What is Delivery Versus Payment (DVP) and How It Works

Delivery Versus Payment (DVP) is a financial transaction settlement method that ensures the simultaneous transfer of securities and cash between two parties. It is commonly used in the securities industry to reduce settlement risk and ensure efficient and secure transactions.

The basic concept of DVP is that the delivery of securities by the seller is contingent upon the receipt of payment from the buyer. This means that both parties must fulfill their obligations simultaneously for the transaction to be completed successfully.

When a DVP transaction occurs, the buyer’s account is debited with the agreed-upon amount, and the seller’s account is credited with the same amount. At the same time, the buyer receives the securities they purchased, and the seller receives the payment for those securities.

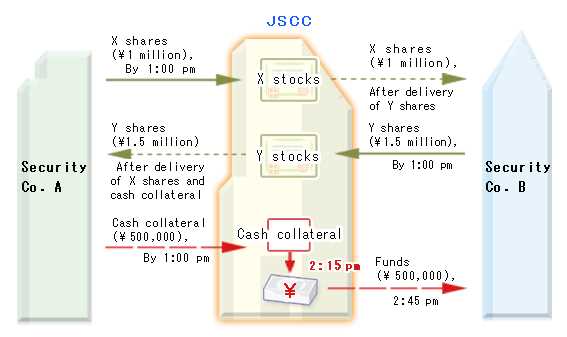

DVP is typically facilitated by a third-party intermediary, such as a clearinghouse or custodian, who acts as a trusted agent to ensure the smooth execution of the transaction. The intermediary verifies the availability of funds and securities, coordinates the transfer of assets, and ensures that the transaction meets all necessary legal and regulatory requirements.

One of the key benefits of DVP is that it reduces the risk of settlement failure. By requiring both parties to fulfill their obligations simultaneously, DVP minimizes the possibility of one party delivering securities without receiving payment or vice versa. This helps to protect against counterparty risk and ensures the timely and accurate settlement of transactions.

In addition to reducing settlement risk, DVP also offers other advantages. It improves operational efficiency by streamlining the settlement process, reduces the need for manual intervention, and increases transparency and auditability. DVP also provides a higher level of security by eliminating the need for physical delivery and reducing the risk of loss or theft of securities.

Overall, Delivery Versus Payment is a critical component of the securities industry that helps to ensure the smooth and secure settlement of transactions. By requiring the simultaneous transfer of securities and cash, DVP minimizes risk and provides numerous benefits to market participants.

Delivery Versus Payment (DVP) is a settlement method commonly used in financial markets to ensure the simultaneous exchange of securities and cash. It is a crucial process that helps mitigate risks and streamline transactions.

What is DVP?

DVP is a mechanism that ensures the delivery of securities only occurs if the corresponding payment is made, and vice versa. This means that both parties involved in a transaction must fulfill their obligations simultaneously, reducing the risk of one party not delivering the securities or the other party not making the payment.

How Does DVP Work?

When a trade is executed, the buyer and seller agree on the terms, including the price, quantity, and settlement date. On the settlement date, the buyer’s account is debited with the agreed-upon amount, and the seller’s account is credited with the same amount. Simultaneously, the securities are transferred from the seller’s account to the buyer’s account.

To facilitate this process, a central depository or clearinghouse is often involved. The depository holds the securities in electronic form and ensures their safe transfer between accounts. It also verifies the availability of funds in the buyer’s account before allowing the transaction to proceed.

Advantages of DVP

Using DVP offers several benefits to market participants:

- Risk Reduction: DVP minimizes the risk of non-delivery or non-payment, as both occur simultaneously.

- Efficiency: The simultaneous settlement of securities and cash simplifies the transaction process and reduces the time required for settlement.

- Cost Savings: DVP eliminates the need for separate securities and cash transfers, reducing transaction costs.

- Increased Liquidity: By reducing settlement risks, DVP promotes market liquidity and encourages more participants to engage in trading.

Overall, DVP is a crucial mechanism in financial markets that ensures the smooth and secure settlement of transactions. Its implementation helps reduce risks, increase efficiency, and promote liquidity, benefiting both buyers and sellers.

