What is Forfaiting and How Does it Work?

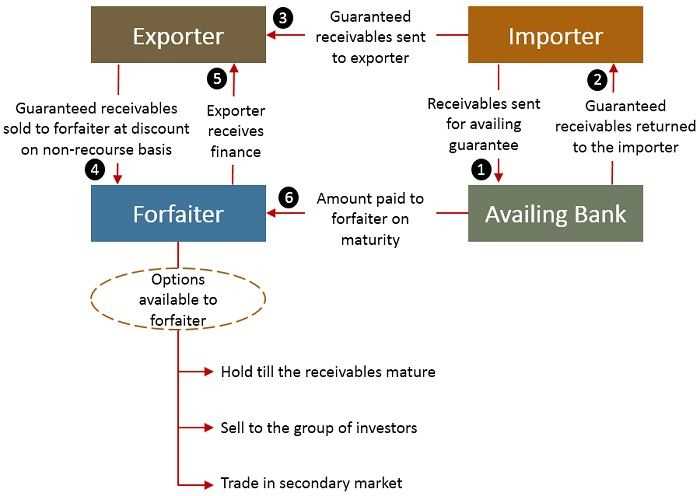

Forfaiting is a financial technique used in international trade to provide exporters with immediate cash flow by selling their receivables to a forfaiter. It is a form of trade finance that allows exporters to mitigate the risk of non-payment and obtain financing without relying on the creditworthiness of the importer.

When an exporter enters into a forfaiting agreement, they sell their trade receivables, typically in the form of promissory notes or bills of exchange, to a forfaiter at a discount. The forfaiter, usually a bank or a specialized financial institution, assumes the risk of non-payment and provides the exporter with a lump sum payment, usually in the form of a discounted cash payment.

The forfaiter then holds the receivables until their maturity date, at which point they collect the full amount from the importer. The exporter is relieved of the risk of non-payment and can use the immediate cash flow to finance their operations, invest in new projects, or expand their business.

The Process of Forfaiting

The process of forfaiting involves several steps:

- The exporter and the importer agree on the terms of the trade transaction, including the payment terms.

- The exporter prepares the necessary trade documents, such as invoices, bills of lading, and promissory notes.

- The exporter approaches a forfaiter and negotiates the terms of the forfaiting agreement, including the discount rate and the maturity date.

- The exporter sells the trade receivables to the forfaiter at a discount.

- The forfaiter provides the exporter with a lump sum payment.

- The forfaiter holds the receivables until their maturity date and collects the full amount from the importer.

Overall, forfaiting is a beneficial financing option for exporters as it allows them to receive immediate cash flow, reduce credit risk, and avoid the administrative burden of collecting payments. It is also advantageous for importers as it provides them with flexible payment terms and allows them to obtain goods and services without immediate payment.

Definition and Process of Forfaiting in International Markets

Forfaiting is a financial technique used in international trade to provide financing for exporters and importers. It involves the sale of medium to long-term receivables, typically in the form of promissory notes or bills of exchange, to a forfaiter at a discount. The forfaiter, who is usually a financial institution or a specialized forfaiting company, takes on the risk of non-payment by the importer and provides immediate cash to the exporter.

The process of forfaiting begins when the exporter and importer agree on the terms of the trade transaction, including the payment terms. Once the terms are agreed upon, the exporter prepares the necessary documentation, such as promissory notes or bills of exchange, which represent the future payment obligations of the importer.

If the exporter accepts the discount rate, they sell the receivables to the forfaiter. The forfaiter pays the exporter the discounted amount upfront, providing immediate cash flow. The forfaiter then assumes the risk of non-payment by the importer and becomes the legal owner of the receivables.

Once the receivables mature, the forfaiter collects the payment from the importer. If the payment is made on time, the forfaiter earns a profit equal to the difference between the discounted amount paid to the exporter and the full amount received from the importer. If the payment is not made, the forfaiter bears the loss and takes appropriate legal action to recover the funds.

In summary, forfaiting is a process where exporters sell their medium to long-term receivables to forfaiters at a discount, providing immediate cash flow and transferring the risk of non-payment to the forfaiter. It is a popular financing option in international trade, especially for exporters dealing with buyers in high-risk countries or those seeking to optimize their cash flow.

