Exercise Price: Overview

Options contracts are financial derivatives that give the holder the right, but not the obligation, to buy or sell the underlying asset at a specified price within a specific time period. The exercise price plays a significant role in determining the profitability and potential risks of options trading.

The exercise price is often used to determine whether an option is in the money, at the money, or out of the money. If the exercise price is lower than the current market price of the underlying asset, a call option is considered in the money. On the other hand, if the exercise price is higher than the current market price, a put option is in the money.

When trading options, investors have the choice to buy or sell the underlying asset at a predetermined price, which is the exercise price. This price is agreed upon at the time the option contract is created and remains fixed throughout the life of the contract.

The exercise price plays a significant role in determining whether an option is profitable or not. For call options, the exercise price is the price at which the underlying asset can be bought. If the market price of the asset is higher than the exercise price, the option is said to be “in the money” and can be exercised for a profit. On the other hand, if the market price is lower than the exercise price, the option is “out of the money” and exercising it would result in a loss.

Similarly, for put options, the exercise price is the price at which the underlying asset can be sold. If the market price of the asset is lower than the exercise price, the put option is in the money and can be exercised for a profit. If the market price is higher than the exercise price, the option is out of the money, and exercising it would result in a loss.

Investors consider various factors when choosing the exercise price for an options contract. These factors include the current market price of the underlying asset, the volatility of the market, and the desired profit potential. The exercise price should be set at a level that provides a reasonable chance of profitability while also considering the potential risks involved.

It is important for options traders to understand the concept of exercise price and its impact on the profitability of options contracts. By carefully analyzing market conditions and selecting an appropriate exercise price, traders can maximize their potential returns and minimize their risks in options trading.

Put and Calls

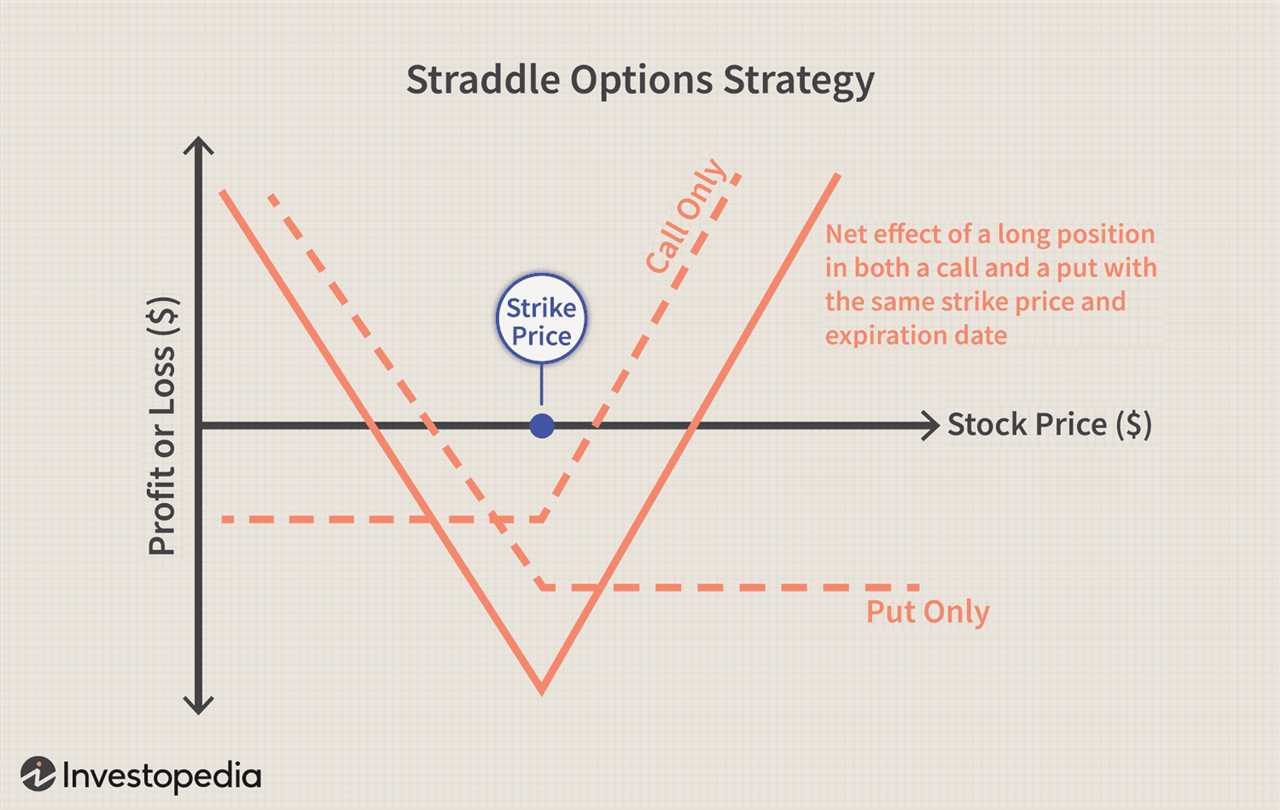

A put option gives the holder the right to sell the underlying asset at the exercise price before the expiration date. On the other hand, a call option gives the holder the right to buy the underlying asset at the exercise price before the expiration date.

Put and call options are used by traders and investors to speculate on the price movement of the underlying asset. If they believe that the price will decrease, they may buy a put option to profit from the decline. Conversely, if they believe that the price will increase, they may buy a call option to profit from the rise.

One of the key factors that determines the value of a put or call option is the difference between the exercise price and the current price of the underlying asset. If the exercise price is lower than the current price, the option is said to be “in the money” for a call option and “out of the money” for a put option. Conversely, if the exercise price is higher than the current price, the option is “out of the money” for a call option and “in the money” for a put option.

Exploring the Role of Exercise Price in Put and Call Options

The exercise price is an important factor in determining the premium of an option. In general, options with lower exercise prices have higher premiums because they offer the holder a greater potential for profit. Conversely, options with higher exercise prices have lower premiums because they offer less potential for profit.

It is important for options traders to carefully consider the exercise price when selecting options to trade. The exercise price should be chosen based on the trader’s expectations for the future price movement of the underlying asset. If the trader believes that the asset’s price will increase, they may choose a call option with a lower exercise price to maximize their potential profit. If the trader believes that the asset’s price will decrease, they may choose a put option with a higher exercise price to maximize their potential profit.

In and Out of The Money

The exercise price plays a crucial role in determining whether an option is in the money or out of the money. When an option is in the money, it means that exercising the option would result in a profit. On the other hand, when an option is out of the money, exercising the option would result in a loss.

Overall, the exercise price is a critical factor in options trading, as it determines whether an option is in the money or out of the money. Traders must carefully consider the relationship between the exercise price and the current market price of the underlying asset to make strategic trading decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.