Exchange Traded Product (ETP): Definition, Types, and Examples

An Exchange Traded Product (ETP) is a type of financial instrument that is traded on a stock exchange. It is designed to provide investors with exposure to a specific asset class, such as stocks, bonds, commodities, or currencies. ETPs are similar to mutual funds or exchange-traded funds (ETFs), but they have some distinct characteristics.

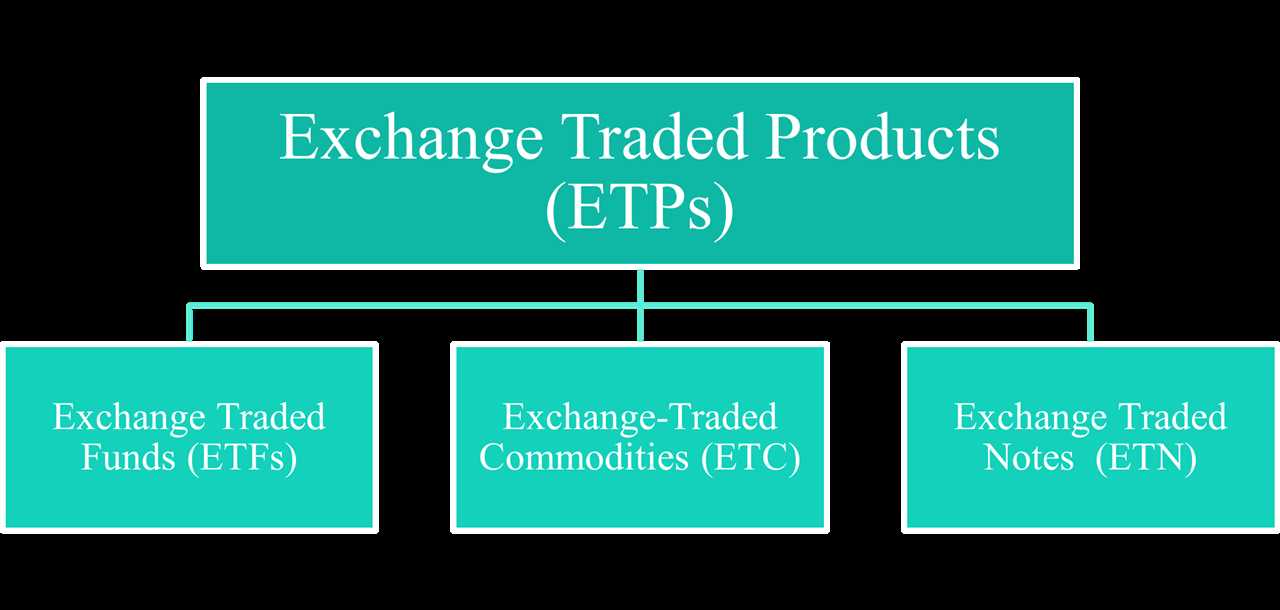

Types of Exchange Traded Products (ETPs)

There are several types of ETPs available in the market:

| Type | Description |

|---|---|

| Exchange Traded Funds (ETFs) | ETFs are investment funds that are traded on a stock exchange. They are designed to track the performance of a specific index, sector, or asset class. ETFs offer diversification and can be bought and sold throughout the trading day at market prices. |

| Exchange Traded Notes (ETNs) | ETNs are debt instruments issued by financial institutions. They are designed to track the performance of an underlying index or asset. ETNs do not own the underlying assets, but they promise to pay the return of the index or asset, minus fees. |

| Exchange Traded Commodities (ETCs) | ETCs are designed to provide exposure to commodities, such as gold, silver, oil, or agricultural products. They can be bought and sold on a stock exchange like a stock. ETCs can be physically backed, where the issuer holds the actual commodity, or synthetically backed, where the issuer uses derivatives to replicate the commodity’s performance. |

| Exchange Traded Certificates (ETCs) | ETCs are similar to ETCs, but they are issued as debt securities rather than shares. They provide exposure to commodities, currencies, or other assets. |

Examples of Exchange Traded Products (ETPs)

Here are some examples of popular ETPs:

- S&P 500 ETF: This ETF tracks the performance of the S&P 500 index, which represents the largest publicly traded companies in the United States.

- Gold ETC: This ETC provides exposure to the price of gold. It can be physically backed, where the issuer holds the actual gold, or synthetically backed, where the issuer uses derivatives to replicate the gold’s price.

