What is Form 1045 Application for Tentative Refund?

Form 1045 Application for Tentative Refund is a tax form used by individuals and businesses to claim a refund of overpaid taxes or to carry back a net operating loss (NOL) to a previous tax year. It is filed with the Internal Revenue Service (IRS) and can be used to claim various types of credits and deductions.

When taxpayers realize that they have overpaid their taxes or have incurred a net operating loss, they can use Form 1045 to request a refund or to apply the loss to a previous tax year in order to reduce their tax liability for that year. This can help taxpayers recoup some of their overpaid taxes or offset the loss against previous income, resulting in a lower tax bill.

Form 1045 is especially beneficial for individuals and businesses that have experienced a significant change in their financial situation, such as a large loss or a substantial decrease in income. By filing this form, taxpayers can potentially receive a refund more quickly than if they were to wait until the end of the tax year to claim the refund on their annual tax return.

It is important to note that Form 1045 is not a standalone tax return, but rather an application for a refund or to carry back a net operating loss. Taxpayers must still file their regular tax return for the applicable tax year in order to report their income and claim any other deductions or credits they may be eligible for.

Form 1045 Application for Tentative Refund is an important document used by taxpayers to claim a refund for certain tax credits and deductions. It is specifically designed for individuals, estates, and trusts who have experienced a net operating loss (NOL) or have unused credits that can be carried back or carried forward to other tax years.

Purpose of Form 1045

The main purpose of Form 1045 is to provide taxpayers with a way to recoup some of their losses or unused credits in a more timely manner. Instead of waiting until the end of the tax year to claim these benefits on their annual tax return, taxpayers can file Form 1045 to request a tentative refund. This allows them to receive the refund sooner, providing much-needed financial relief.

Benefits of Form 1045

There are several benefits to filing Form 1045:

- Timely Refunds: By filing Form 1045, taxpayers can receive a refund for their NOL or unused credits sooner than if they were to wait until the end of the tax year.

- Financial Relief: For individuals, estates, and trusts facing financial difficulties, receiving a refund through Form 1045 can provide immediate relief and help alleviate some of the financial burden.

- Maximizing Tax Benefits: Filing Form 1045 allows taxpayers to maximize their tax benefits by carrying back or carrying forward their NOL or unused credits to offset taxable income in other tax years. This can result in significant tax savings.

- Reducing Future Tax Liability: By carrying forward unused credits, taxpayers can reduce their future tax liability, potentially resulting in lower tax payments in the future.

Overall, Form 1045 is a valuable tool for taxpayers who have experienced losses or have unused credits. It provides a way to claim refunds in a more timely manner and offers various benefits, including financial relief and tax savings. It is important for eligible taxpayers to understand the purpose and benefits of Form 1045 and consider filing it if they meet the eligibility criteria.

Eligibility Criteria for Filing Form 1045

Here are the eligibility criteria for filing Form 1045:

| Criteria | Description |

|---|---|

| 1. Net Operating Loss (NOL) | You must have a net operating loss for the current tax year or a carryback year. A net operating loss occurs when your allowable deductions exceed your taxable income. |

| 2. Alternative Minimum Tax (AMT) Credit | You must have an unused AMT credit from a previous tax year that you want to apply to the current tax year. |

| 3. General Business Credit | You must have an unused general business credit from a previous tax year that you want to apply to the current tax year. |

| 4. Capital Loss Carryback | You must have a capital loss that you want to carry back to a previous tax year in order to offset capital gains and reduce your tax liability. |

| 5. Section 1256 Contracts and Straddles | You must have losses from section 1256 contracts or straddles that you want to carry back to a previous tax year. |

If you meet any of the above criteria, you may be eligible to file Form 1045 and claim a refund for the applicable tax credits or deductions. It is important to carefully review the instructions for Form 1045 and consult with a tax professional to ensure that you meet all the necessary requirements before filing.

