What is Ethereum Classic?

Ethereum Classic (ETC) is a decentralized blockchain platform that was created as a result of a split from the original Ethereum blockchain. It is a continuation of the original Ethereum blockchain, which was created in 2015 by Vitalik Buterin.

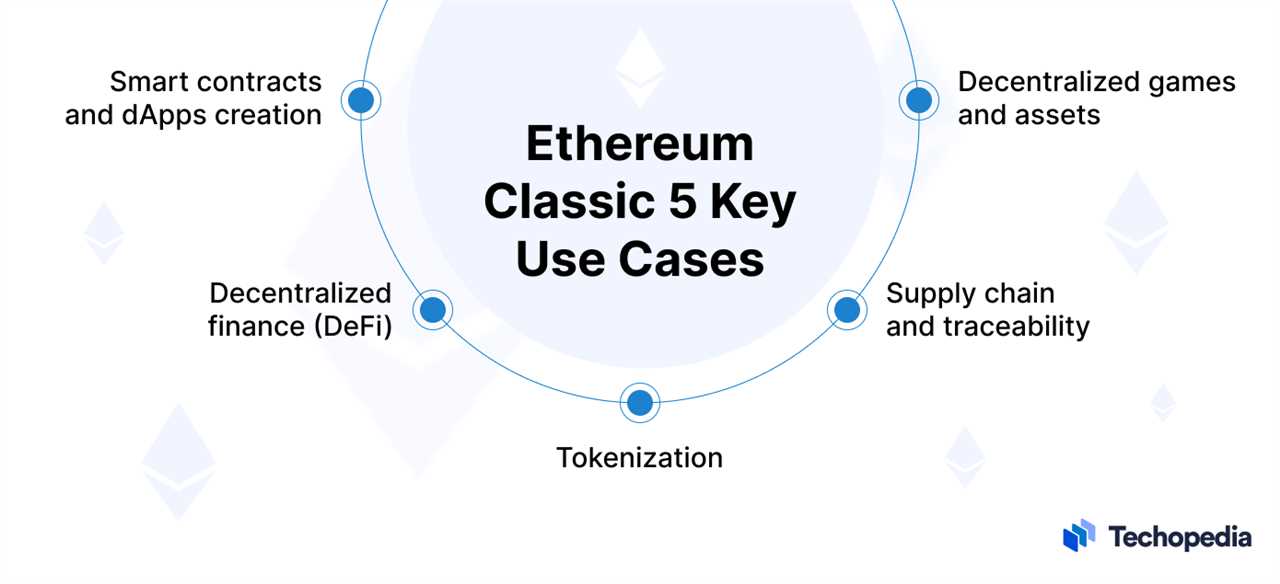

Ethereum Classic operates on the same principles as Ethereum, with a focus on smart contracts and decentralized applications (dApps). It allows developers to build and deploy applications on its platform, using its native cryptocurrency ETC as a means of exchange.

One of the main differences between Ethereum Classic and Ethereum is the concept of immutability. Ethereum Classic believes in the principle of “code is law,” which means that once a smart contract is deployed on the blockchain, it cannot be changed or altered. This is in contrast to Ethereum, which implemented a hard fork in 2016 to reverse the effects of a hack.

The Philosophy of Ethereum Classic

Ethereum Classic is guided by a set of principles that prioritize decentralization, immutability, and censorship resistance. It aims to provide a platform that is free from external interference and control, allowing for the development of trustless applications.

The Ethereum Classic community believes that the blockchain should be a neutral and unbiased platform, where transactions and contracts are executed as intended, without any possibility of censorship or manipulation. They argue that immutability is a fundamental characteristic of a blockchain, and any attempt to change the blockchain undermines its integrity.

The ETC Token

The native cryptocurrency of the Ethereum Classic platform is called ETC. It is used as a means of exchange within the network, allowing users to pay for transaction fees and interact with smart contracts.

ETC can be acquired through mining or by purchasing it from cryptocurrency exchanges. It can also be stored in digital wallets that support Ethereum Classic.

As with other cryptocurrencies, the value of ETC is subject to market fluctuations and can be influenced by factors such as supply and demand, investor sentiment, and overall market conditions.

