Debtor-in-Possession Financing: Definition and Types

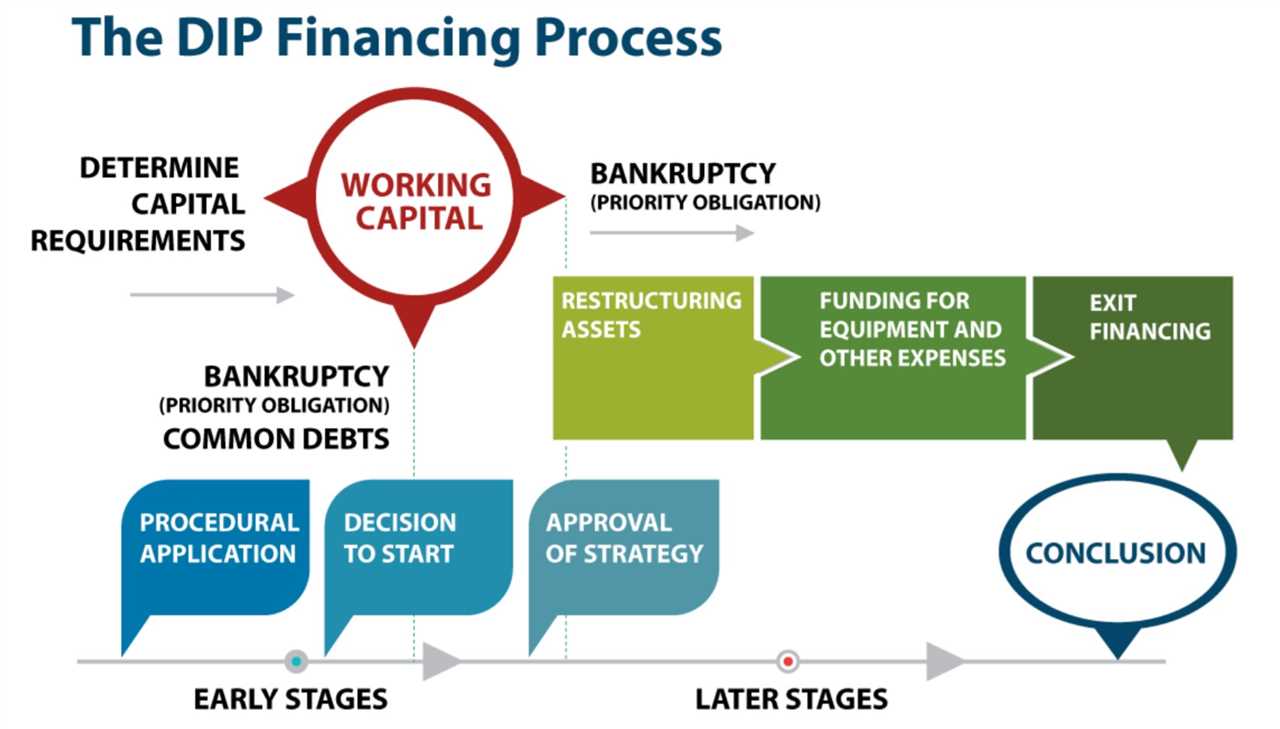

Debtor-in-Possession (DIP) financing refers to a type of funding provided to a company that has filed for bankruptcy and is operating under the supervision of a bankruptcy court. This financing allows the company to continue its operations and restructure its debts while it navigates through the bankruptcy process.

There are two main types of DIP financing: secured and unsecured. Secured DIP financing involves the company obtaining a loan that is backed by specific assets, such as inventory, equipment, or real estate. This type of financing typically has priority over other existing debts and provides the lender with a higher level of security in case of default.

DIP financing can provide several benefits to a company in bankruptcy. Firstly, it allows the company to continue its operations and maintain its value, which is crucial for maximizing the recovery for creditors. Secondly, it provides the company with the necessary funds to restructure its debts and implement a turnaround plan. Lastly, DIP financing can attract new investors and lenders who may be more willing to provide funding to a company in bankruptcy due to the potential for higher returns.

Debtor-in-possession (DIP) financing is a type of financing that is provided to a company that has filed for bankruptcy and is operating under the protection of the bankruptcy court. This type of financing is unique because it allows the debtor to continue operating its business while restructuring its debts and developing a plan to emerge from bankruptcy.

Key Features of Debtor-in-Possession Financing

There are several key features of debtor-in-possession financing that make it different from traditional financing options:

- Priority Status: DIP financing is given priority status over existing debt, meaning that the lender providing the financing will be repaid before other creditors in the event of liquidation.

- Flexible Terms: DIP financing often comes with more flexible terms compared to traditional financing options. This flexibility allows the debtor to tailor the financing to its specific needs and circumstances.

- Higher Interest Rates: Due to the increased risk associated with lending to a company in bankruptcy, DIP financing typically comes with higher interest rates compared to traditional financing.

- Use of Collateral: In order to secure the financing, the debtor may be required to pledge collateral, such as assets or property, to the lender.

Benefits of Debtor-in-Possession Financing

Debtor-in-possession financing offers several benefits to companies in bankruptcy:

- Continued Operations: DIP financing allows the debtor to continue operating its business, which can help preserve the value of the company and its assets.

- Access to Capital: By providing financing to a company in bankruptcy, DIP financing ensures that the debtor has access to the capital it needs to fund its operations and implement its restructuring plan.

- Improved Creditor Relations: DIP financing can help improve relations with creditors, as it demonstrates the debtor’s commitment to repaying its debts and emerging from bankruptcy.

- Opportunity for Recovery: By providing the necessary funding, DIP financing gives the debtor a chance to reorganize its debts, improve its financial position, and ultimately emerge from bankruptcy as a stronger and more viable company.

Overall, debtor-in-possession financing plays a crucial role in the bankruptcy process, providing companies with the financial resources they need to navigate through the challenges of bankruptcy and work towards a successful reorganization.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.