What is Form 6251?

Form 6251 is a tax form used by individuals to calculate and determine their Alternative Minimum Tax (AMT) liability. The Alternative Minimum Tax is a separate tax system designed to ensure that individuals who benefit from certain tax deductions and credits still pay a minimum amount of tax.

The AMT was introduced in 1969 to prevent high-income individuals from using various tax deductions and credits to significantly reduce their tax liability. It is intended to ensure that everyone pays their fair share of taxes, regardless of the deductions and credits they may be eligible for.

Who needs to file Form 6251?

Not everyone is required to file Form 6251. Individuals who meet certain criteria must use this form to calculate their AMT liability. You may need to file Form 6251 if:

- You have high income

- You have large amounts of certain types of deductions

- You have exercised incentive stock options

- You have certain types of tax-exempt interest

If you are unsure whether you need to file Form 6251, it is recommended to consult a tax professional or use tax software that can help you determine your AMT liability.

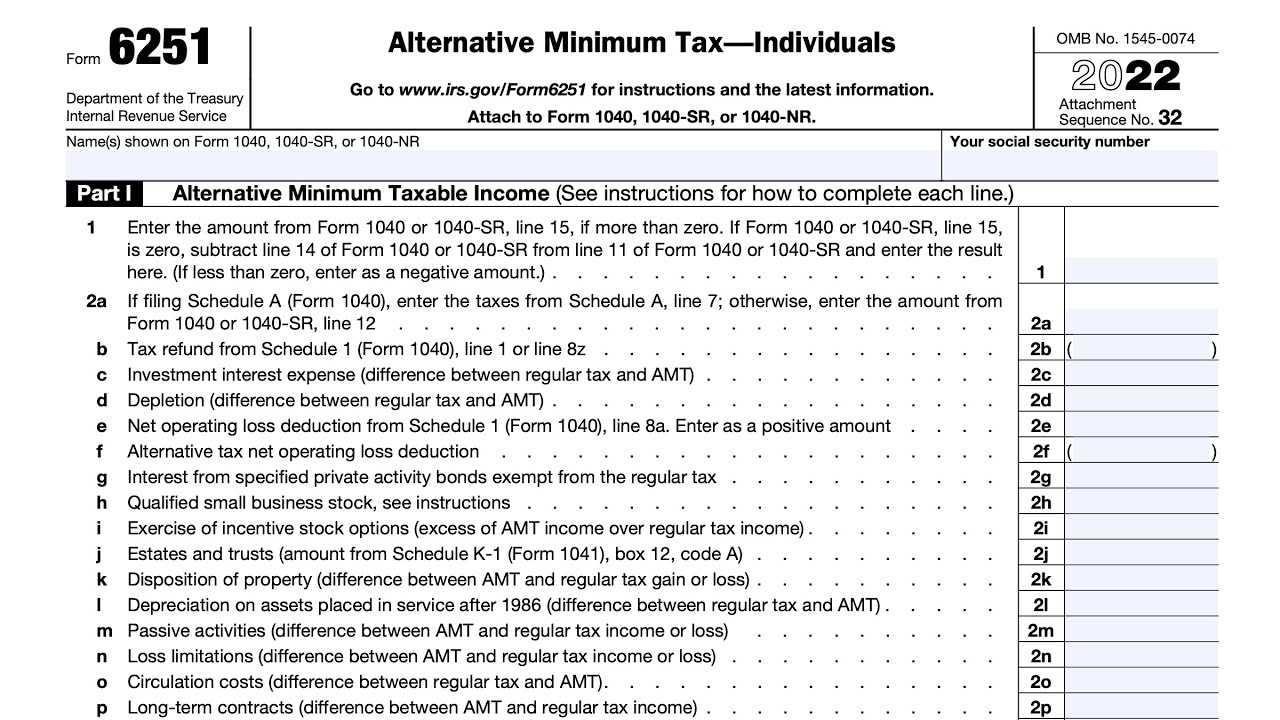

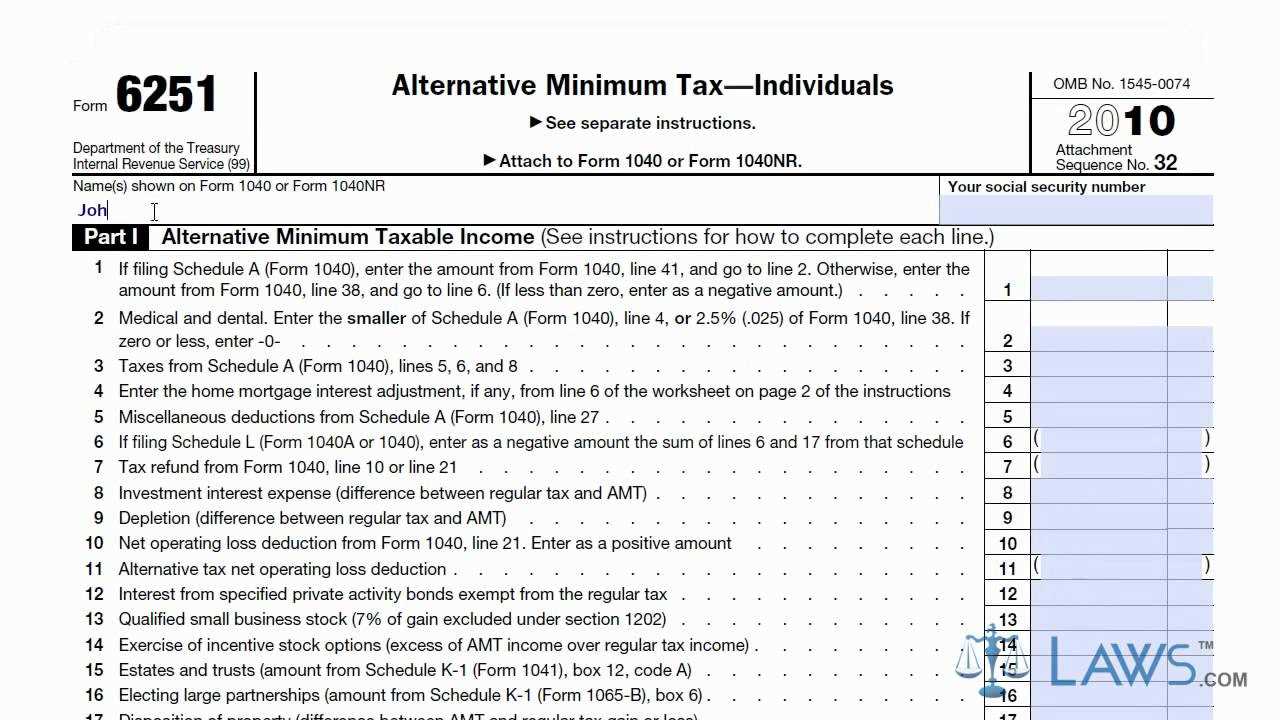

How to fill out Form 6251?

Filling out Form 6251 can be complex, as it requires detailed calculations and the inclusion of various tax-related information. The form consists of several sections, including:

- Identification information

- AMT income and adjustments

- AMT exemptions

- AMT taxable income

- AMT calculation and comparison

It is important to carefully review the instructions provided with the form to ensure accurate completion. Additionally, using tax software or consulting a tax professional can help simplify the process and ensure accurate calculations.

Once the form is completed, it should be attached to your regular income tax return (Form 1040) and filed with the IRS.

Note: The information provided here is for general informational purposes only and should not be considered as tax advice. It is recommended to consult a qualified tax professional for personalized guidance regarding your specific tax situation.