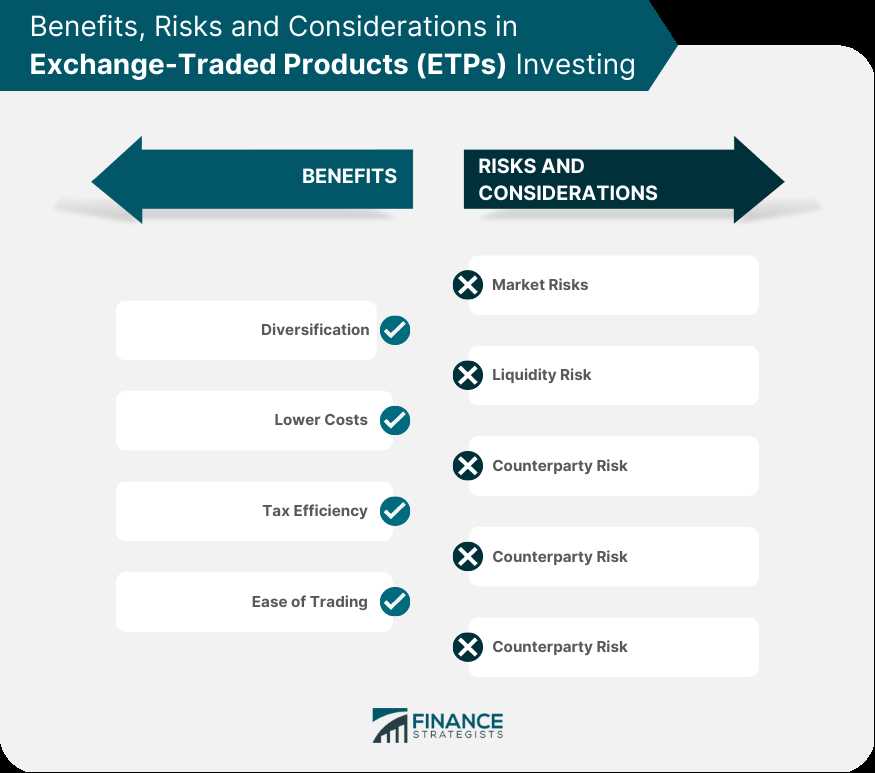

Overall, ETPs offer investors a convenient and cost-effective way to gain exposure to various asset classes. They provide flexibility, liquidity, and transparency, making them popular investment options for both individual and institutional investors.

What is an Exchange Traded Product (ETP)?

An Exchange Traded Product (ETP) is a type of financial instrument that is traded on an exchange, similar to stocks. ETPs are designed to track the performance of a specific index, commodity, or asset class. They offer investors an opportunity to gain exposure to a wide range of assets without having to directly own them.

ETPs can be categorized into different types, including exchange-traded funds (ETFs), exchange-traded notes (ETNs), and exchange-traded commodities (ETCs). Each type of ETP has its own unique characteristics and investment strategies.

ETNs, on the other hand, are debt instruments issued by financial institutions. They are designed to track the performance of an underlying index or asset class. ETNs do not own the underlying assets, but rather promise to pay the return of the index or asset class, minus fees and expenses, at maturity.

ETCs are similar to ETFs, but they track the performance of a specific commodity, such as gold or oil. ETCs can be physically backed, meaning they hold the actual commodity, or they can be synthetically backed, meaning they use derivatives to replicate the performance of the commodity.

Examples of ETPs include the SPDR S&P 500 ETF, which tracks the performance of the S&P 500 index, and the iShares Gold Trust, which tracks the price of gold. These ETPs allow investors to gain exposure to the performance of these assets without having to directly own them.

Types of Exchange Traded Products (ETPs)

Exchange Traded Products (ETPs) are a type of investment vehicle that trade on stock exchanges, similar to individual stocks. ETPs provide investors with exposure to a wide range of assets, including stocks, bonds, commodities, and currencies. There are several types of ETPs available in the market, each with its own unique characteristics and investment strategies.

1. Exchange Traded Funds (ETFs)

2. Exchange Traded Notes (ETNs)

3. Exchange Traded Commodities (ETCs)

ETCs are designed to track the performance of a specific commodity or a basket of commodities. They offer investors a convenient way to gain exposure to commodities without the need to physically own and store them. ETCs can provide exposure to various commodities, including precious metals, energy, agriculture, and industrial metals. Investors should be aware that ETCs may be subject to the risks associated with commodity price fluctuations.

