How Direct Deposit Works

Direct deposit is a convenient and secure way to receive payments directly into your bank account. It eliminates the need for physical checks and provides faster access to your funds. Here is a step-by-step breakdown of how direct deposit works:

- Enrollment: To set up direct deposit, you need to provide your employer or the organization making the payment with your bank account information. This typically includes your account number and the bank’s routing number.

- Authorization: Once you have provided your bank account information, you will need to authorize the payer to deposit funds directly into your account. This can be done by signing a form or completing an online authorization process.

- Payment Processing: When it’s time for the payment to be made, the payer initiates the transaction through the Automated Clearing House (ACH) network. The ACH network securely transfers the funds from the payer’s bank account to your bank account.

- Funds Availability: After the payment is processed, the funds are typically available in your bank account within one to two business days. This allows you to access your money quickly and conveniently.

- Notification: Many banks offer email or text notifications to alert you when a direct deposit has been made to your account. This helps you keep track of your income and ensures that you are aware of any deposits made.

Overall, direct deposit offers a seamless and efficient way to receive payments. It eliminates the need for physical checks, reduces the risk of lost or stolen payments, and provides faster access to your funds. By setting up direct deposit, you can enjoy the convenience and security it offers.

Advantages of Direct Deposit

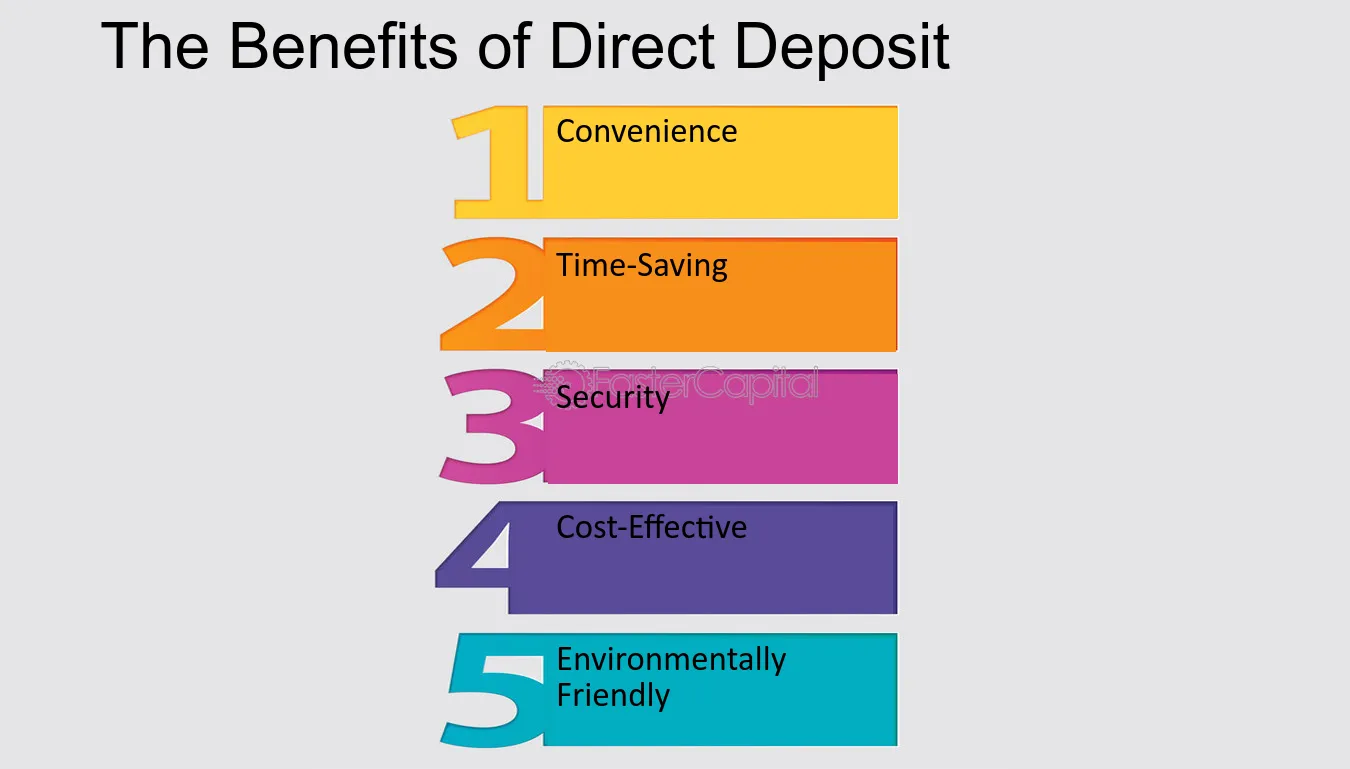

Direct deposit offers several advantages for both individuals and businesses. Here are some of the key benefits:

| Convenience | Direct deposit eliminates the need to physically deposit a check at a bank or wait in line to cash it. The funds are automatically deposited into the recipient’s account, saving time and effort. |

| Security | With direct deposit, there is no risk of losing or misplacing a physical check. The funds are electronically transferred, reducing the chances of theft or fraud. |

| Reliability | Direct deposit ensures that funds are deposited on time and consistently. There is no need to worry about delays or disruptions due to postal service issues or bank holidays. |

| Cost Savings | Direct deposit eliminates the need for paper checks, envelopes, and postage, resulting in cost savings for businesses. It also reduces the risk of check fraud, which can be expensive to resolve. |

| Flexibility | Direct deposit allows individuals to easily allocate their funds to different accounts. They can choose to deposit a portion of their paycheck into a savings account, retirement account, or other designated accounts. |

| Environmental Impact | By eliminating the need for paper checks, direct deposit helps reduce paper waste and its associated environmental impact. It is a more sustainable and eco-friendly option. |