Pros of Forfaiting in International Trade

Forfaiting offers several advantages for exporters and importers engaged in international trade. These benefits make it an attractive financing option for businesses involved in cross-border transactions:

1. Risk Mitigation:

Forfaiting helps mitigate the risk of non-payment by transferring it to the forfaiter. Exporters can sell their receivables to a forfaiter, eliminating the risk of default by the importer. This allows exporters to focus on their core business activities without worrying about payment delays or non-payment.

2. Cash Flow Improvement:

Forfaiting provides immediate cash flow to exporters by converting their credit sales into cash. Instead of waiting for the importer to make the payment, exporters can receive the full amount upfront from the forfaiter. This improves their liquidity and allows them to fund their operations or invest in new projects.

By offering favorable payment terms to importers, exporters can gain a competitive advantage in the international market. Forfaiting allows exporters to offer longer credit periods without affecting their own cash flow. This can attract more customers and help expand their market share.

4. Simplified Financing:

Forfaiting provides a straightforward financing solution without the need for complex documentation or collateral. Exporters can easily sell their receivables to a forfaiter and receive immediate payment. This simplifies the financing process and reduces administrative burdens for exporters.

5. Currency Risk Management:

Forfaiting allows exporters to eliminate the risk of currency fluctuations by receiving payment in their preferred currency. The forfaiter takes on the responsibility of dealing with foreign exchange risks, providing exporters with stability and predictability in their cash flows.

6. Access to New Markets:

Forfaiting can help exporters enter new markets by providing them with the necessary financing to support their international expansion. By offering attractive payment terms, exporters can attract buyers from different countries and increase their global presence.

Advantages and Benefits of Forfaiting for Exporters and Importers

Forfaiting is a popular financing option in international trade that offers several advantages and benefits for both exporters and importers. Here are some of the key advantages of forfaiting:

1. Risk Mitigation

Forfaiting allows exporters to transfer the risk of non-payment to a forfaiter, reducing their exposure to credit risk. This is particularly beneficial for exporters dealing with buyers in high-risk countries or those with limited access to financing options.

2. Cash Flow Improvement

By forfaiting their receivables, exporters can receive immediate cash payment for their goods or services, improving their cash flow. This can help them meet their working capital needs, invest in new projects, or expand their business.

3. Enhanced Liquidity

Forfaiting provides importers with enhanced liquidity by allowing them to defer payment for a longer period. This can be especially advantageous for importers who need time to generate sufficient funds or arrange alternative financing options.

4. Competitive Advantage

For exporters, offering forfaiting as a financing option can give them a competitive edge in international markets. By providing attractive payment terms to buyers, exporters can attract more customers and secure larger contracts.

5. Simplified Documentation

Forfaiting simplifies the documentation process compared to other financing options like letters of credit. This reduces administrative burden and costs for both exporters and importers, making the transaction more efficient.

6. Flexible Financing Terms

Forfaiting offers flexibility in financing terms, allowing exporters and importers to negotiate payment terms that suit their specific needs. This flexibility can help parties involved in the transaction to reach mutually beneficial agreements.

7. Access to New Markets

Forfaiting can enable exporters to enter new markets by providing them with the necessary financing to support their international trade activities. This can open up opportunities for business expansion and diversification.

Cons of Forfaiting in International Trade

While forfaiting can be a beneficial financing option for exporters and importers in international trade, it also comes with its own set of disadvantages and risks. It is important to consider these factors before engaging in forfaiting transactions. Some of the cons of forfaiting in international trade include:

1. Higher Costs

One of the main disadvantages of forfaiting is that it can be a relatively expensive financing option compared to other alternatives. Forfaiting involves the purchase of receivables at a discount, which means that the exporter will receive less money upfront than the face value of the receivables. This discount is essentially the cost of forfaiting, and it can be higher compared to other financing options such as traditional bank loans.

2. Limited Flexibility

Forfaiting transactions are typically structured as fixed-term agreements, which means that the exporter is committed to selling the receivables for a specific period of time. This lack of flexibility can be a disadvantage for exporters who may need to access funds quickly or who may want to retain control over their receivables for strategic purposes.

3. Credit Risk

While forfaiting transfers the credit risk from the exporter to the forfaiter, there is still a level of credit risk involved in the transaction. The forfaiter relies on the creditworthiness of the importer and their ability to repay the debt. If the importer defaults on the payment, the exporter may still be held liable for the repayment or may need to engage in costly legal proceedings to recover the funds.