4. Exchange Traded Currencies (ETCs)

ETCs provide investors with exposure to foreign currencies. They are designed to track the performance of a specific currency or a basket of currencies. ETCs can be used by investors to hedge against currency risk or to speculate on the movements of foreign exchange rates. Investors should be aware that currency exchange rates can be volatile and may be influenced by various economic and geopolitical factors.

These are just a few examples of the types of ETPs available in the market. Each type of ETP has its own unique characteristics and investment objectives. It is important for investors to carefully consider their investment goals and risk tolerance before investing in ETPs.

Examples of Exchange Traded Products (ETPs)

Exchange Traded Products (ETPs) offer investors a wide range of options to diversify their portfolios and gain exposure to various asset classes. Here are some examples of popular ETPs:

1. Exchange Traded Funds (ETFs): ETFs are one of the most common types of ETPs. They are investment funds that trade on stock exchanges, allowing investors to buy or sell shares throughout the trading day. ETFs can track various indexes, sectors, commodities, or asset classes. For example, the SPDR S&P 500 ETF tracks the performance of the S&P 500 index.

2. Exchange Traded Notes (ETNs): ETNs are debt instruments issued by financial institutions. They are designed to track the performance of an underlying index or asset. Unlike ETFs, ETNs do not hold the underlying assets directly. Instead, investors receive a promise from the issuer to pay a return based on the performance of the index or asset. For instance, the iPath S&P 500 VIX Short-Term Futures ETN provides exposure to volatility in the stock market.

3. Exchange Traded Commodities (ETCs): ETCs are ETPs that track the performance of commodities such as gold, oil, or agricultural products. They allow investors to gain exposure to these commodities without physically owning them. For example, the ETFS Physical Gold ETC represents ownership of physical gold stored in vaults.

4. Exchange Traded Currencies (ETCs): ETCs provide exposure to foreign currencies. They can track the performance of a single currency or a basket of currencies. Investors can use ETCs to speculate on currency movements or hedge against currency risk. The Invesco CurrencyShares Euro Trust is an example of an ETC that tracks the euro’s performance against the U.S. dollar.

5. Exchange Traded Derivatives (ETDs): ETDs are ETPs that derive their value from an underlying asset, such as futures contracts or options. They allow investors to gain exposure to the price movements of the underlying asset without owning it directly. For instance, the ProShares UltraPro QQQ is an ETD that aims to provide three times the daily return of the Nasdaq-100 Index.

6. Exchange Traded Structured Products (ETSPs): ETSPs are ETPs that combine elements of traditional securities, such as bonds or equities, with derivatives. They offer investors a unique risk-return profile and can be tailored to specific investment strategies. Examples of ETSPs include leveraged or inverse ETFs, which aim to amplify or inverse the performance of an underlying index.

These are just a few examples of the wide variety of ETPs available in the market. Each type of ETP offers different investment opportunities and risk profiles, allowing investors to customize their portfolios according to their specific goals and preferences.

ETFS: A Category of Exchange Traded Products (ETPs)

Exchange Traded Funds (ETFs) are a type of Exchange Traded Product (ETP) that are designed to track the performance of a specific index, sector, commodity, or asset class. ETFs are traded on stock exchanges, just like individual stocks, and can be bought and sold throughout the trading day at market prices.

ETFS, or Exchange Traded Funds Securities, are a category of ETPs that provide investors with exposure to a diversified portfolio of securities. These securities can include stocks, bonds, commodities, or other asset classes. ETFS are designed to provide investors with a low-cost, transparent, and efficient way to gain exposure to a specific market or asset class.

One of the key features of ETFS is their ability to offer investors diversification. By investing in an ETFS, investors gain exposure to a basket of securities, which helps to spread risk and reduce the impact of any single security on the overall performance of the fund. This diversification can help to protect investors from the volatility and risk associated with investing in individual securities.

Another advantage of ETFS is their liquidity. ETFS are traded on stock exchanges, which means that investors can buy and sell shares of an ETFS throughout the trading day at market prices. This liquidity provides investors with the flexibility to enter and exit positions quickly and easily, without having to wait for the end of the trading day.

ETFS also offer investors transparency. The holdings of an ETFS are disclosed on a daily basis, allowing investors to see exactly what securities they are invested in. This transparency helps to build trust and confidence in the fund, as investors can easily assess the risk and performance of the underlying securities.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.