Benefits of Growth Investing |

|---|

| Potential for High Returns |

| Long-Term Wealth Creation |

| Diversification Opportunities |

| Access to Innovative Companies |

| Flexibility and Adaptability |

Strategies for Identifying Growth Stocks

2. Industry Analysis:

3. Top-Down Approach:

A top-down approach involves starting with a macroeconomic analysis and then narrowing down to specific companies. Consider factors such as economic trends, government policies, and demographic shifts that could impact certain industries. Once you identify promising industries, you can then focus on finding individual growth stocks within those industries.

4. Bottom-Up Approach:

In contrast to the top-down approach, the bottom-up approach involves focusing on individual companies rather than macroeconomic factors. This strategy involves researching and analyzing specific companies to determine their growth potential. Look for companies with innovative products or services, strong management teams, and a track record of consistent growth.

While fundamental analysis focuses on a company’s financials, technical analysis involves studying stock price patterns and trends. This strategy uses charts, indicators, and other tools to identify potential buying or selling opportunities. Technical analysis can be particularly useful for short-term traders looking to capitalize on short-term price movements.

6. Diversification:

Risks and Challenges of Growth Investing

Growth investing can be a lucrative strategy, but it is not without its risks and challenges. Investors who choose to pursue this strategy must be aware of the potential pitfalls and be prepared to navigate them effectively. Here are some of the key risks and challenges associated with growth investing:

1. Volatility

Growth stocks are often more volatile than other types of investments. Their prices can fluctuate significantly in response to market conditions, economic factors, or company-specific news. This volatility can lead to rapid and substantial gains, but it can also result in significant losses. Investors must be prepared for the ups and downs that come with investing in growth stocks.

2. Valuation

One of the challenges of growth investing is determining the appropriate valuation for a growth stock. Since growth stocks tend to have high price-to-earnings ratios, it can be difficult to determine whether a stock is overvalued or undervalued. Investors must carefully analyze a company’s financials and growth prospects to make an informed decision about its valuation.

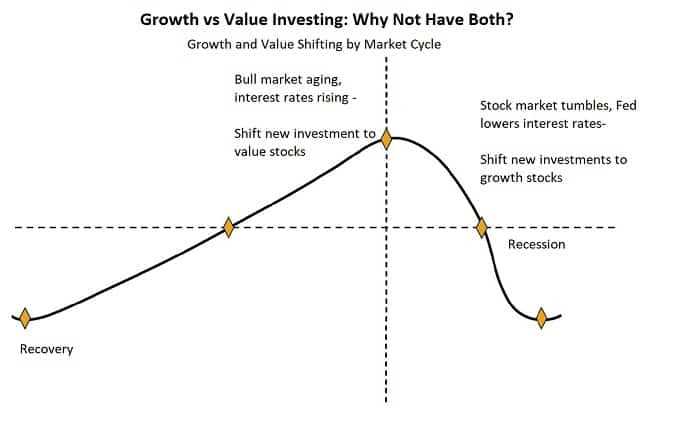

3. Market Timing

Timing the market is always a challenge, but it can be especially difficult for growth investors. Since growth stocks are often priced based on their future potential, investors must be able to accurately predict when a company’s growth will be reflected in its stock price. Making the wrong timing decisions can result in missed opportunities or losses.

4. Concentration Risk

Growth investors often focus their portfolios on a few select stocks that they believe have significant growth potential. While this concentrated approach can lead to substantial gains, it also exposes investors to concentration risk. If one or more of the selected stocks underperform or experience setbacks, the entire portfolio can be negatively impacted.

5. Information Asymmetry

Tips for Successful Growth Investing

1. Do your research:

Before investing in any growth stock, it is important to thoroughly research the company. Look at their financial statements, industry trends, and competitive landscape. Understand the company’s growth potential and evaluate whether it aligns with your investment goals.

2. Diversify your portfolio:

While growth stocks can offer significant returns, they also come with higher risks. To mitigate these risks, it is important to diversify your portfolio. Invest in a mix of growth stocks from different industries and sectors to spread out your risk.

3. Focus on long-term growth:

Growth investing is not a short-term strategy. It requires patience and a focus on long-term growth potential. Look for companies that have a strong track record of consistent growth and a clear plan for future expansion.

4. Monitor your investments:

Once you have invested in growth stocks, it is important to regularly monitor your investments. Keep track of any news or developments that may impact the company’s growth prospects. Stay informed and be prepared to make adjustments to your portfolio if necessary.

5. Set realistic expectations:

While growth stocks can offer significant returns, it is important to set realistic expectations. Not every investment will be a home run, and there will be ups and downs along the way. Be prepared for volatility and understand that growth investing is a long-term strategy.

6. Consider professional advice:

If you are new to growth investing or feel overwhelmed by the research and analysis involved, consider seeking professional advice. A financial advisor or investment professional can provide guidance and help you make informed decisions.

7. Stay disciplined:

Lastly, it is important to stay disciplined and stick to your investment strategy. Avoid making impulsive decisions based on short-term market fluctuations. Stick to your long-term goals and remain focused on the fundamentals of growth investing.

By following these tips, investors can increase their chances of success in growth investing. Remember, it is important to do your own research and make informed decisions based on your individual investment goals and risk tolerance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.