4. Limited Availability

Forfaiting is not as widely available as other financing options such as bank loans or factoring. It may be more difficult for exporters to find forfaiters willing to purchase their receivables, especially for smaller or riskier transactions. This limited availability can restrict the options for exporters and may result in higher costs or less favorable terms.

5. Lack of Currency Flexibility

Forfaiting transactions are typically denominated in a specific currency, which can limit the flexibility for exporters and importers who operate in multiple currencies. If the transaction involves different currencies, the exporter may need to engage in currency hedging or bear the risk of currency fluctuations, which can add additional complexity and cost to the transaction.

Despite these disadvantages, forfaiting can still be a valuable financing option for exporters and importers in international trade. It offers a way to mitigate credit risk, access upfront cash flow, and improve liquidity. However, it is important to carefully consider the cons and weigh them against the potential benefits before deciding to engage in forfaiting transactions.

Cons of Forfaiting in International Trade

While forfaiting offers several advantages for exporters and importers in international trade, there are also some disadvantages and risks associated with this financing method. It is important for businesses to consider these cons before deciding to engage in forfaiting transactions.

| Cons | Description |

| Limited Financing Options | Forfaiting may not be suitable for all types of transactions or industries. It is primarily used for medium to long-term trade finance, and may not be available for short-term or small-scale deals. This limitation can restrict the financing options available to businesses. |

| Higher Costs | Compared to other financing methods, forfaiting can be relatively expensive. The discount rate applied to the future cash flows can be higher than the interest rates charged by banks for traditional loans. This can increase the overall cost of financing for businesses. |

| Loss of Control | When a business engages in forfaiting, it transfers the rights and obligations of the receivables to the forfaiter. This means that the business loses control over the collection process and the relationship with the buyer. If any issues arise during the collection period, the business may have limited control over resolving them. |

| Potential Default Risk | There is always a risk of default by the buyer in any trade finance transaction. If the buyer fails to make the payments as agreed, the forfaiter may demand immediate repayment from the exporter. This can create financial difficulties for the exporter, especially if they have already used the funds received from the forfaiter. |

| Complex Documentation | Forfaiting transactions involve complex documentation and legal processes. The exporter needs to provide detailed information about the transaction, including the underlying contract, invoices, and shipping documents. This can be time-consuming and may require the assistance of legal professionals. |

Despite these cons, forfaiting can still be a valuable financing option for businesses engaged in international trade. It provides a way to mitigate credit and political risks, improve cash flow, and access funds without relying on traditional bank loans. However, it is essential for businesses to carefully evaluate the pros and cons of forfaiting and consider their specific needs and circumstances before deciding to pursue this financing method.

Examples of Forfaiting Deals in International Markets

Forfaiting is a widely used financing technique in international trade, and there are numerous examples of successful forfaiting deals in the global market. Here are a few notable examples:

Example 1: A manufacturing company in Germany exports machinery to a buyer in China. The buyer requires a long credit period, but the exporter needs immediate cash flow to fund its operations. The exporter decides to forfait the receivables by selling them to a forfaiting company at a discount. This allows the exporter to receive the payment upfront, while the forfaiting company takes on the risk of collecting the payment from the buyer in China.

Example 2: An oil company in Russia enters into a long-term contract to supply oil to a buyer in India. The buyer requires financing to purchase the oil, and the exporter is not willing to provide credit terms. Instead, the exporter decides to forfait the receivables by selling them to a forfaiting company. The forfaiting company provides the necessary financing to the buyer, and the exporter receives immediate payment for the oil.

Example 3: A textile manufacturer in India exports garments to a buyer in the United States. The buyer requires a credit period of six months, but the exporter needs immediate cash flow to fulfill other orders. The exporter decides to forfait the receivables by selling them to a forfaiting company. The forfaiting company pays the exporter upfront, allowing them to finance their operations, while taking on the risk of collecting the payment from the buyer in the United States.

These examples illustrate the versatility and benefits of forfaiting in international trade. By forfaiting their receivables, exporters can access immediate cash flow, reduce credit risk, and focus on their core business activities. Importers, on the other hand, can obtain financing for their purchases without relying on traditional bank loans or credit lines. Overall, forfaiting plays a crucial role in facilitating global trade and providing financial solutions for businesses operating in international markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.