Calculating and Filing Form 6251

Calculating Form 6251 can be a complex process, as it involves comparing your regular tax liability with your AMT liability. To begin, you will need to gather all the necessary information, including your income, deductions, and credits. It is important to note that certain deductions and credits that are allowed under the regular tax system may be disallowed or limited under the AMT system.

Once you have gathered all the necessary information, you can start filling out Form 6251. The form consists of several sections, each requiring specific information. It is important to carefully read the instructions provided by the IRS to ensure that you are correctly filling out each section.

One of the key calculations on Form 6251 is the Alternative Minimum Taxable Income (AMTI). This calculation involves making adjustments to your regular taxable income, such as adding back certain deductions and exemptions. The result is your AMTI, which is then used to determine your AMT liability.

After calculating your AMTI, you will need to determine your AMT liability by applying the appropriate tax rates. The AMT rates are generally lower than the regular tax rates, but the AMT system eliminates many deductions and exemptions, which can result in a higher tax liability for some individuals.

Once you have calculated your AMT liability, you will compare it to your regular tax liability. If your AMT liability is higher, you will need to pay the difference as an additional tax. However, if your regular tax liability is higher, you will not owe any additional tax under the AMT system.

After completing all the necessary calculations, you can file Form 6251 along with your regular tax return. It is important to keep a copy of the form for your records and to follow the IRS guidelines for filing and payment deadlines.

Filing Form 6251 can be a complex process, and it is recommended that you seek the assistance of a tax professional or use tax software to ensure accuracy. The IRS also provides resources and guidance on their website to help individuals understand and complete Form 6251.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.