Dollarization: Definition

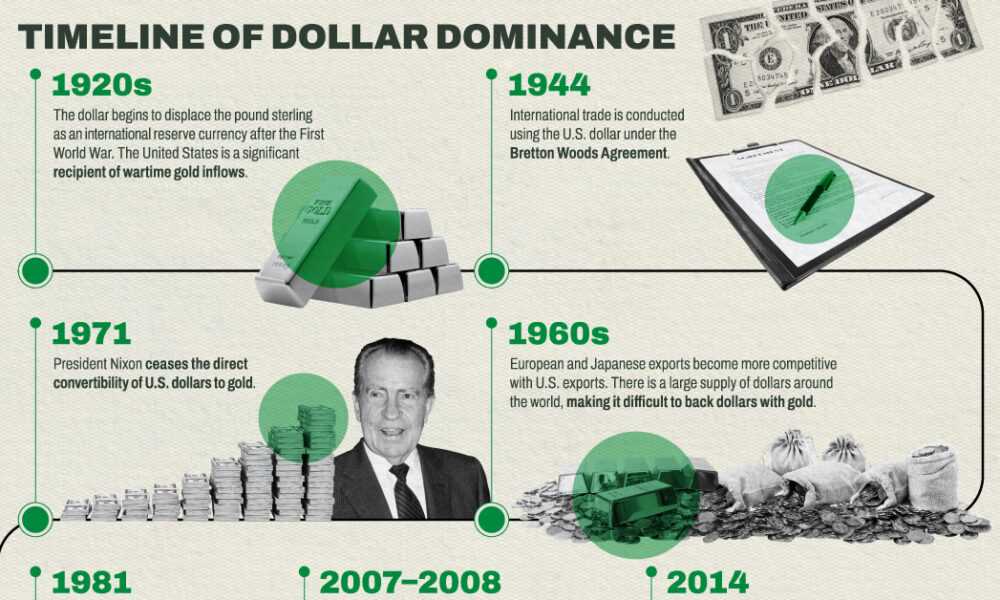

Dollarization refers to the process by which a country adopts the US dollar as its official currency or uses it alongside its own currency. This means that the US dollar becomes the medium of exchange, store of value, and unit of account within the country’s economy.

There are two forms of dollarization: official dollarization and unofficial dollarization. Official dollarization occurs when a country completely replaces its own currency with the US dollar, meaning that the US dollar becomes the sole legal tender. Unofficial dollarization, on the other hand, refers to the situation where the US dollar is widely used and accepted in daily transactions, although the country still maintains its own currency.

Benefits of Dollarization

Dollarization can bring several benefits to a country’s economy. Firstly, it can provide stability and credibility to the financial system. The US dollar is considered a stable and reliable currency, which can help reduce inflation and exchange rate volatility. This stability can attract foreign investment and promote economic growth.

Drawbacks of Dollarization

However, dollarization also has its drawbacks. One major concern is the loss of control over monetary policy. When a country adopts the US dollar, it gives up its ability to independently manage its monetary policy, including setting interest rates and controlling money supply. This can limit the country’s ability to respond to economic shocks and tailor its monetary policy to its specific needs.

Another drawback is the potential loss of seigniorage revenue. Seigniorage refers to the profit made by a country’s central bank from issuing currency. When a country dollarizes, it loses the ability to earn seigniorage revenue, as it no longer issues its own currency. This can have implications for the country’s fiscal position and ability to finance government expenditures.

Examples of Dollarization

There are several examples of dollarization around the world. One prominent example is Ecuador, which officially adopted the US dollar as its currency in the year 2000. Another example is El Salvador, which also uses the US dollar as its official currency. These countries made the decision to dollarize in order to stabilize their economies and attract foreign investment.

In macroeconomics, dollarization refers to the process by which a country adopts the United States dollar as its official currency or uses it alongside its domestic currency. This phenomenon can occur voluntarily or as a result of economic and financial instability in the country.

There are several reasons why a country may choose to dollarize its economy. One of the main reasons is to stabilize its currency and reduce inflation. By adopting a stable and widely accepted currency like the US dollar, a country can eliminate the risk of hyperinflation and provide a more stable economic environment for businesses and consumers.

Dollarization can also help attract foreign investment and promote economic growth. When a country uses the US dollar as its official currency, it can benefit from increased confidence and trust from international investors. This can lead to higher levels of foreign direct investment, which can stimulate economic activity and create jobs.

