Credit Analyst: Definition

A credit analyst is a financial professional who assesses the creditworthiness of individuals, businesses, or organizations. They analyze financial data, review credit reports, and evaluate the risk associated with extending credit or lending money. Credit analysts play a crucial role in determining whether a borrower is likely to repay their debts and help financial institutions make informed decisions about lending.

Key Responsibilities of a Credit Analyst:

- Reviewing financial statements and credit reports to assess the creditworthiness of borrowers

- Analyzing financial data and ratios to evaluate the risk of default

- Conducting industry and market research to understand the economic factors that may impact credit risk

- Preparing detailed credit reports and making recommendations on credit limits and terms

- Collaborating with other departments such as sales, underwriting, and risk management to assess credit applications

- Monitoring the credit performance of existing borrowers and recommending actions for credit remediation

What is a Credit Analyst?

A credit analyst is a financial professional who assesses the creditworthiness of individuals or businesses applying for loans or credit. They analyze financial data, such as income statements, balance sheets, and credit reports, to determine the borrower’s ability to repay the loan and their likelihood of defaulting.

Additionally, credit analysts monitor the ongoing creditworthiness of existing borrowers, reviewing financial statements and credit reports on a regular basis. They may also be involved in negotiating loan terms and conditions, such as interest rates and repayment schedules.

Overall, credit analysts play a vital role in maintaining the financial health of lending institutions by ensuring that loans are granted to borrowers who are likely to repay them. Their expertise in assessing credit risk helps minimize the potential for loan defaults and financial losses.

Credit Analyst: Work

As a credit analyst, your work will primarily involve assessing the creditworthiness of individuals, businesses, or organizations. This involves analyzing financial data, evaluating credit risk, and making recommendations on whether to approve or deny credit applications.

Financial Analysis

One of the key tasks of a credit analyst is to conduct thorough financial analysis. This includes reviewing financial statements, tax returns, and other relevant documents to assess the financial health of the applicant. You will need to analyze income, expenses, assets, and liabilities to determine the applicant’s ability to repay the loan or credit.

Credit Risk Assessment

Another important aspect of your work as a credit analyst is to assess the credit risk associated with each application. This involves evaluating the applicant’s credit history, payment patterns, and any past defaults or delinquencies. You will need to determine the likelihood of the applicant defaulting on their obligations and calculate the level of risk involved.

Based on your analysis, you will assign a credit rating or score to each applicant, indicating their creditworthiness. This rating will help lenders or financial institutions make informed decisions regarding the approval or denial of credit.

Recommendations

Once you have completed your analysis and assessment, you will be responsible for making recommendations to lenders or credit committees. These recommendations will be based on your evaluation of the applicant’s financial health and credit risk. You may recommend approving the credit application, denying it, or suggesting modifications to the terms and conditions.

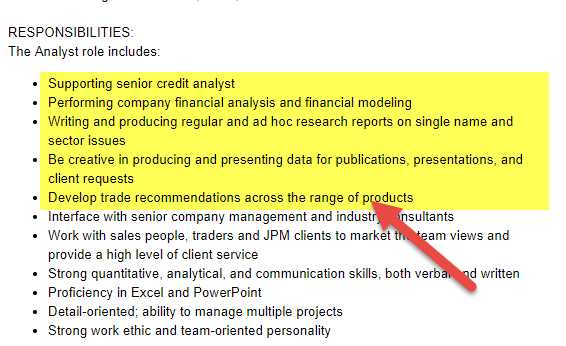

Responsibilities of a Credit Analyst

A credit analyst plays a crucial role in assessing the creditworthiness of individuals, businesses, and organizations. They are responsible for analyzing financial data, evaluating credit risk, and making recommendations to lenders or financial institutions.

Some of the key responsibilities of a credit analyst include:

- Reviewing and analyzing financial statements, credit reports, and other relevant information to assess the creditworthiness of borrowers.

- Evaluating the financial health and stability of individuals or businesses by examining their income, assets, and liabilities.

- Assessing the risk associated with extending credit or granting loans to borrowers.

- Preparing detailed credit reports and making recommendations to lenders or financial institutions based on their findings.

- Monitoring the credit performance of borrowers and identifying any potential issues or risks.

- Collaborating with other departments, such as sales or underwriting, to gather additional information or clarify any discrepancies.

- Staying updated on industry trends, regulations, and best practices related to credit analysis.

- Providing guidance and support to lenders or financial institutions in making informed decisions regarding credit approvals or denials.

Overall, a credit analyst plays a critical role in helping lenders make informed decisions about extending credit or granting loans. Their attention to detail, analytical skills, and ability to assess risk are essential in ensuring the financial stability and success of both borrowers and lenders.

Credit Analyst: Required Skills

A successful credit analyst possesses a unique set of skills that enable them to excel in their role. Here are some of the key skills required to be a credit analyst:

1. Financial Analysis:

2. Attention to Detail:

3. Risk Assessment:

4. Communication Skills:

5. Problem-Solving:

Credit analysts often encounter complex financial situations and need to be able to think critically and come up with innovative solutions. They should be able to identify potential issues, evaluate alternatives, and make sound decisions that align with the organization’s risk appetite.

6. Industry Knowledge:

By possessing these skills, a credit analyst can effectively assess creditworthiness, manage risk, and make informed credit decisions that contribute to the success of their organization.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.