Equity Derivative: Definition and Usage

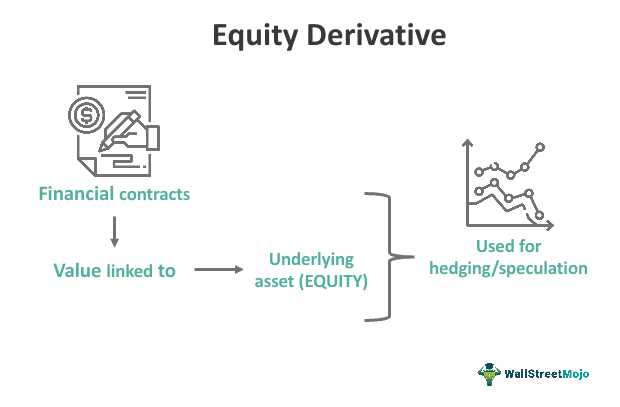

An equity derivative is a financial instrument whose value is derived from the price of an underlying equity security. It is a type of derivative contract that allows investors to speculate on the price movements of individual stocks or entire equity indices without owning the underlying assets.

The usage of equity derivatives can be categorized into three main purposes:

| Usage | Description |

|---|---|

| Hedging | Investors can use equity derivatives to hedge their existing equity positions against potential losses. By taking offsetting positions in derivatives, investors can protect their portfolios from adverse price movements. |

| Speculation | Equity derivatives provide opportunities for investors to speculate on the future price movements of stocks or indices. By taking leveraged positions in derivatives, investors can amplify their potential returns, but also increase their risk exposure. |

| Arbitrage | Arbitrageurs can use equity derivatives to exploit price discrepancies between the underlying assets and their derivative contracts. By simultaneously buying and selling related securities, arbitrageurs can profit from the price differentials. |

Equity derivatives are widely used by institutional investors, such as hedge funds and investment banks, as well as individual traders. They provide flexibility, liquidity, and the ability to tailor investment strategies to specific market conditions.

Overall, equity derivatives play a crucial role in the financial markets, allowing investors to manage risk, speculate on price movements, and capitalize on arbitrage opportunities.

What is an Equity Derivative?

An equity derivative is a financial instrument whose value is derived from the price of an underlying equity security. It is a type of derivative contract that allows investors to speculate on the future price movements of stocks or stock indices without owning the actual underlying assets. Equity derivatives are commonly used by investors and traders to manage risk, hedge against potential losses, and speculate on market movements.

Types of Equity Derivatives

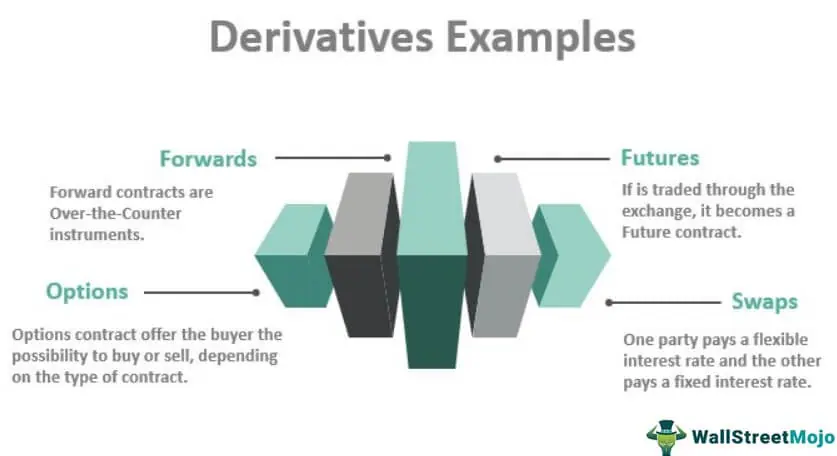

There are several types of equity derivatives, including:

- Options: An option is a contract that gives the holder the right, but not the obligation, to buy or sell a specific quantity of the underlying equity security at a predetermined price (strike price) within a specified period of time.

- Futures: A futures contract is an agreement to buy or sell a specific quantity of the underlying equity security at a predetermined price (futures price) on a future date.

- Forwards: A forward contract is similar to a futures contract, but it is customized between two parties and traded over-the-counter (OTC) rather than on an exchange.

- Swaps: A swap is a derivative contract in which two parties agree to exchange cash flows based on the price movements of an underlying equity security.

Usage of Equity Derivatives

Equity derivatives are widely used for various purposes, including:

- Hedging: Investors can use equity derivatives to hedge against potential losses in their equity portfolios. By taking opposite positions in derivatives, they can offset the risk of adverse price movements.

- Speculation: Traders can use equity derivatives to speculate on the future price movements of stocks or stock indices. By taking leveraged positions, they can potentially amplify their returns.

- Arbitrage: Arbitrageurs can use equity derivatives to exploit price discrepancies between the derivatives market and the underlying equity market. They can buy low and sell high to make risk-free profits.

- Portfolio Management: Fund managers can use equity derivatives to adjust the risk and return characteristics of their portfolios. They can implement various strategies, such as sector rotation, market timing, and volatility management.

Overall, equity derivatives play a crucial role in the financial markets by providing investors and traders with flexible tools to manage risk, speculate on market movements, and enhance portfolio performance.

Usage of Equity Derivatives

Equity derivatives are financial instruments that derive their value from an underlying stock or equity index. They are widely used by investors and traders for various purposes, including hedging, speculation, and arbitrage.

Hedging

One of the primary uses of equity derivatives is hedging. Investors and traders can use these instruments to protect their portfolios against potential losses. For example, if an investor holds a large number of shares in a particular company and is concerned about a potential decline in the stock price, they can use equity derivatives such as options or futures to hedge their position. By buying put options or selling futures contracts, they can offset potential losses in the underlying stock.

Speculation

Arbitrage

Another common use of equity derivatives is arbitrage. Arbitrageurs take advantage of price discrepancies between different markets or instruments to make risk-free profits. They can exploit these inefficiencies by simultaneously buying and selling related securities. For example, if the price of a stock futures contract is lower than the price of the underlying stock, an arbitrageur can buy the futures contract and sell the stock to lock in a profit.

Equity Derivative: Example

An equity derivative is a financial instrument whose value is based on the price of an underlying equity security. It is a contract between two parties, where one party agrees to buy or sell the underlying equity asset at a predetermined price and date in the future.

Let’s consider an example to understand how equity derivatives work:

- Company XYZ is a publicly traded company with its stock currently priced at $100 per share.

- Investor A believes that the stock price of Company XYZ will increase in the next three months.

- The strike price for the call option is set at $110, and the expiration date is three months from now.

- Investor A pays a premium of $5 per share for the call option.

- If the stock price of Company XYZ increases to $120 per share within the next three months, Investor A can exercise their call option and buy the stock at the strike price of $110.

- Investor A can then sell the stock at the market price of $120, making a profit of $10 per share.

This example illustrates how equity derivatives, such as call options, can be used by investors to speculate on the future price movements of underlying equity securities. They provide opportunities for investors to profit from both rising and falling stock prices, depending on the type of derivative contract used.

It is important to note that equity derivatives can be complex financial instruments and involve risks. Investors should carefully consider their investment objectives, risk tolerance, and seek professional advice before trading or investing in equity derivatives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.