However, dollarization is not without its challenges and drawbacks. One of the main concerns is the loss of control over monetary policy. When a country adopts a foreign currency, it gives up its ability to independently manage its monetary policy, including setting interest rates and controlling the money supply. This can limit the government’s ability to respond to economic shocks and adjust its policies to meet the needs of the domestic economy.

Additionally, dollarization can lead to income inequality and social disparities. Since the US dollar is often more valuable and stable than the domestic currency, those who have access to US dollars or earn income in US dollars may benefit more from dollarization, while those who rely on the domestic currency may face challenges and economic hardships.

Dollarization: Impact

Dollarization refers to the process of a country adopting the US dollar as its official currency or using it alongside its domestic currency. This decision can have a significant impact on the economy of the country in question. Let’s explore some of the key impacts of dollarization.

1. Stability and Confidence

One of the main advantages of dollarization is the stability it brings to the economy. By adopting a strong and widely accepted currency like the US dollar, a country can benefit from reduced inflation and exchange rate volatility. This stability instills confidence in both domestic and foreign investors, leading to increased economic growth and investment.

2. Trade and Investment

Dollarization can also have a positive impact on trade and investment. When a country adopts the US dollar, it becomes more attractive to international investors and businesses. This can lead to increased foreign direct investment (FDI) and trade, as it eliminates the need for currency exchange and reduces transaction costs. Additionally, dollarization can make it easier for domestic businesses to access international markets and compete globally.

3. Monetary Policy Constraints

One of the challenges of dollarization is the loss of control over monetary policy. When a country adopts the US dollar, it gives up its ability to independently manage its monetary policy, including setting interest rates and controlling the money supply. This can be both a positive and a negative impact. On one hand, it eliminates the risk of excessive money printing and hyperinflation. On the other hand, it limits the country’s flexibility to respond to economic shocks and implement policies tailored to its specific needs.

4. Financial Stability

Dollarization can also have implications for financial stability. By adopting the US dollar, a country aligns its financial system with the regulations and standards of the United States. This can lead to increased confidence in the banking sector and improved financial stability. However, it can also expose the country to external shocks and vulnerabilities in the US economy, as any changes in the US financial system can have a direct impact on the dollarized country.

Examining the Effects of Dollarization on Economies

1. Economic Stability

One potential benefit of dollarization is increased economic stability. By adopting a stable and widely accepted currency like the US dollar, countries can reduce exchange rate volatility and inflationary pressures. This can attract foreign investment, stabilize prices, and promote economic growth.

2. Loss of Monetary Policy Control

However, dollarization also comes with the loss of monetary policy control. When a country adopts the US dollar, it gives up its ability to independently set interest rates and conduct monetary policy. This means that the country is subject to the monetary policies of the United States, which may not always align with its own economic needs.

Additionally, countries that dollarize may lose the ability to use currency devaluation as a tool to boost exports and competitiveness. This can be particularly challenging for countries with less diversified economies that heavily rely on exports.

3. Financial Integration

Dollarization can also lead to increased financial integration with the United States. This can provide access to larger and more developed financial markets, which can benefit both individuals and businesses. It can also facilitate trade and investment between the dollarized country and the United States.

4. Dependency on the United States

5. Income Inequality

Dollarization can also have implications for income inequality. In some cases, dollarization can lead to a concentration of wealth and income in the hands of a few individuals or businesses that have access to US dollars. This can exacerbate existing income disparities and create social tensions within the country.

Conclusion

Dollarization: Example

Ecuador is a small South American country that adopted the US dollar as its official currency in the year 2000. Prior to dollarization, Ecuador faced severe economic instability, including high inflation rates and frequent currency devaluations. The government decided to dollarize the economy as a measure to stabilize prices, attract foreign investment, and promote economic growth.

However, dollarization also presented challenges for Ecuador. The country lost control over its monetary policy, as it could no longer adjust interest rates or print money to stimulate the economy. This limited the government’s ability to respond to economic shocks and crises. Furthermore, dollarization increased the country’s dependence on the US economy, making it vulnerable to fluctuations in the US dollar exchange rate and economic conditions.

Over the years, Ecuador has faced both benefits and drawbacks of dollarization. The stability provided by the US dollar has helped attract foreign investment and promote economic growth. However, the loss of monetary policy autonomy and increased vulnerability to external shocks remain significant challenges.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.