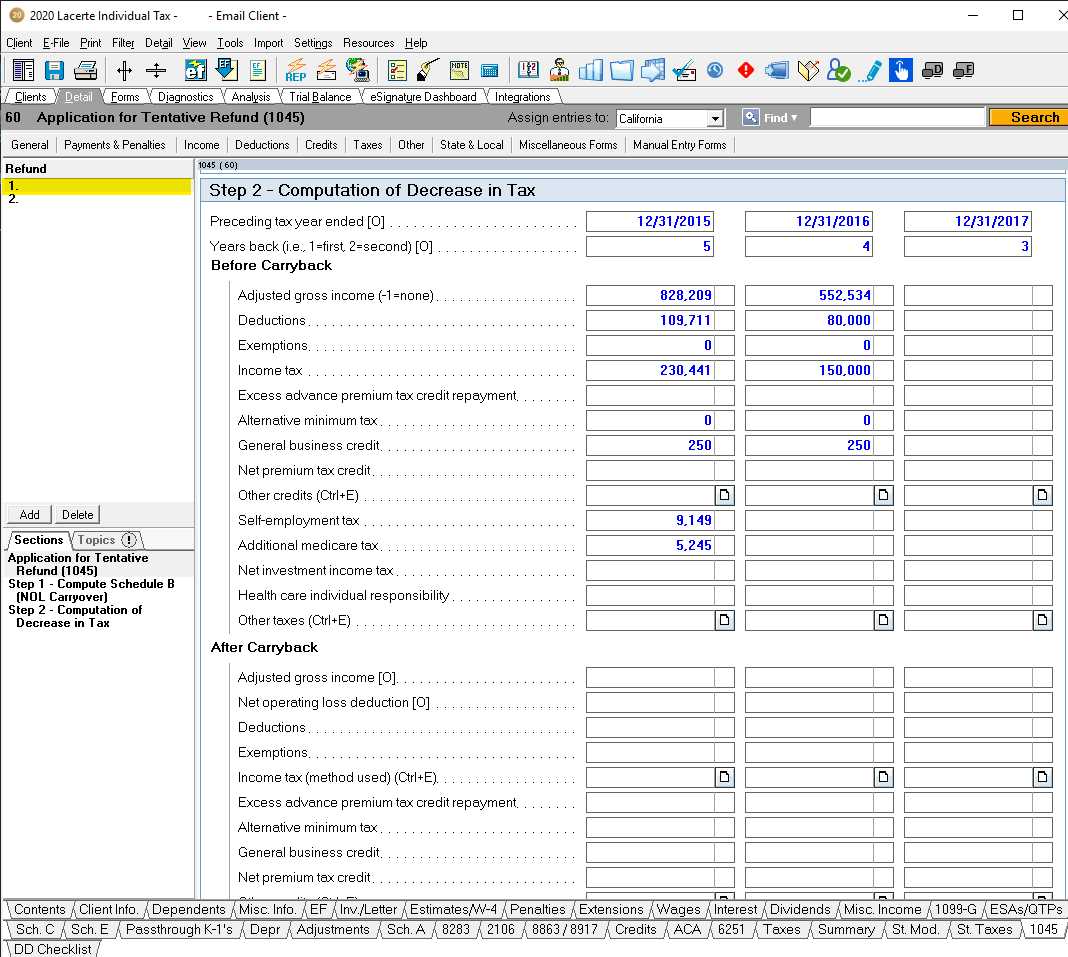

How to Fill Out Form 1045

Filling out Form 1045 Application for Tentative Refund can seem overwhelming at first, but with careful attention to detail, it can be completed accurately. Here is a step-by-step guide on how to fill out the form:

Step 1: Provide Basic Information

Start by entering your name, address, and Social Security number at the top of the form. If you are filing jointly, include your spouse’s information as well.

Step 2: Choose the Appropriate Tax Year

Indicate the tax year for which you are claiming a refund. Ensure that the tax year matches the one for which you are filing your tax return.

Step 3: Calculate Your Tentative Refund

If you are claiming a net operating loss deduction, fill out Part I of the form. This section requires you to provide details about your business or trade, including income and expenses.

