Economic Calendar: Everything You Need to Know

An economic calendar is a tool used by traders, investors, and economists to keep track of important economic events and announcements. It provides a schedule of upcoming releases of key economic indicators, such as GDP growth, inflation rates, employment data, and central bank decisions.

By using an economic calendar, individuals can stay informed about the latest economic developments and make more informed decisions regarding their investments. It allows them to anticipate market movements and adjust their trading strategies accordingly.

There are several reasons why an economic calendar is important. Firstly, it helps traders and investors to identify potential trading opportunities. For example, if a country is scheduled to release positive GDP growth data, it could indicate a strengthening economy and potentially lead to an increase in the value of its currency.

Secondly, an economic calendar helps to manage risk. By being aware of upcoming economic events, traders can adjust their positions or even stay out of the market during periods of high volatility. This can help to protect their capital and avoid unnecessary losses.

Furthermore, an economic calendar can provide valuable insights into the overall health of an economy. By analyzing the data released in economic reports, economists can assess the current state of the economy and make predictions about future trends. This information is crucial for policymakers and businesses in making informed decisions.

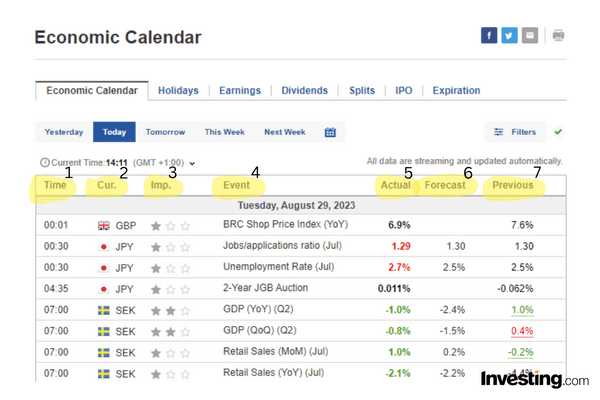

Using an economic calendar is relatively straightforward. It typically includes the date and time of the event, the name of the indicator, the previous value, the forecasted value, and the actual value once it is released. Traders can filter the calendar based on their preferences and set up alerts to be notified of upcoming events.

What is an Economic Calendar?

An economic calendar is a tool used by traders, investors, and economists to keep track of important economic events and indicators. It provides a schedule of upcoming releases of economic data, such as GDP growth, unemployment rates, inflation figures, and central bank decisions.

The economic calendar is usually organized by date and time, allowing users to easily see when each event is scheduled to take place. It also provides a brief description of each event, along with the expected impact it may have on the financial markets.

Traders and investors use the economic calendar to stay informed about key economic data that can potentially affect the prices of stocks, currencies, commodities, and other financial instruments. By knowing when important economic events are scheduled, they can make more informed trading decisions and adjust their strategies accordingly.

Economists and analysts also rely on the economic calendar to track the overall health of the economy and make forecasts about future economic trends. By analyzing the data released in the economic calendar, they can gain insights into the state of the economy and make predictions about its future performance.

In addition to scheduled economic events, the economic calendar may also include other important dates, such as holidays, central bank meetings, and speeches by influential policymakers. These events can also have a significant impact on the financial markets and are therefore important to be aware of.

Overall, an economic calendar is a valuable tool for anyone involved in the financial markets. It helps users stay informed about important economic events, make better trading decisions, and gain insights into the state of the economy. By regularly checking the economic calendar, traders, investors, and economists can stay ahead of the curve and navigate the markets more effectively.

Why is an Economic Calendar Important?

An economic calendar is an essential tool for traders, investors, and economists as it provides a comprehensive overview of key economic events and indicators that can impact financial markets. Here are some reasons why an economic calendar is important:

| 1. Stay Informed: | By using an economic calendar, individuals can stay informed about upcoming economic events, such as central bank meetings, economic data releases, and political events that can affect the markets. This information allows traders and investors to make informed decisions and adjust their strategies accordingly. |

| 2. Market Analysis: | An economic calendar provides valuable data on economic indicators like GDP growth, inflation rates, employment figures, and consumer sentiment. By analyzing this data, traders and investors can gain insights into the health of the economy and make predictions about future market trends. |

| 3. Volatility Management: | Financial markets can experience increased volatility during important economic events. By consulting an economic calendar, traders can identify periods of high volatility and adjust their trading strategies accordingly. This helps in managing risk and avoiding potential losses. |

| 4. Timing of Trades: | An economic calendar helps traders in timing their trades effectively. By knowing the schedule of important economic events, traders can plan their trades around these events to take advantage of potential market movements. For example, a trader may choose to avoid trading during a major economic announcement to reduce the risk of unexpected price fluctuations. |

| 5. Fundamental Analysis: | An economic calendar is a valuable tool for conducting fundamental analysis. By tracking economic events and their impact on the markets, traders can assess the intrinsic value of an asset and make informed investment decisions based on the long-term prospects of the underlying economy. |

How to Use an Economic Calendar?

Using an economic calendar can be a valuable tool for traders and investors to stay informed about upcoming economic events and data releases that can impact the financial markets. Here are some steps to effectively use an economic calendar:

- Filter the events: Economic calendars often have a large number of events listed, so it’s helpful to filter the events based on your interests and trading strategy. You can filter by country, type of event, and impact level to focus on the events that are most relevant to your trading decisions.

- Analyze the potential market impact: Based on the event details, you can assess the potential impact on the market. Some events may have a high impact and can cause significant volatility, while others may have a lower impact. Consider how the event aligns with the current market sentiment and your trading strategy.

- Monitor the market reaction: After the event is released, closely monitor the market reaction to see if it aligns with your analysis. This can help you evaluate the accuracy of your predictions and make any necessary adjustments to your trading strategy.

By following these steps, you can effectively use an economic calendar to stay informed about important economic events and make more informed trading decisions. Remember to regularly update your calendar and stay updated on any changes or additions to the events list.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.