Overall, direct deposit offers a convenient, secure, and reliable way to receive funds. It simplifies financial transactions and provides peace of mind for both individuals and businesses.

Potential Risks of Direct Deposit

While direct deposit offers many advantages, there are also potential risks that individuals should be aware of:

1. Unauthorized Access:

One of the main risks associated with direct deposit is the possibility of unauthorized access to your bank account. If someone gains access to your account information, they may be able to change your direct deposit settings or withdraw funds without your knowledge or consent.

2. Errors:

Another risk is the potential for errors in the direct deposit process. This could include incorrect amounts being deposited, deposits being made to the wrong account, or delays in receiving funds. These errors can be frustrating and may require time and effort to resolve.

3. Fraudulent Activity:

Direct deposit can also make individuals more vulnerable to fraudulent activity. Scammers may attempt to obtain your account information by posing as legitimate organizations or individuals. They can then use this information to commit identity theft or unauthorized transactions.

4. Lack of Control:

With direct deposit, you are giving up some control over when and how you receive your funds. While this can be convenient for regular income, it may not be ideal for individuals who prefer to have more control over their finances or who rely on irregular income sources.

5. Overdrafts:

If you do not carefully monitor your account balance, direct deposit can potentially lead to overdrafts. If more funds are withdrawn from your account than you have available, you may be charged overdraft fees or face other financial consequences.

It is important to be aware of these potential risks and take steps to protect yourself. This includes regularly monitoring your account activity, keeping your account information secure, and promptly reporting any suspicious or unauthorized transactions to your bank.

Steps to Set Up Direct Deposit

Setting up direct deposit is a simple process that can save you time and make managing your finances easier. Follow these steps to set up direct deposit:

- Contact your employer or the organization making the payment. They will provide you with a direct deposit form or give you instructions on how to set up direct deposit.

- Fill out the direct deposit form or provide the necessary information. This typically includes your bank account number, routing number, and the name of your bank.

- Double-check the information you provided to ensure accuracy. Mistakes in the account or routing numbers can result in delays or failed deposits.

- Submit the completed form or information to your employer or the organization. They may require a physical copy or accept electronic submissions.

- Wait for confirmation. Once your direct deposit is set up, you will receive confirmation from your employer or the organization. This may be in the form of an email or a paper statement.

- Monitor your bank account. After the initial direct deposit, regularly check your bank account to ensure the funds are being deposited correctly.

By following these steps, you can set up direct deposit and enjoy the convenience and benefits it offers. Remember to keep your bank account information secure and notify your employer or the organization if any changes need to be made.

Tips for Managing Direct Deposit

1. Review your pay stubs regularly

Make sure to review your pay stubs regularly to ensure that your employer is depositing the correct amount into your account. Look for any discrepancies or errors and report them to your employer immediately.

2. Keep your bank account information up to date

If you change banks or open a new account, make sure to update your direct deposit information with your employer. This will ensure that your payments are deposited into the correct account and avoid any delays or issues.

3. Set up alerts

Most banks offer alert services that notify you when a deposit is made into your account. Take advantage of these services to stay informed about your direct deposits and to quickly identify any unauthorized transactions.

4. Monitor your account regularly

Regularly check your bank account statements to ensure that all direct deposits are being made correctly. Keep an eye out for any suspicious activity or unauthorized withdrawals and report them to your bank immediately.

5. Plan for any changes

If you anticipate any changes to your direct deposit, such as a change in employment or bank account, make sure to plan ahead. Notify your employer and bank in advance to avoid any disruptions in your payments.

6. Be cautious with sharing your account information

Only provide your bank account information to trusted sources. Be cautious when sharing your account information online or over the phone, and avoid giving it out unless necessary.

7. Keep track of your deposits

Maintain a record of your direct deposits, including the dates and amounts. This will help you reconcile your income and ensure that all payments are being made correctly.

| Advantages of Direct Deposit | Potential Risks of Direct Deposit |

|---|---|

| – Convenient and time-saving | – Risk of incorrect deposits or delays |

| – Secure and reduces the risk of lost or stolen checks | – Potential for unauthorized access to your account |

| – Faster access to funds | – Risk of overdraft if not managed properly |

| – Environmentally friendly, reduces paper waste | – Difficulty in stopping or reversing payments |

By following these tips, you can effectively manage your direct deposit and ensure a smooth and secure process for receiving your income.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.