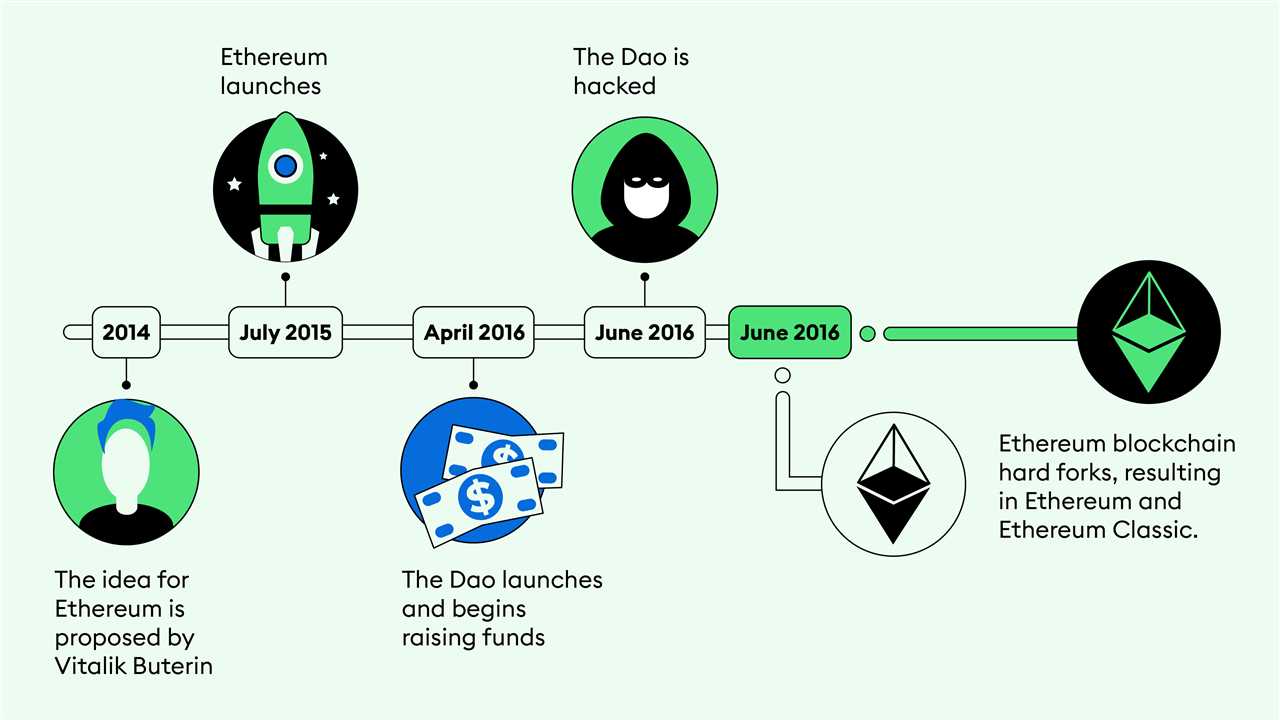

The History of Ethereum Classic

The DAO (Decentralized Autonomous Organization) was a smart contract-based investment fund built on the Ethereum blockchain. It raised a significant amount of funds through a token sale. However, a vulnerability in the DAO’s code was exploited, resulting in the theft of millions of dollars worth of Ether (ETH).

In response to the hack, the Ethereum community proposed a hard fork to reverse the transactions and recover the stolen funds. This proposal was met with mixed reactions, as some believed that the immutability of the blockchain should be preserved, even in the face of such a significant hack.

A portion of the Ethereum community, who disagreed with the hard fork, decided to continue using the original blockchain and formed Ethereum Classic. They believed that the blockchain should remain immutable and that the stolen funds should not be recovered through a centralized decision.

Ethereum Classic retained the original Ethereum blockchain, including the transactions that occurred before the hard fork. This means that Ethereum Classic and Ethereum have separate transaction histories from the point of the hard fork onwards.

Since its creation, Ethereum Classic has continued to operate as an independent blockchain platform. It has its own native cryptocurrency called ETC, which is used for transactions and as a store of value.

Ethereum Classic has faced challenges and controversies throughout its history. It has been criticized for its lack of development and slower adoption compared to Ethereum. However, the Ethereum Classic community remains committed to the principles of decentralization and immutability.

Despite the challenges, Ethereum Classic has gained a dedicated following and continues to be traded on various cryptocurrency exchanges. Its future remains uncertain, but it has established itself as a distinct blockchain platform with its own set of supporters and use cases.

Ethereum Classic vs Ethereum

1. History: Ethereum Classic is the original Ethereum blockchain that remained after a controversial hard fork in 2016. The hard fork was a result of a hack that led to the loss of millions of dollars worth of Ether. The Ethereum community decided to fork the blockchain to reverse the hack, while a group of developers and miners chose to continue on the original chain, which became Ethereum Classic.

