Form 1095-A Definition and Filing Requirements

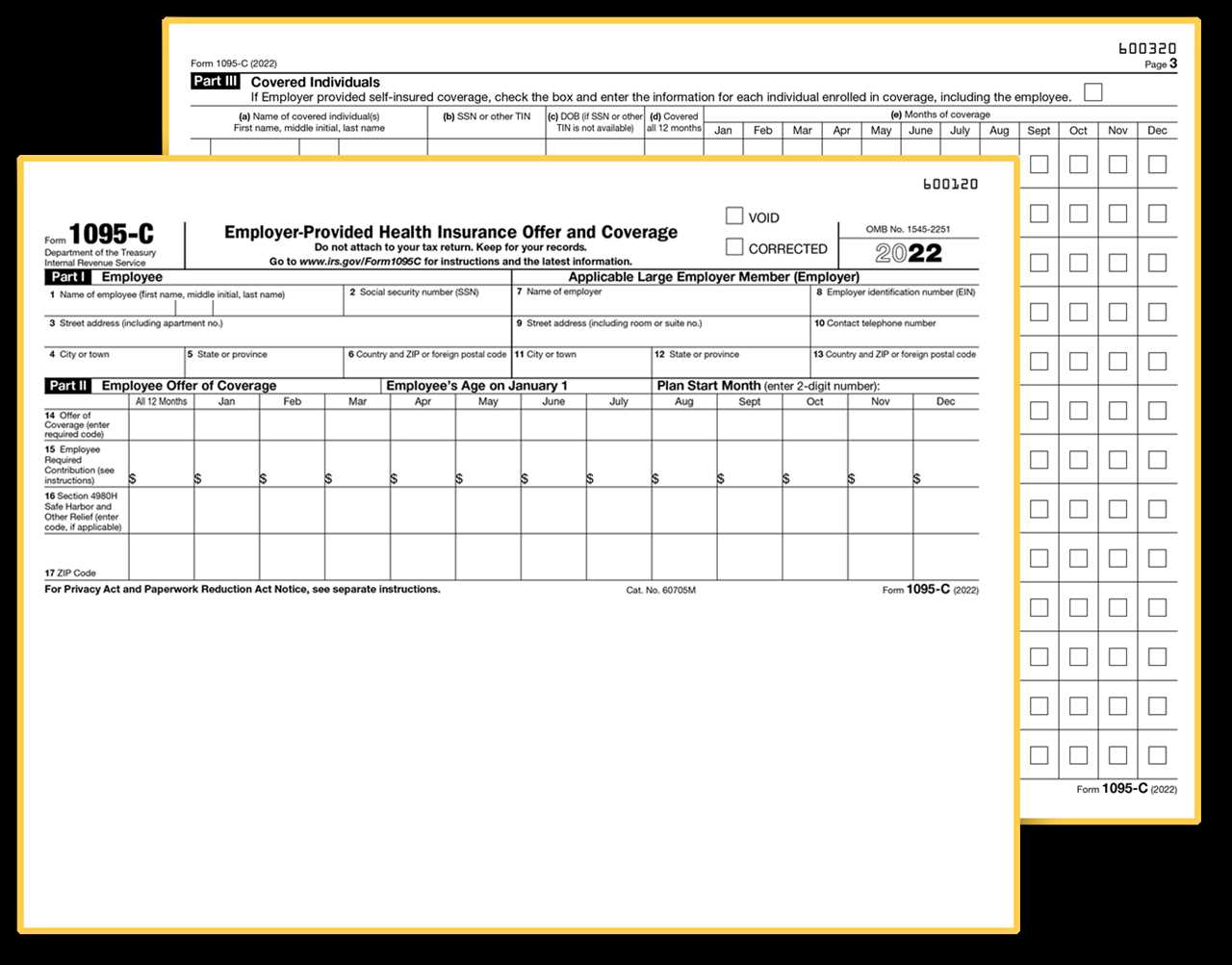

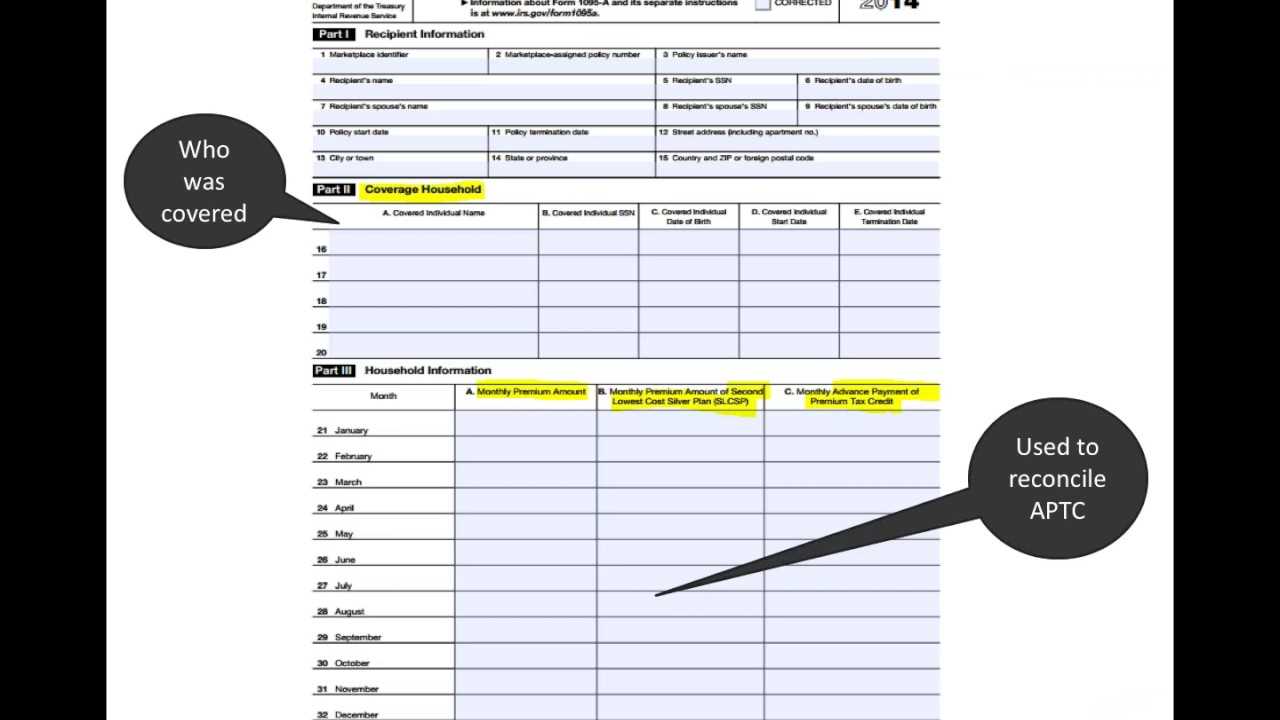

Form 1095-A is an important document that taxpayers need to be aware of when filing their taxes. This form is used to report information about the health insurance coverage obtained through the Health Insurance Marketplace. It provides details about the coverage, including the premium amount, the amount of any advance premium tax credit received, and the coverage start and end dates.

Why is Form 1095-A important?

Form 1095-A is important because it helps determine if individuals are eligible for the premium tax credit, which is a tax subsidy provided to help lower-income individuals and families afford health insurance coverage. The information on this form is used to reconcile the advance premium tax credit that individuals may have received throughout the year with the actual premium tax credit they are eligible for based on their income.

Additionally, Form 1095-A is needed to complete Form 8962, which is used to calculate the premium tax credit. Without this form, individuals may not be able to accurately calculate their tax liability or claim the premium tax credit they are entitled to.

Filing Requirements for Form 1095-A

Individuals who received Form 1095-A must include it when filing their federal income tax return. It is important to review the information on the form for accuracy and make any necessary corrections before filing. If any changes need to be made, individuals should contact the Marketplace to update their information.

If individuals received advance payments of the premium tax credit, they will need to file Form 8962 along with their tax return. This form is used to reconcile the advance payments with the actual premium tax credit they are eligible for.

It is important to note that individuals who did not receive Form 1095-A are still required to report their health insurance coverage on their tax return. They can do this by checking a box on their tax return indicating that they had coverage for the entire year or by reporting any exemptions they may qualify for.

Form 1095-A is an important document that individuals who purchased health insurance through the Health Insurance Marketplace need to understand. This form provides information about the coverage they had during the year and is necessary for filing their taxes.

What is Form 1095-A?

It is important to note that Form 1095-A is not sent directly to the Internal Revenue Service (IRS), but rather to the individuals who purchased the insurance. Individuals must use the information on this form to complete Form 8962, which is used to reconcile any advance premium tax credits they received with the actual premium tax credit they are eligible for.

Why is Form 1095-A important?

