Earnings Before Interest and Taxes (EBIT) Calculation

To calculate EBIT, you need to know a company’s revenue and its operating expenses. The formula for EBIT is:

This calculation helps investors and analysts assess a company’s operating performance and profitability without the influence of interest and tax expenses. It provides a clearer picture of a company’s ability to generate profits from its core operations.

EBIT is an important metric for comparing the financial performance of different companies, especially those in the same industry. By focusing on operating income, it eliminates the impact of financing decisions and tax rates, allowing for a more accurate comparison.

EBIT can also be used to calculate other financial ratios, such as EBIT margin and EBIT coverage ratio. The EBIT margin measures a company’s profitability as a percentage of its revenue, while the EBIT coverage ratio assesses a company’s ability to cover its interest expenses with its operating income.

Components of EBIT

Earnings Before Interest and Taxes (EBIT) is a key financial metric that provides insight into a company’s operating performance. It is calculated by subtracting operating expenses from operating revenue. EBIT is a useful measure for investors and analysts as it allows them to assess a company’s profitability before taking into account interest and tax expenses.

The components of EBIT include:

- Operating Revenue: This refers to the total revenue generated by a company’s core operations. It includes sales of goods or services, rental income, and any other income directly related to the company’s primary business activities.

- Cost of Goods Sold (COGS): This represents the direct costs associated with producing or delivering the goods or services sold by the company. It includes the cost of raw materials, labor, and any other expenses directly attributable to production.

- Operating Expenses: These are the costs incurred by a company in its day-to-day operations, excluding interest and taxes. Examples of operating expenses include salaries and wages, rent, utilities, marketing expenses, and research and development costs.

- Depreciation and Amortization: This represents the systematic allocation of the cost of tangible and intangible assets over their useful lives. Depreciation is used for tangible assets such as buildings and equipment, while amortization is used for intangible assets such as patents and trademarks.

Overall, EBIT is a valuable metric for assessing a company’s profitability and can provide important insights into its financial health and performance.

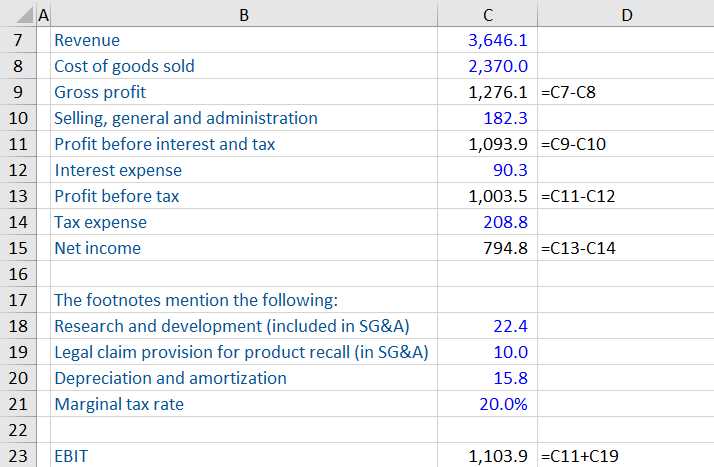

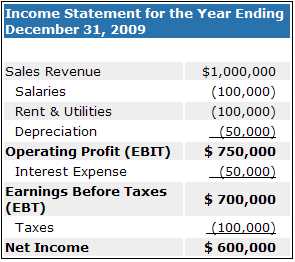

Illustration of EBIT Calculation

Let’s consider a fictional company, XYZ Corporation, which operates in the manufacturing industry. XYZ Corporation’s financial statements show the following information:

- Sales Revenue: $1,000,000

- Cost of Goods Sold: $600,000

- Operating Expenses: $200,000

- Depreciation Expense: $50,000

- Interest Expense: $20,000

- Tax Rate: 30%

To calculate EBIT, we need to subtract the cost of goods sold, operating expenses, and depreciation expense from the sales revenue. This gives us the operating income before interest and taxes.

Operating Income = $150,000

Next, we need to subtract the interest expense from the operating income to calculate EBIT.

EBIT = $130,000

Net Income Before Taxes = $91,000

It is important to note that EBIT does not include non-operating income or expenses, such as gains or losses from the sale of assets. Therefore, it provides a clearer picture of a company’s core profitability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.