If you are claiming an AMT credit, fill out Part II of the form. This section requires you to provide information about any AMT paid in previous years and any adjustments or preferences that may affect your AMT credit.

Step 7: Calculate Your Tentative Refund

Once you have completed all the relevant sections, calculate your tentative refund by adding up the amounts from Parts I, II, and III. This will give you the total amount of your tentative refund.

Step 8: Sign and Date the Form

Finally, sign and date the form to certify that the information provided is accurate and complete.

Remember to review your completed form carefully before submitting it to the IRS. Any errors or omissions could delay the processing of your refund. It may also be helpful to consult with a tax professional or refer to the instructions provided by the IRS for additional guidance.

| Form 1045 | Application for Tentative Refund |

|---|---|

| Part I | Net Operating Loss Deduction |

| Part II | Alternative Minimum Tax (AMT) Credit |

| Part III | Other Credits and Payments |

Important Considerations and Tips for Filing Form 1045

When filing Form 1045 Application for Tentative Refund, there are several important considerations and tips to keep in mind. These can help ensure that the process goes smoothly and increase the chances of receiving a refund.

1. Understand the Purpose and Requirements

Before filling out Form 1045, it is crucial to understand its purpose and eligibility criteria. The form is used to claim a refund for certain tax credits or net operating losses. Make sure you meet the requirements and have all the necessary documentation before proceeding.

2. Double-Check Accuracy

Accuracy is key when filling out Form 1045. Make sure to double-check all the information provided, including your personal details, income, deductions, and credits. Any errors or omissions can delay the processing of your refund or even result in a denial.

3. Attach Supporting Documents

When filing Form 1045, it is essential to attach any supporting documents required by the IRS. These may include copies of your tax returns, schedules, and other relevant forms. Failing to include the necessary documentation can lead to delays or rejection of your refund claim.

4. Seek Professional Assistance

If you are unsure about how to fill out Form 1045 or have complex tax situations, it is advisable to seek professional assistance. Tax professionals, such as accountants or tax attorneys, can provide guidance and ensure that your refund claim is accurate and complete.

5. File within the Applicable Timeframe

Form 1045 must be filed within the applicable timeframe to be eligible for a refund. Generally, it should be filed within one year after the end of the tax year in which the loss or credit occurred. Failing to meet the deadline can result in the loss of your refund eligibility.

6. Keep Copies and Track Progress

It is important to keep copies of all documents related to Form 1045 and to track the progress of your refund claim. This includes keeping copies of the filed form, supporting documents, and any correspondence with the IRS. Tracking the progress can help you stay informed and address any issues that may arise.

By following these important considerations and tips, you can navigate the process of filing Form 1045 Application for Tentative Refund more effectively. Remember to consult the IRS instructions or seek professional advice if you have any doubts or questions along the way.

What to Expect After Submitting Form 1045

After submitting Form 1045 Application for Tentative Refund, there are a few things you can expect:

1. Confirmation of Receipt

Once you submit your Form 1045, you should receive a confirmation of receipt from the Internal Revenue Service (IRS). This confirmation will serve as proof that your form has been received and is being processed.

2. Processing Time

3. Additional Documentation Requests

In some cases, the IRS may request additional documentation or information to support your claim for a refund. If this happens, it is important to provide the requested documents promptly to avoid any delays in the processing of your refund.

4. Refund or Adjustment

Once the IRS has reviewed your Form 1045 and any supporting documentation, they will make a determination on your refund or adjustment. If your claim is approved, you will receive a refund of the overpaid taxes or a credit towards future tax liabilities. If your claim is denied, the IRS will provide an explanation for the denial.

5. Appeals Process

If your claim for a refund is denied, you have the right to appeal the decision. The IRS will provide instructions on how to initiate the appeals process and what steps you need to take. It is important to follow these instructions carefully and provide any additional documentation or information requested during the appeals process.

Overall, after submitting Form 1045, it is important to keep track of any correspondence from the IRS and respond promptly to any requests for additional information. By doing so, you can ensure that your claim for a refund is processed efficiently and accurately.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.