Key Components of DVP

Delivery Versus Payment (DVP) is a settlement method used in financial markets to ensure the simultaneous delivery of securities and the payment of funds. It involves several key components that are essential for its successful implementation:

1. Securities

The first component of DVP is the securities being traded. These can include stocks, bonds, or any other type of financial instrument. The seller must have the securities available for delivery, while the buyer must have the necessary funds to purchase them.

2. Payment

The second component is the payment for the securities. The buyer must have the funds available to pay for the securities, while the seller must ensure that the payment is received. This can be done through various payment methods, such as wire transfer or electronic funds transfer.

3. Settlement Agent

A settlement agent, often a custodian or a clearinghouse, acts as an intermediary between the buyer and the seller. It ensures that the securities are delivered to the buyer and the payment is made to the seller. The settlement agent also verifies the ownership of the securities and ensures that they are free from any encumbrances.

4. Delivery Instructions

5. Confirmation

Once the securities are delivered and the payment is made, the settlement agent sends a confirmation to both the buyer and the seller. This confirmation serves as proof that the transaction has been successfully completed and that the securities and funds have been exchanged.

6. Regulatory Compliance

DVP transactions must comply with the regulations and rules set by the relevant financial authorities. This ensures transparency, fairness, and the prevention of fraudulent activities in the financial markets.

Benefits of Using Delivery Versus Payment

Delivery Versus Payment (DVP) is a settlement method used in financial markets that offers several benefits to participants. Here are some of the key advantages of using DVP:

| 1. Risk Reduction: | DVP helps to reduce counterparty risk by ensuring that the delivery of securities occurs simultaneously with the payment. This eliminates the possibility of one party fulfilling their obligation while the other fails to do so. |

| 2. Efficiency: | DVP streamlines the settlement process by automating the exchange of securities and funds. This improves operational efficiency and reduces the time and cost associated with manual settlement processes. |

| 3. Transparency: | With DVP, all parties involved in a transaction have access to real-time information on the status of the delivery and payment. This transparency enhances trust and reduces the likelihood of disputes or errors. |

| 4. Liquidity Management: | DVP allows participants to better manage their liquidity by ensuring that the delivery and payment occur simultaneously. This helps to prevent the tying up of funds or securities in incomplete transactions. |

| 5. Regulatory Compliance: | Many financial regulators require the use of DVP for certain types of transactions to ensure the integrity and stability of the market. By using DVP, participants can easily comply with these regulatory requirements. |

Examples of Delivery Versus Payment in Action

Delivery Versus Payment (DVP) is a crucial process in the financial industry that ensures the simultaneous transfer of securities and cash between two parties involved in a transaction. Let’s take a look at a few examples to better understand how DVP works:

| Example 1: | Investor A wants to sell 100 shares of a particular stock to Investor B. Both parties agree on the price of $50 per share, resulting in a total transaction value of $5,000. They decide to use the DVP method to ensure a secure and efficient transaction. |

|---|---|

| Step 1: | Investor A initiates the transaction by instructing their custodian to transfer the 100 shares to Investor B’s custodian. |

| Step 2: | Investor B ensures that they have sufficient funds in their account to cover the transaction. Once confirmed, they instruct their custodian to transfer $5,000 to Investor A’s custodian. |

| Step 3: | Both custodians verify the instructions and confirm that the securities and cash are available for transfer. |

| Step 4: | Upon confirmation, the custodians simultaneously transfer the securities and cash, ensuring that the delivery of shares and payment occur at the same time. |

| Example 2: | A financial institution wants to settle a large-scale bond issuance. They use the DVP method to ensure a secure and efficient settlement process. |

| Step 1: | The financial institution issues the bonds and delivers them to the investors who have purchased them. |

| Step 2: | The investors ensure that they have sufficient funds in their accounts to cover the bond purchase. Once confirmed, they instruct their custodian to transfer the funds to the financial institution’s custodian. |

| Step 3: | The custodians verify the instructions and confirm that the bonds and funds are available for transfer. |

| Step 4: | Upon confirmation, the custodians simultaneously transfer the bonds and funds, ensuring that the delivery of bonds and payment occur at the same time. |

These examples demonstrate how DVP provides a secure and efficient method for settling transactions in the financial industry. By ensuring the simultaneous transfer of securities and cash, DVP minimizes the risk of non-delivery or non-payment, protecting the interests of both parties involved.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.