2. Development: Ethereum (ETH) has seen significant development and upgrades since the hard fork, including the implementation of the Proof of Stake (PoS) consensus algorithm in its upcoming Ethereum 2.0 upgrade. On the other hand, Ethereum Classic (ETC) has remained more focused on preserving the immutability and decentralization principles of blockchain technology, with no plans for a switch to PoS.

3. Community: The Ethereum community is larger and more active compared to the Ethereum Classic community. Ethereum has gained significant adoption and support from developers, businesses, and investors, leading to a vibrant ecosystem of decentralized applications (dApps) and smart contracts. Ethereum Classic, while having a smaller community, still has its own dedicated supporters who believe in its principles and vision.

4. Market Value: Ethereum (ETH) has a higher market value and liquidity compared to Ethereum Classic (ETC). This is partly due to the larger community and adoption of Ethereum, which has attracted more investment and trading activity. However, Ethereum Classic still holds value and has its own market, with some investors seeing it as a potential investment opportunity.

5. Philosophy: The main philosophical difference between Ethereum Classic and Ethereum lies in their approach to immutability. Ethereum Classic adheres to the principle of “code is law,” meaning that once a transaction is recorded on the blockchain, it cannot be changed or reversed. On the other hand, Ethereum believes in the ability to make changes to the blockchain through community consensus, as demonstrated by the hard fork in 2016.

The Future of Ethereum Classic

Ethereum Classic (ETC) has a promising future ahead, as it continues to differentiate itself from its sibling cryptocurrency, Ethereum (ETH). While Ethereum focuses on scalability and smart contracts, Ethereum Classic remains committed to the principles of decentralization and immutability.

One of the key advantages of Ethereum Classic is its strong community of developers and supporters. Despite being a smaller network compared to Ethereum, ETC has a dedicated following that believes in its long-term potential. This community actively contributes to the development of the Ethereum Classic ecosystem, creating new applications and improving the overall functionality of the platform.

Furthermore, Ethereum Classic has been gaining traction in the decentralized finance (DeFi) space. DeFi has emerged as one of the hottest trends in the cryptocurrency industry, offering users the ability to access financial services without relying on traditional intermediaries. Ethereum Classic’s compatibility with Ethereum’s smart contracts makes it an attractive option for developers looking to build decentralized applications (dApps) in the DeFi sector.

Another factor that bodes well for the future of Ethereum Classic is its strong focus on security. The Ethereum Classic network has implemented measures to prevent 51% attacks, which have plagued other blockchain networks in the past. This commitment to security is crucial in maintaining user trust and attracting new participants to the ecosystem.

Challenges and Risks

While Ethereum Classic has a promising future, it also faces several challenges and risks that could impact its growth. One of the main challenges is the ongoing competition with Ethereum. As Ethereum continues to dominate the market and attract more developers and users, Ethereum Classic must find ways to differentiate itself and offer unique value propositions.

Additionally, Ethereum Classic’s smaller market capitalization and lower liquidity compared to Ethereum make it more susceptible to market volatility and manipulation. This can pose risks for investors and traders looking to participate in the Ethereum Classic ecosystem.

Conclusion

Investing in Ethereum Classic

Investing in Ethereum Classic (ETC) can be a lucrative opportunity for those looking to diversify their cryptocurrency portfolio. As one of the leading altcoins in the market, Ethereum Classic has gained significant attention and popularity since its inception.

Before investing in Ethereum Classic, it is important to understand the fundamentals of the cryptocurrency and its potential for growth. Ethereum Classic is a decentralized platform that enables smart contracts and decentralized applications (DApps) to be built and run without any downtime, fraud, control, or interference from a third party.

One of the main advantages of investing in Ethereum Classic is its strong community support. The Ethereum Classic community is composed of developers, enthusiasts, and investors who believe in the long-term potential of the cryptocurrency. This community-driven approach has led to the development of various projects and initiatives aimed at improving the Ethereum Classic ecosystem.

Another factor to consider when investing in Ethereum Classic is its price volatility. Like other cryptocurrencies, Ethereum Classic’s price can experience significant fluctuations in a short period of time. This volatility can present both opportunities and risks for investors. It is important to conduct thorough research and analysis before making any investment decisions.

When investing in Ethereum Classic, it is also crucial to consider the security of your investment. As with any cryptocurrency investment, it is recommended to store your Ethereum Classic in a secure wallet. This can be a hardware wallet, software wallet, or an offline cold storage solution. By taking proper security measures, you can protect your investment from potential hacks or theft.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.