What is Form 1099-R?

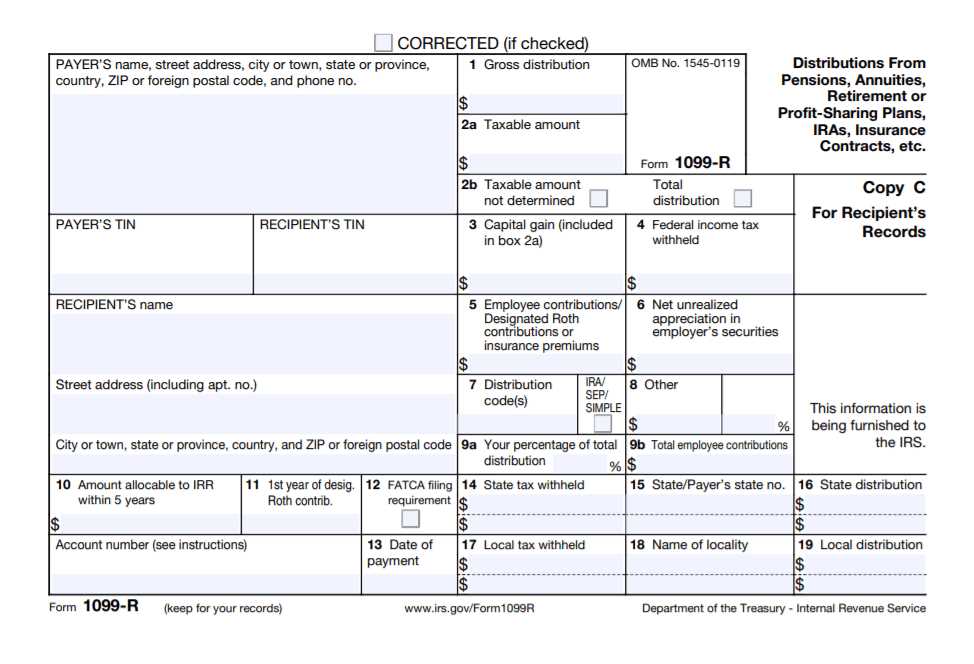

Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement plans, profit-sharing plans, IRAs, and other similar accounts. It is issued by the payer of the distribution to the recipient, as well as to the IRS.

When you receive a distribution from any of these accounts, the payer is required to report the amount on Form 1099-R. This form provides important information to both the recipient and the IRS for tax purposes.

Form 1099-R is essential for accurately reporting your income and ensuring that you meet your tax obligations. It helps the IRS track distributions from retirement accounts and ensures that the appropriate taxes are paid.

It is important to note that not all distributions from retirement accounts are taxable. Some may be considered non-taxable, such as certain distributions from Roth IRAs or qualified distributions from designated Roth accounts.

When you receive Form 1099-R, it is crucial to review it carefully and ensure that the information is accurate. If you believe there is an error on the form, you should contact the payer to request a corrected form.

Overall, Form 1099-R plays a vital role in the tax reporting process for individuals who receive distributions from retirement accounts. It helps ensure that the appropriate taxes are paid and that accurate records are maintained for both the recipient and the IRS.

Who Should File Form 1099-R?

Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement plans, and other similar accounts. It is important to understand who should file this form to ensure compliance with tax regulations.

1. Payers: Any person or organization that makes a distribution of $10 or more from a retirement account or pension plan must file Form 1099-R. This includes financial institutions, employers, and government agencies.

2. Recipients: If you received a distribution from a retirement account or pension plan, you may also need to file Form 1099-R. This applies to individuals who received a distribution of $10 or more during the tax year.

3. Exceptions: There are certain exceptions to filing Form 1099-R. For example, if the distribution is a return of contributions and there are no earnings, or if the distribution is a direct rollover to another qualified plan, then Form 1099-R may not be required.

4. Additional Reporting: In some cases, additional reporting may be required along with Form 1099-R. For example, if the distribution is subject to withholding, the payer must also report the amount of withholding on Form 1099-R.

It is important to consult with a tax professional or refer to the IRS guidelines to determine if you are required to file Form 1099-R. Failing to file this form when required can result in penalties and interest charges.

How to Fill Out Form 1099-R?

Filling out Form 1099-R is an important step in reporting distributions from pensions, annuities, retirement plans, and other similar sources. Here is a step-by-step guide on how to fill out this form correctly:

Step 1: Start by entering your personal information, including your name, address, and Social Security number, in the designated boxes at the top of the form.

Step 2: Identify the payer by entering their name, address, and identification number in the appropriate boxes. This information should be provided to you by the payer.

Step 3: Provide a brief description of the type of retirement plan or distribution in Box 7. This could include information such as IRA, 401(k), or pension plan.

Step 4: Enter the distribution amount in Box 1. This should include the total amount of money you received from the retirement plan or annuity during the tax year.

Step 5: If any federal income tax was withheld from the distribution, enter the amount in Box 4. This information can usually be found on the Form 1099-R you received from the payer.

Step 6: If you are under the age of 59 ½ and received an early distribution, you may be subject to an additional 10% tax. Indicate whether this applies to you by checking the appropriate box in Box 2.

Step 7: If the distribution is from a Roth IRA conversion, check the box in Box 5. This indicates that the distribution is a qualified distribution and may be tax-free.

Step 8: Complete any other applicable boxes on the form, such as Box 13 if the distribution is from a governmental or tax-exempt organization.

Step 9: Review the completed form for accuracy and make sure all necessary information has been provided. Sign and date the form before submitting it to the IRS.

By following these steps and accurately filling out Form 1099-R, you can ensure that your retirement plan distributions are properly reported to the IRS and avoid any potential tax issues or penalties.

Important Considerations for Form 1099-R

When filling out Form 1099-R, there are several important considerations to keep in mind. This form is used to report distributions from pensions, annuities, retirement plans, and other similar accounts. Here are some key points to consider:

1. Correctly Identifying the Recipient

It is crucial to accurately identify the recipient of the distribution. This includes providing their full name, address, and taxpayer identification number (TIN). Failure to provide correct information may result in penalties or delays in processing the form.

2. Reporting the Correct Distribution Amount

When reporting the distribution amount, it is important to ensure accuracy. The taxable amount should be reported in Box 2a, while any federal income tax withheld should be reported in Box 4. Double-checking the numbers can help avoid errors and potential issues with the IRS.

Form 1099-R includes distribution codes that provide information about the nature of the distribution. It is essential to understand these codes and select the appropriate one for each distribution. The codes range from early distributions to rollovers and conversions.

4. Reporting Correctly for Different Types of Accounts

5. Timely Filing and Furnishing of Forms

Form 1099-R must be filed with the IRS by the end of February, following the year of the distribution. Additionally, a copy of the form must be furnished to the recipient by the same deadline. Failing to meet these deadlines may result in penalties.

| Box Number | Description |

|---|---|

| Box 1 | Total distribution |

| Box 2a | Taxable amount |

| Box 4 | Federal income tax withheld |

| Box 7 | Distribution codes |

Overall, it is crucial to carefully review and understand the instructions for Form 1099-R to ensure accurate and timely reporting. Consulting with a tax professional can also be beneficial in navigating the complexities of this form.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.