Contribution Margin: Definition and Overview

The contribution margin is a financial metric that measures the profitability of a product or service. It represents the amount of revenue that remains after deducting variable costs directly associated with the production or delivery of the product or service.

The contribution margin is an essential tool for businesses to assess the profitability of individual products or services and make informed decisions about pricing, production volume, and cost management.

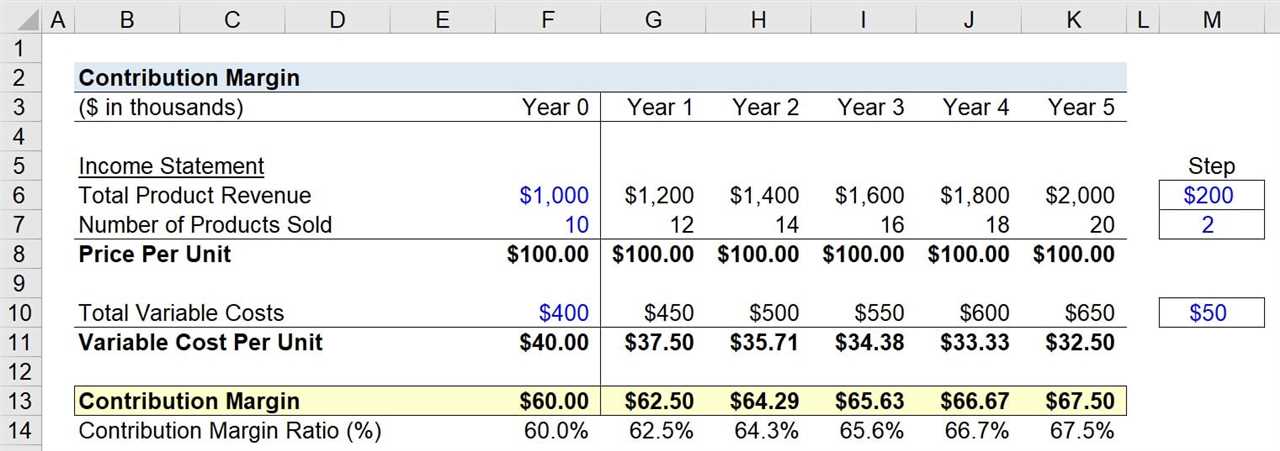

To calculate the contribution margin, subtract the variable costs from the revenue generated by the product or service. Variable costs include expenses such as direct materials, direct labor, and variable overhead. The contribution margin can be expressed as a percentage by dividing it by the revenue.

The contribution margin provides valuable insights into the financial health of a business. A high contribution margin indicates that a product or service is generating enough revenue to cover both variable costs and contribute to fixed costs and profits. On the other hand, a low contribution margin may indicate that adjustments need to be made to pricing, production processes, or cost management strategies.

By analyzing the contribution margin of different products or services, businesses can identify their most profitable offerings and allocate resources accordingly. This information can also be used to evaluate the impact of changes in pricing, production volume, or costs on the overall profitability of the business.

What is Contribution Margin?

Contribution margin is a financial metric that measures the profitability of a product or service. It represents the amount of revenue that is left over after deducting variable costs associated with producing or delivering the product or service.

Contribution margin is an important concept in cost accounting and financial analysis, as it helps businesses understand how much each unit sold contributes to covering fixed costs and generating profit. It allows companies to make informed decisions about pricing, production levels, and product mix.

Calculation of Contribution Margin

The contribution margin can be calculated using the following formula:

Revenue represents the total sales generated from selling a product or service, while variable costs include all the expenses directly related to producing or delivering the product or service. These variable costs may include raw materials, direct labor, and variable overhead expenses.

Once the contribution margin is calculated, it can be expressed as a percentage by dividing it by the revenue:

Contribution Margin Ratio = (Contribution Margin / Revenue) * 100

The contribution margin ratio helps businesses understand the proportion of each dollar of revenue that contributes to covering fixed costs and generating profit.

Importance of Contribution Margin

Contribution margin is a crucial metric for businesses as it provides insights into the profitability of individual products or services. By analyzing the contribution margin, companies can identify which products or services are the most profitable and focus their efforts on promoting and selling those items.

Additionally, contribution margin analysis can assist in determining the break-even point. The break-even point is the level of sales at which a company neither makes a profit nor incurs a loss. By comparing the contribution margin to the fixed costs, businesses can determine how many units they need to sell to cover their expenses and reach the break-even point.

Overview of Contribution Margin

Contribution margin is a key financial metric that helps businesses understand the profitability of their products or services. It is a measure of how much each unit sold contributes to covering fixed costs and generating profit. By calculating the contribution margin, businesses can make informed decisions about pricing, cost control, and overall profitability.

The contribution margin is calculated by subtracting the variable costs associated with producing a product or service from the revenue generated by its sale. Variable costs include direct labor, materials, and other expenses that vary with the level of production. Fixed costs, such as rent, salaries, and utilities, are not included in the calculation.

The contribution margin ratio is another useful metric that expresses the contribution margin as a percentage of revenue. It is calculated by dividing the contribution margin by the revenue. This ratio helps businesses compare the profitability of different products or services and make strategic decisions about resource allocation and product mix.

By analyzing the contribution margin, businesses can identify opportunities to increase profitability. For example, they can focus on selling products or services with higher contribution margins, reduce variable costs, or increase prices. Additionally, businesses can use the contribution margin to perform break-even analysis and determine the number of units they need to sell in order to cover their fixed costs.

How To Calculate Contribution Margin

Step 1: Determine the Sales Revenue

The first step is to determine the total sales revenue generated from the product or service. This can be done by multiplying the selling price per unit by the total number of units sold.

Step 2: Calculate the Variable Costs

Next, calculate the total variable costs associated with producing the product or service. Variable costs are expenses that vary in direct proportion to the level of production or sales. Examples of variable costs include raw materials, direct labor, and direct overhead costs.

Step 3: Subtract Variable Costs from Sales Revenue

Subtract the total variable costs from the sales revenue to determine the contribution margin. The contribution margin represents the amount of revenue that is available to cover fixed costs and contribute to the company’s profit.

Step 4: Calculate the Contribution Margin Ratio

The contribution margin ratio is calculated by dividing the contribution margin by the sales revenue. This ratio indicates the percentage of each sales dollar that is available to cover fixed costs and contribute to profit.

Step 5: Analyze the Contribution Margin

Finally, analyze the contribution margin to assess the profitability of the product or service. A higher contribution margin indicates a greater ability to cover fixed costs and generate profit, while a lower contribution margin may require adjustments to pricing or cost structure.

| Formula: | Calculation: |

|---|---|

| Contribution Margin | |

| Contribution Margin Ratio | (Contribution Margin / Sales Revenue) x 100 |

By calculating and analyzing the contribution margin, businesses can make informed decisions regarding pricing, cost management, and overall profitability. It provides valuable insights into the financial health of a product or service and helps guide strategic planning and decision-making.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.