What is Corporate Finance?

Corporate finance is a field of finance that deals with the financial decisions made by corporations and the methods and tools used to make those decisions. It involves analyzing and managing the financial resources of a company to maximize its value and achieve its financial goals.

In simple terms, corporate finance focuses on how businesses raise capital, invest it in different projects or assets, and make decisions about the allocation of resources. It also involves assessing the financial risks and returns associated with these decisions.

To better understand corporate finance, let’s take a look at some key concepts:

| Capital Structure | The mix of debt and equity used by a company to finance its operations and investments. |

| Cost of Capital | The required rate of return that a company must earn on its investments to satisfy its investors. |

| Valuation | The process of determining the worth or value of a company or its assets. |

| Financial Markets | The platforms where companies can raise capital by issuing stocks and bonds. |

| Financial Statements | The reports that provide information about a company’s financial performance and position. |

Overall, corporate finance is essential for businesses to make informed financial decisions, manage their resources effectively, and create value for their shareholders. It combines financial theory, analysis, and practical strategies to optimize the financial health and success of a company.

Definition and Explanation

In the world of finance, corporate finance refers to the activities and decisions made by a company to manage its financial resources and achieve its financial goals. It involves the analysis of various financial aspects of a business, such as investments, capital structure, risk management, and financial planning.

Corporate finance plays a crucial role in the success and growth of a company. It helps in determining the most effective ways to allocate financial resources, make investment decisions, and manage the company’s financial risks. By optimizing the use of funds, corporate finance aims to maximize the value of the company and enhance shareholder wealth.

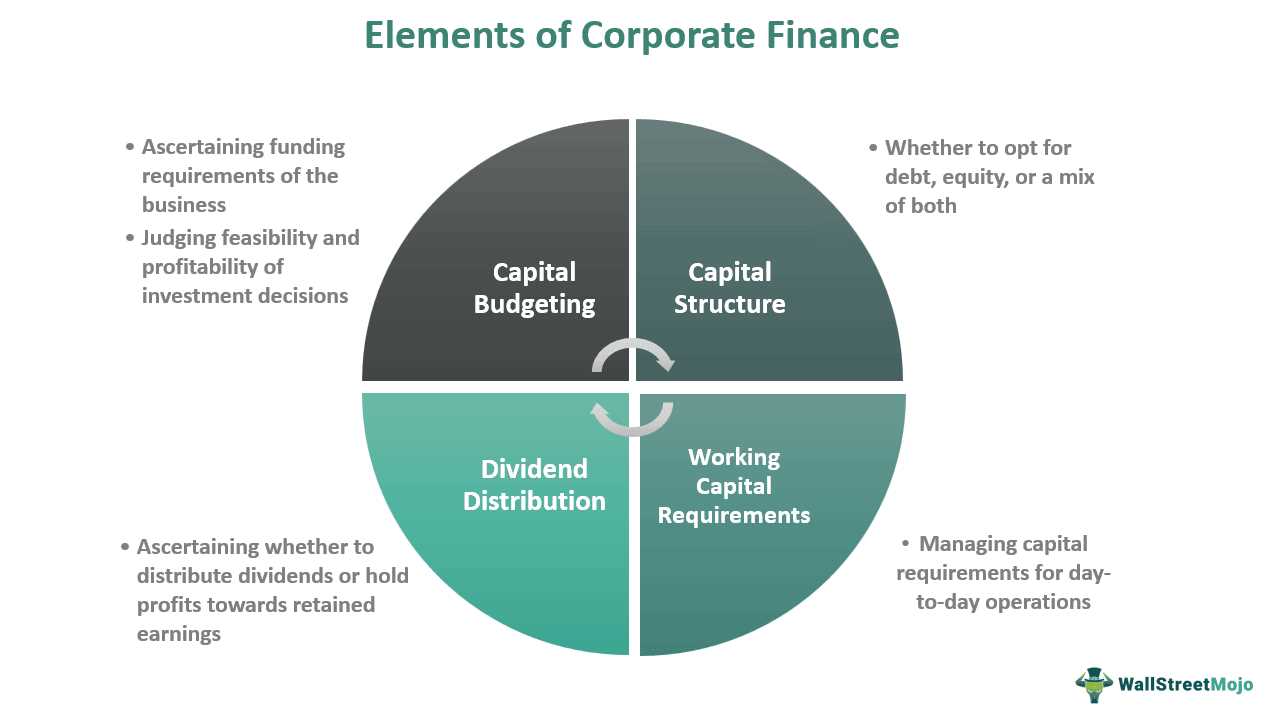

One of the key areas of corporate finance is capital budgeting, which involves evaluating and selecting investment projects that can generate positive returns for the company. This process includes estimating the cash flows associated with each project, assessing their risks, and determining their profitability. By making informed investment decisions, companies can allocate their resources efficiently and generate higher returns.

Another important aspect of corporate finance is capital structure, which refers to the mix of debt and equity financing used by a company to fund its operations. The choice of capital structure affects the company’s cost of capital, risk profile, and financial flexibility. Corporate finance professionals analyze various factors, such as interest rates, tax implications, and investor preferences, to determine the optimal capital structure for a company.

Risk management is also a critical component of corporate finance. Companies face various financial risks, such as market risk, credit risk, and operational risk. Corporate finance professionals develop strategies to identify, assess, and mitigate these risks to protect the company’s financial health and stability. This may involve implementing risk management tools, such as insurance, hedging, and diversification.

Financial planning is another essential aspect of corporate finance. It involves forecasting and managing the company’s financial performance, including budgeting, cash flow management, and financial reporting. By developing comprehensive financial plans, companies can set realistic goals, monitor their financial performance, and make informed decisions to achieve long-term success.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.