Form 1095-A is important because it is used to determine if individuals received the correct amount of premium tax credits throughout the year. These tax credits are based on the individual’s income and the cost of the insurance plan they purchased. If the advance premium tax credits were too high, individuals may owe money when they file their taxes. On the other hand, if the credits were too low, individuals may be eligible for a refund.

Additionally, Form 1095-A is used to verify that individuals had qualifying health coverage during the year. Under the Affordable Care Act, individuals are required to have health insurance or pay a penalty. By providing details about the coverage, Form 1095-A helps individuals demonstrate that they had the necessary coverage and avoid any penalties.

It is important for individuals to carefully review Form 1095-A and ensure that all the information is accurate. If there are any discrepancies, individuals should contact the Marketplace immediately to correct the information. Failing to report accurate information from Form 1095-A can result in errors on the tax return and potential penalties from the IRS.

How to Obtain Form 1095-A and File Your Taxes

Form 1095-A is an important document that you need to file your taxes if you have received premium tax credits or enrolled in a qualified health plan through the Health Insurance Marketplace. Here are the steps to obtain Form 1095-A and file your taxes:

Step 1: Check your mailbox or online account

Form 1095-A is typically sent to you by mail or made available in your online account. Check your mailbox for a physical copy or log in to your Health Insurance Marketplace account to access the form electronically.

Step 2: Review the information on Form 1095-A

Once you have obtained Form 1095-A, carefully review the information provided. This form includes details about your coverage, premium amounts, and any advance premium tax credits you may have received.

Step 3: Correct any errors

If you notice any errors on Form 1095-A, such as incorrect coverage dates or premium amounts, contact the Health Insurance Marketplace immediately to have the form corrected. It is crucial to ensure the accuracy of this form before filing your taxes.

Step 4: Use Form 1095-A to complete your tax return

When filing your taxes, you will need to use the information from Form 1095-A to complete Form 8962, which calculates your premium tax credit. Include Form 8962 with your tax return to reconcile any advance premium tax credits you received with the actual amount you are eligible for.

Step 5: File your taxes on time

By following these steps, you can obtain Form 1095-A and accurately file your taxes. It is essential to ensure the accuracy of this form and report any changes or discrepancies to the Health Insurance Marketplace to avoid any issues with your tax return.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.