Dealer Market: Definition, Example, Vs. Broker or Auction Market

A dealer market is a type of financial market where securities, such as stocks and bonds, are bought and sold directly between dealers and investors. In a dealer market, dealers act as intermediaries between buyers and sellers, facilitating the trading process.

Unlike broker or auction markets, where orders are matched through a central exchange or auction, a dealer market operates through a network of dealers who maintain an inventory of securities. These dealers quote bid and ask prices at which they are willing to buy or sell securities.

Compared to broker or auction markets, dealer markets offer several advantages. Firstly, they provide liquidity as dealers are always ready to buy or sell securities. This ensures that investors can easily enter or exit positions without significant price fluctuations.

Secondly, dealer markets offer faster execution times as trades can be executed directly with dealers, without the need for a central exchange or auction. This allows for quicker transactions and reduces the risk of price changes during the execution process.

Definition of Dealer Market

A dealer market is a type of financial market where securities, such as stocks and bonds, are traded directly between buyers and sellers through authorized dealers. In a dealer market, the dealers act as intermediaries, buying and selling securities from their own inventory to facilitate trading.

Unlike a broker market or an auction market, where trades are facilitated by brokers or through a centralized auction, a dealer market allows for more immediate and direct transactions. This is because the dealers are always ready to buy and sell securities, providing liquidity to the market.

Dealers in a dealer market can be individuals or institutions, such as banks or brokerage firms. They play a crucial role in maintaining an orderly market by providing continuous quotes for buying and selling securities. They also help determine the market price of securities through their buying and selling activities.

One key characteristic of a dealer market is the bid-ask spread. The bid price is the price at which a dealer is willing to buy a security, while the ask price is the price at which a dealer is willing to sell a security. The difference between the bid and ask prices represents the spread, which is the profit margin for the dealer.

Dealer markets are commonly found in over-the-counter (OTC) markets, where securities are not listed on a centralized exchange. Examples of dealer markets include the bond market, foreign exchange market, and certain segments of the stock market.

In summary, a dealer market is a financial market where securities are traded directly between buyers and sellers through authorized dealers. The dealers act as intermediaries, providing liquidity and determining market prices. Dealer markets are characterized by bid-ask spreads and are commonly found in OTC markets.

Example of Dealer Market

When an investor wants to buy or sell a stock, they place an order with their broker who then sends the order to the specialist on the floor of the exchange. The specialist matches the buyer with a seller and executes the trade. The specialist also provides liquidity by buying or selling stocks from their own inventory if there are no immediate buyers or sellers.

The NYSE is an example of a dealer market because the trading is facilitated by specialists who act as intermediaries between buyers and sellers. These specialists have in-depth knowledge of the stocks they trade and play a crucial role in maintaining an orderly market.

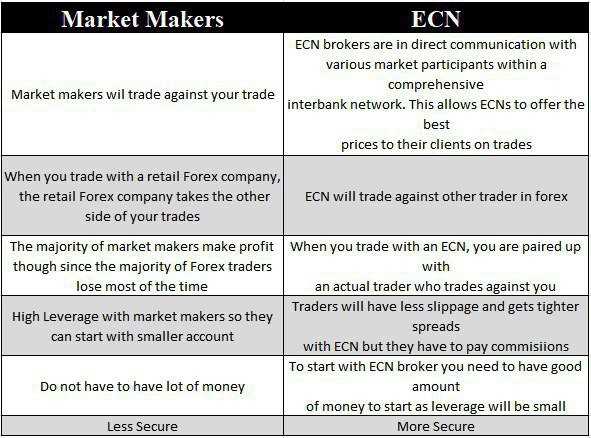

Another example of a dealer market is the foreign exchange market (Forex). In the Forex market, currency traders buy and sell currencies with the goal of making a profit from changes in exchange rates. Dealers in the Forex market, such as banks and financial institutions, provide liquidity and facilitate the trading of currencies.

In a dealer market like the Forex market, traders can place orders directly with the dealers, who then execute the trades. The dealers make money by buying currencies at a lower price and selling them at a higher price, taking advantage of the fluctuations in exchange rates.

Overall, dealer markets like the NYSE and the Forex market play a crucial role in facilitating the buying and selling of financial instruments. They provide liquidity, ensure fair pricing, and help maintain an orderly market for investors and traders.

Comparison of Dealer Market Vs. Broker or Auction Market

In the financial world, there are different types of markets where securities and other financial instruments are traded. Two common types of markets are dealer markets and broker or auction markets. While both serve the purpose of facilitating the buying and selling of securities, there are some key differences between them.

Dealer Market

In a dealer market, transactions are typically conducted over-the-counter (OTC), which means they are not conducted on a centralized exchange. This allows for more flexibility in terms of trading hours and the types of securities that can be traded. Dealer markets are commonly used for trading bonds, foreign currencies, and other less liquid securities.

Broker or Auction Market

In a broker or auction market, the prices at which securities are bought or sold are determined by supply and demand. The highest bid and the lowest ask price are matched, and the trade is executed at that price. This type of market is commonly used for trading stocks, options, and futures.

Comparison

One of the main differences between a dealer market and a broker or auction market is the role of intermediaries. In a dealer market, dealers act as intermediaries and set the prices at which securities are bought and sold. In a broker or auction market, the prices are determined by supply and demand and are not set by intermediaries.

Another difference is the level of transparency. In a dealer market, the prices at which securities are bought and sold may not be readily available to the public. On the other hand, in a broker or auction market, the prices are publicly displayed and can be accessed by all market participants.

Furthermore, dealer markets tend to be more flexible in terms of trading hours and the types of securities that can be traded. Broker or auction markets, on the other hand, have more standardized trading hours and typically trade a wider range of securities.

Overall, both dealer markets and broker or auction markets play important roles in the financial system. They provide liquidity and facilitate the buying and selling of securities. The choice between the two depends on the specific needs and preferences of investors and traders.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.