What is an Electronic Check (E-Check)?

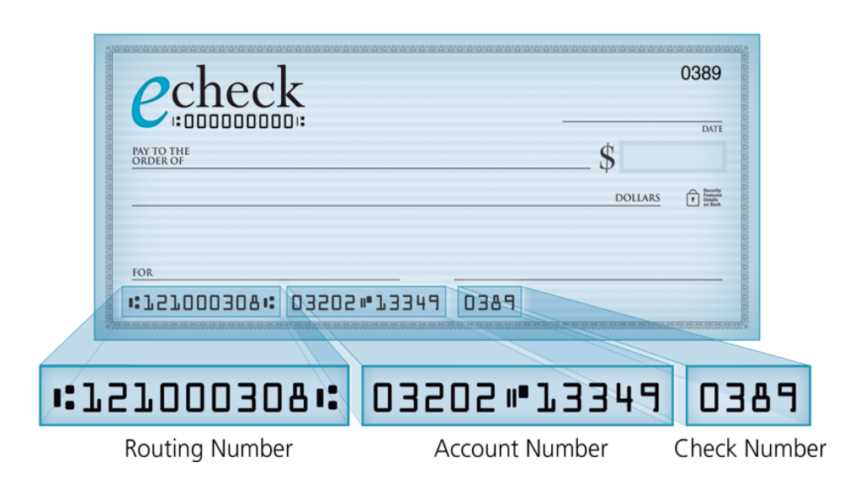

Similar to a paper check, an E-check contains all the necessary information to complete a payment, including the recipient’s name, bank account number, routing number, and the payment amount. However, instead of physically signing the check, you authorize the payment using an electronic signature or through an online payment platform.

Definition and How It Works

An E-check works by utilizing the Automated Clearing House (ACH) network, which is a secure electronic payment system that facilitates the transfer of funds between banks. When you initiate an E-check payment, the payment details are securely transmitted to the recipient’s bank through the ACH network.

Once the recipient’s bank receives the payment details, the funds are electronically debited from your checking account and credited to the recipient’s account. This process typically takes a few business days to complete, depending on the banks involved and their processing times.

Benefits of Using Electronic Checks

There are several benefits to using electronic checks:

Convenience and Time Savings

Using E-checks eliminates the need to write physical checks, find envelopes, and pay for postage. It saves time and allows you to initiate payments from the comfort of your own home or office. Additionally, you can schedule recurring payments, eliminating the need to manually initiate payments each time.

Reduced Risk of Fraud

How to Use Electronic Checks

To use electronic checks, you will need to have a checking account with a bank that offers E-check services. You can typically initiate E-check payments through your bank’s online banking platform or through a third-party payment provider.

When initiating an E-check payment, you will need to provide the recipient’s bank account information, including their name, account number, and routing number. You may also need to provide additional information, such as an invoice number or payment reference.

Setting Up an E-Check Payment Method

To set up an E-check payment method, you will need to link your checking account to the payment platform or online banking system. This may involve verifying your account information and authorizing the platform to initiate payments on your behalf.

Once your E-check payment method is set up, you can easily select it as a payment option when making online purchases or paying bills. The payment platform or online banking system will guide you through the process of entering the necessary payment details and authorizing the payment.

Definition and How It Works

When you initiate an E-check payment, the process begins with the payer authorizing the payment through an online platform or software. The payer provides the necessary information, including the recipient’s banking details, the payment amount, and any additional information required.

Once the payment is authorized, the payer’s bank electronically transfers the funds to the recipient’s bank account. This transfer typically occurs through the Automated Clearing House (ACH) network, a secure system that facilitates electronic transactions between financial institutions.

The recipient’s bank verifies the payment details and deposits the funds into the recipient’s account. The entire process is completed electronically, eliminating the need for physical checks to be processed and deposited manually.

E-checks offer several advantages over traditional paper checks. They are faster, more convenient, and reduce the risk of fraud. Additionally, they can be easily integrated into existing online payment systems, making them a popular choice for businesses and individuals alike.

Benefits of Using Electronic Checks

1. Convenience and Time Savings

One of the primary benefits of electronic checks is the convenience they offer. With E-checks, you can make payments directly from your checking account without the need for paper checks or physical visits to the bank. This saves you time and effort, as you can initiate payments from the comfort of your own home or office.

2. Reduced Risk of Fraud

Electronic checks provide a higher level of security compared to traditional paper checks. The risk of fraud, such as check alteration or forgery, is significantly reduced with E-checks. Electronic checks are encrypted and require authentication, making them more secure and less susceptible to unauthorized access.

3. Cost Savings

Using electronic checks can also result in cost savings for both individuals and businesses. With E-checks, there is no need to purchase physical checks or pay for postage to mail them. This can lead to significant savings over time, especially for businesses that process a large volume of payments.

4. Faster Processing and Clearing

Electronic checks are processed and cleared much faster than traditional paper checks. With E-checks, the payment information is transmitted electronically, allowing for quicker processing and settlement. This means that funds are available to the recipient sooner, reducing the waiting time for payments to be credited to your account.

5. Environmentally Friendly

By using electronic checks, you can contribute to a more sustainable and environmentally friendly way of conducting financial transactions. E-checks eliminate the need for paper checks, reducing paper waste and the environmental impact associated with the production and disposal of paper products.

Convenience and Time Savings

One of the major benefits of using electronic checks (e-checks) is the convenience and time savings they offer. With e-checks, you can easily make payments without the need for physical checks or trips to the bank.

Unlike traditional paper checks, which require you to write, sign, and mail them, e-checks can be created and sent electronically. This means you can initiate payments from the comfort of your own home or office, saving you valuable time and effort.

Additionally, e-checks can be processed much faster than traditional checks. While paper checks may take several days to clear, e-checks can be processed and deposited into the recipient’s account within a matter of hours or even minutes. This quick processing time allows for faster payment and reduces the risk of late fees or penalties.

Furthermore, e-checks provide the convenience of automatic recurring payments. You can set up recurring payments for bills or subscriptions, ensuring that your payments are made on time without the need for manual intervention each month. This feature is especially useful for individuals who have regular monthly expenses.

Overall, the convenience and time savings offered by electronic checks make them a popular choice for individuals and businesses alike. By eliminating the need for physical checks and streamlining the payment process, e-checks provide a hassle-free and efficient way to make payments.

Reduced Risk of Fraud

Electronic checks, on the other hand, are processed electronically and do not require physical handling. This significantly reduces the chances of them being lost or stolen. Additionally, e-checks are encrypted and require authentication, making them more secure than traditional paper checks.

Furthermore, electronic checks offer additional security features such as digital signatures and verification processes. These features help to ensure that the check is valid and has not been tampered with. In case of any suspicious activity, banks and financial institutions have advanced fraud detection systems in place to identify and prevent fraudulent transactions.

By using electronic checks, you can have peace of mind knowing that your financial transactions are secure and protected against fraud. This can save you from potential financial losses and the hassle of dealing with fraudulent activities.

| Benefits of Using Electronic Checks |

|---|

| Convenience and Time Savings |

| Reduced Risk of Fraud |

How to Use Electronic Checks

Step 1: Gather the Required Information

Step 2: Choose an E-Check Payment Method

Next, you will need to choose an e-check payment method. This can typically be done through the payment options provided by the merchant or service provider. Common e-check payment methods include online payment platforms, bank websites, and mobile banking apps.

Step 3: Enter the Payment Details

Once you have selected the e-check payment method, you will need to enter the payment details. This will include the recipient’s information, as well as any additional details required by the payment platform. Make sure to double-check all the information before proceeding.

Step 4: Verify and Submit the Payment

After entering the payment details, you will have the opportunity to review and verify the information. Take a moment to ensure that all the details are accurate and correct any errors if necessary. Once you are satisfied, submit the payment to initiate the transfer of funds.

Step 5: Confirm the Payment

After submitting the payment, you may receive a confirmation message or email. This will serve as proof that the payment has been successfully processed. Keep this confirmation for your records, as it may be needed for future reference or disputes.

Using electronic checks offers a convenient and secure way to make payments online. By following these steps, you can easily utilize this payment method for various transactions, such as bill payments, online purchases, and more.

Setting Up an E-Check Payment Method

Setting up an E-Check payment method is a simple and straightforward process that can be done in a few easy steps. Here’s how you can get started:

Step 1: Choose an E-Check Provider

Step 2: Sign Up for an Account

Once you have chosen an E-Check provider, the next step is to sign up for an account. This usually involves providing some basic information about your business, such as your name, address, and contact details. You may also need to provide some additional documentation, such as proof of identity and bank account information.

Step 3: Verify Your Account

After signing up for an account, you will need to verify your account. This is usually done by providing some additional documentation, such as a copy of your ID and a voided check from your bank account. The E-Check provider will review your information and verify your account within a few business days.

Step 4: Set Up Payment Gateway Integration

Once your account is verified, you will need to set up payment gateway integration. This involves linking your E-Check account with your website or online store. Most E-Check providers offer easy-to-use plugins or APIs that can be integrated with popular e-commerce platforms. Follow the instructions provided by your E-Check provider to complete the integration process.

Step 5: Test and Launch

By following these steps, you can easily set up an E-Check payment method for your business. E-Checks offer a convenient and secure way to accept payments, and integrating them into your payment system can help streamline your business operations and improve customer satisfaction.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.